Office Depot Tax Exempt Form

What is the Office Depot Tax Exempt Form

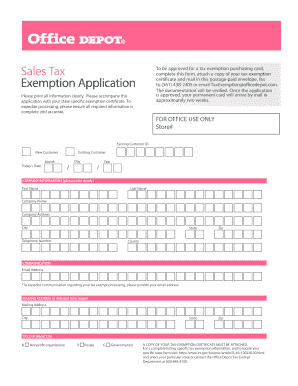

The Office Depot Tax Exempt Form is a document that allows qualifying organizations to make purchases without paying sales tax. This form is essential for entities such as non-profits, government agencies, and educational institutions that are exempt from sales tax obligations under U.S. law. By submitting this form, these organizations can facilitate tax-exempt purchases at Office Depot, ensuring compliance with state and federal regulations.

How to use the Office Depot Tax Exempt Form

Using the Office Depot Tax Exempt Form involves several straightforward steps. First, ensure that your organization qualifies for tax exemption by reviewing state-specific eligibility criteria. Next, complete the form accurately, providing necessary details such as your organization’s name, address, and tax identification number. Once filled out, submit the form to Office Depot either online or in-store, depending on your preference. This process allows your organization to make tax-exempt purchases seamlessly.

Steps to complete the Office Depot Tax Exempt Form

Completing the Office Depot Tax Exempt Form requires careful attention to detail. Follow these steps:

- Download the form from the Office Depot website or obtain a physical copy at a store.

- Fill in the organization’s legal name and address as registered with the IRS.

- Provide the tax identification number, ensuring it is accurate.

- Indicate the type of organization and the reason for tax exemption.

- Sign and date the form to validate the information provided.

After completing these steps, submit the form according to the specified submission methods.

Legal use of the Office Depot Tax Exempt Form

The legal use of the Office Depot Tax Exempt Form is governed by various state and federal laws. To ensure compliance, organizations must only use the form for eligible purchases. Misuse of the form can lead to penalties, including fines and back taxes. It is crucial for organizations to maintain accurate records of tax-exempt purchases and the corresponding forms submitted to avoid legal complications.

Required Documents

To successfully complete the Office Depot Tax Exempt Form, certain documents may be required. These typically include:

- A valid tax identification number.

- Proof of the organization’s tax-exempt status, such as a letter from the IRS.

- Any state-specific documentation that verifies the organization’s exemption status.

Having these documents ready will streamline the process and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Office Depot Tax Exempt Form can be submitted through various methods to accommodate different preferences. Organizations can submit the form online via the Office Depot website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the designated Office Depot address or delivered in person at a local store. Each method offers a convenient way to ensure that tax-exempt status is recognized at the point of sale.

Quick guide on how to complete office depot tax exempt form

Prepare Office Depot Tax Exempt Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Office Depot Tax Exempt Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Office Depot Tax Exempt Form with ease

- Locate Office Depot Tax Exempt Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of your documents or mask sensitive information with tools provided by airSlate SignNow explicitly for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Office Depot Tax Exempt Form and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the office depot tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the office depot sales exemption fillable form?

The office depot sales exemption fillable form is a document that allows businesses to claim tax exemptions when purchasing goods from Office Depot. This form streamlines the purchasing process and ensures compliance with state and local tax laws. By using the fillable form, you can easily enter your information and submit it electronically.

-

How can I obtain the office depot sales exemption fillable form?

You can obtain the office depot sales exemption fillable form directly from Office Depot's website or through airSlate SignNow. Simply download the form, fill it out digitally, and you'll be ready to submit it with your purchase. Using airSlate SignNow makes the process even easier with electronic signatures.

-

Is there a cost associated with using the office depot sales exemption fillable form?

The office depot sales exemption fillable form itself is free to download and use. However, airSlate SignNow offers cost-effective solutions for electronically signing and managing your forms. Consider utilizing their services for better efficiency and enhanced document management.

-

What are the benefits of using the office depot sales exemption fillable form?

Using the office depot sales exemption fillable form provides several benefits, including time-saving electronic completion and the ability to ensure all necessary information is included. Additionally, submitting a completed form can prevent unnecessary tax payments, allowing your business to save money. AirSlate SignNow enhances this process by allowing for quick e-signatures.

-

Can I integrate the office depot sales exemption fillable form with other applications?

Yes, you can integrate the office depot sales exemption fillable form with various business applications when using airSlate SignNow. This integration allows for seamless data transfer and better management of documents across your business systems. This connectivity helps streamline your workflows and improve overall efficiency.

-

What features does airSlate SignNow offer for the office depot sales exemption fillable form?

AirSlate SignNow offers several features for the office depot sales exemption fillable form, including easy-to-use templates, electronic signatures, and document storage. Additionally, it provides tracking and reminders, ensuring you stay on top of your submissions. All these features help optimize your experience and improve document handling.

-

How can I ensure my office depot sales exemption fillable form is completed correctly?

To ensure your office depot sales exemption fillable form is completed correctly, double-check all entered information for accuracy before submission. Using airSlate SignNow’s step-by-step guidance can help you avoid common mistakes. Additionally, you can preview your form before sending it to ensure everything is as required.

Get more for Office Depot Tax Exempt Form

- City planning commission disposition sheet sara av form

- Service hours time sheet fill online printable fillable blank form

- Music therapy referral form 612662894

- Oh elections absent voters ballot form

- Ohio judicial release 457737134 form

- Pdf vermont certificate of veteran status form

- Vermont record request dmv form

- Selfhelp courts ca govrespond divorce papersformsrespond to divorce paperscalifornia courtsself help guide

Find out other Office Depot Tax Exempt Form

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF