Rev 1220 Form

What is the Rev 1220

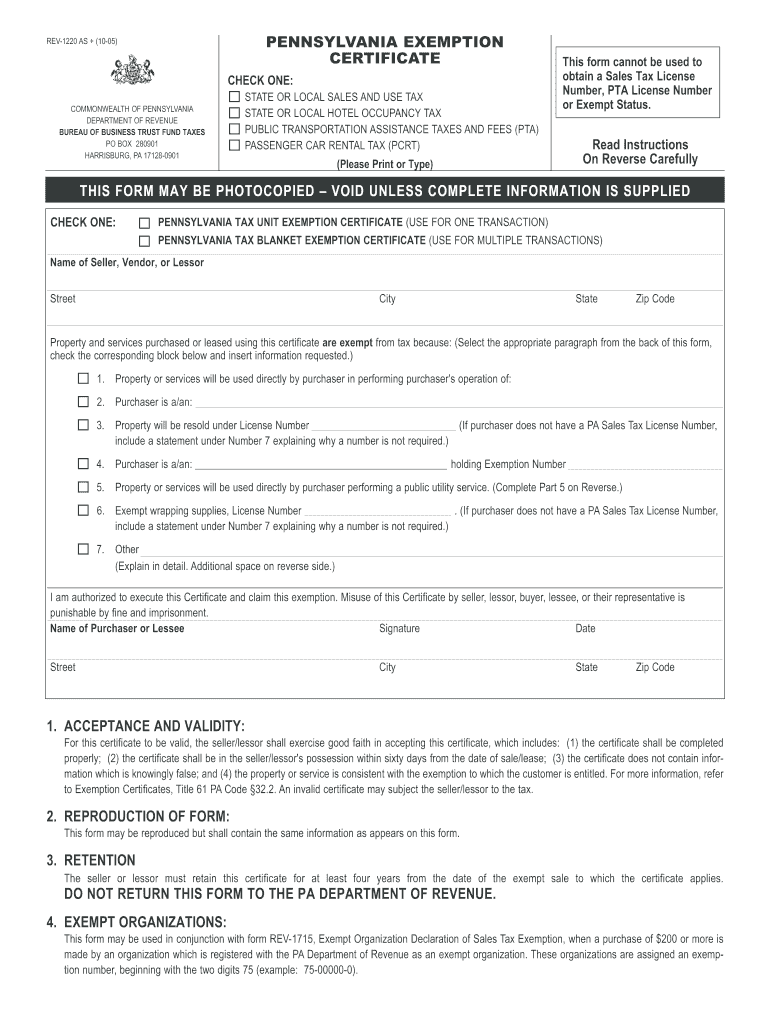

The Rev 1220 form is a specific document used in the United States for various administrative purposes, often related to tax and legal compliance. It serves as an official request or declaration that requires accurate information to ensure its validity. Understanding the Rev 1220 is crucial for individuals and businesses to navigate their obligations effectively.

How to use the Rev 1220

Using the Rev 1220 form involves several key steps that ensure proper completion and submission. First, gather all necessary information required by the form, including personal identification details and any relevant financial data. Next, fill out the form accurately, ensuring that all fields are completed as instructed. Once completed, review the form for any errors before submission to avoid delays in processing.

Steps to complete the Rev 1220

Completing the Rev 1220 form involves a systematic approach:

- Gather required documentation, such as identification and financial records.

- Carefully read the instructions provided with the form.

- Fill in all necessary fields, ensuring accuracy and completeness.

- Review the form for any mistakes or missing information.

- Submit the form according to the specified methods, whether online, by mail, or in person.

Legal use of the Rev 1220

The legal use of the Rev 1220 form is governed by specific regulations and guidelines. To ensure that the form is recognized as valid, it must be completed in accordance with applicable laws. This includes providing accurate information, obtaining necessary signatures, and adhering to submission deadlines. Compliance with these legal standards is essential for the form to be accepted by relevant authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Rev 1220 form can vary based on the specific purpose of the form and the jurisdiction involved. It is crucial to be aware of these deadlines to avoid penalties or complications. Typically, these dates are outlined in the instructions accompanying the form or can be verified through official government resources.

Examples of using the Rev 1220

The Rev 1220 form may be utilized in various scenarios, such as:

- Submitting tax-related information to the IRS.

- Requesting changes to personal or business information.

- Documenting compliance with state regulations.

Each of these examples highlights the form's versatility and importance in maintaining accurate records and fulfilling legal obligations.

Quick guide on how to complete rev 1220

Effortlessly Complete Rev 1220 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without setbacks. Handle Rev 1220 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Rev 1220 with Ease

- Find Rev 1220 and click on Get Form to initiate the process.

- Utilize the available tools to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Rev 1220 to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1220

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rev 1220 and how does it relate to airSlate SignNow?

Rev 1220 is a unique feature within airSlate SignNow that streamlines the document signing process for businesses. It allows users to send and eSign documents quickly and efficiently, improving workflow and reducing turnaround times. By utilizing Rev 1220, organizations can enhance their document management and eSignature capabilities.

-

How much does Rev 1220 cost with airSlate SignNow?

The pricing for airSlate SignNow, including the Rev 1220 feature, varies based on the plan you choose. We offer flexible subscription options that cater to different business sizes and needs. To get the most accurate pricing information, you can visit our website or contact our sales team for a detailed quote.

-

What are the key features of Rev 1220 in airSlate SignNow?

Rev 1220 includes several powerful features such as customizable templates, real-time tracking, and secure eSigning. Users can create personalized documents and monitor the signing process in real-time for enhanced efficiency. This combination of features makes Rev 1220 an invaluable tool for any business aiming for improved document workflows.

-

What benefits does Rev 1220 provide to businesses?

Businesses that implement Rev 1220 with airSlate SignNow experience increased productivity and signNow time savings. By simplifying the eSignature process, Rev 1220 allows teams to focus on core tasks rather than getting bogged down by paperwork. Additionally, it enhances compliance and security, ensuring documents are signed promptly and safely.

-

Can Rev 1220 integrate with other applications?

Yes, Rev 1220 is designed to seamlessly integrate with various applications, enhancing its functionality within your existing workflows. airSlate SignNow supports integrations with popular tools such as Salesforce, Google Drive, and Microsoft Office. This ensures you can leverage Rev 1220’s capabilities without disrupting your current systems.

-

Is there a trial available for Rev 1220 in airSlate SignNow?

Yes, airSlate SignNow offers a free trial for users interested in exploring the Rev 1220 feature. This trial provides access to all functionalities, allowing prospective customers to experience the benefits firsthand. Sign up on our website to start your trial and see how Rev 1220 can transform your document signing process.

-

How secure is the signing process with Rev 1220?

The signing process with Rev 1220 is highly secure, utilizing advanced encryption methods to protect your information. airSlate SignNow complies with industry standards and regulations to ensure data integrity and confidentiality. You can trust that your documents are safe and secure while using Rev 1220 for eSigning.

Get more for Rev 1220

- Alexandria va form

- Tax number form

- Dubai derma application contract for exhibit space promotional tools sponsorship form

- Pa tax form

- Dekalb county fire rescue captains promotional exam form

- Elementarynest commastering phonologicalmastering phonological awareness for first grade common core form

- Renewal title form

- Employee waiver form

Find out other Rev 1220

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT