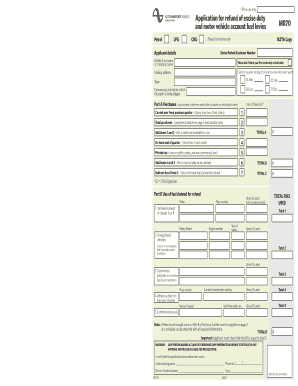

Mr70 Form 2013

What is the Mr70 Form

The Mr70 form, also known as the NZTA Mr70, is a document used primarily in the context of vehicle registration and licensing in New Zealand. It serves as a declaration for the ownership of a vehicle and is crucial for transferring or registering vehicles. This form is essential for ensuring that all legal requirements regarding vehicle ownership are met, which is vital for both buyers and sellers in a vehicle transaction.

How to use the Mr70 Form

Using the Mr70 form involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from the relevant authority or downloaded online. Next, fill out the required information, including details about the vehicle and the parties involved in the transaction. After completing the form, it must be signed by all parties to validate the transaction. Finally, submit the form to the appropriate agency to finalize the vehicle registration or transfer process.

Steps to complete the Mr70 Form

Completing the Mr70 form involves the following steps:

- Obtain the Mr70 form from a reliable source.

- Fill in the vehicle details, including make, model, and VIN (Vehicle Identification Number).

- Provide personal information for both the seller and buyer, such as names and addresses.

- Sign the form to confirm the accuracy of the information provided.

- Submit the completed form to the relevant authority, either online or in person.

Legal use of the Mr70 Form

The Mr70 form is legally binding when completed correctly. It serves as proof of ownership transfer and is recognized by authorities as a valid document for vehicle registration. To ensure its legal standing, all required fields must be filled out accurately, and signatures must be obtained from all parties involved. Compliance with local laws and regulations is essential to avoid any disputes regarding vehicle ownership.

Key elements of the Mr70 Form

Several key elements must be included in the Mr70 form to ensure its validity:

- Vehicle Information: This includes the make, model, year, and VIN.

- Seller Information: Full name and address of the seller.

- Buyer Information: Full name and address of the buyer.

- Signatures: Signatures of both the seller and buyer are required to validate the transaction.

Form Submission Methods

The Mr70 form can be submitted through various methods, depending on the requirements of the local authority. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic submission via their official websites.

- Mail: The form can be printed and sent through postal services to the relevant authority.

- In-Person: Submitting the form directly at a local office is often an option for those who prefer face-to-face interaction.

Quick guide on how to complete mr70 form

Complete Mr70 Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly and without holdups. Handle Mr70 Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based procedure today.

The easiest way to modify and eSign Mr70 Form with ease

- Obtain Mr70 Form and click Get Form to get started.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Mr70 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mr70 form

Create this form in 5 minutes!

How to create an eSignature for the mr70 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mr70 form, and how is it used?

The mr70 form is a specific document format used for various business processes. It facilitates efficient document management, allowing organizations to collect necessary signatures and approvals electronically. By using the mr70 form, businesses can streamline their workflows and maintain compliance.

-

How can airSlate SignNow help with the mr70 form?

airSlate SignNow provides an intuitive platform for creating, sharing, and eSigning the mr70 form. The software simplifies the process, ensuring that all parties can easily complete and submit the form electronically. This reduces turnaround time and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for the mr70 form?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs. Each plan includes access to features for managing the mr70 form and other documents. Choose a plan that best fits your business’s requirements and budget.

-

What features does airSlate SignNow offer for the mr70 form?

airSlate SignNow offers a range of features for the mr70 form, including customizable templates, automated workflows, and secure storage. These features help businesses enhance efficiency and ensure that all necessary signatures are captured seamlessly. Additionally, the platform supports real-time tracking.

-

Can I integrate airSlate SignNow with other applications for managing the mr70 form?

Yes, airSlate SignNow supports integrations with numerous applications to streamline the management of the mr70 form. You can connect with popular CRMs, document storage services, and other productivity tools to create a more cohesive workflow. This flexibility helps businesses maintain an organized system.

-

What are the benefits of using airSlate SignNow for the mr70 form?

Using airSlate SignNow for the mr70 form provides businesses with enhanced efficiency, reduced costs, and improved document security. The platform allows users to easily eSign and process forms, minimizing delays and errors. Overall, it simplifies administrative tasks and improves collaboration.

-

Is airSlate SignNow secure for handling the mr70 form?

Absolutely, airSlate SignNow prioritizes security when handling the mr70 form and other documents. The platform employs robust encryption, secure access controls, and data compliance measures to protect sensitive information. Users can confidently manage their forms without compromising security.

Get more for Mr70 Form

Find out other Mr70 Form

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy