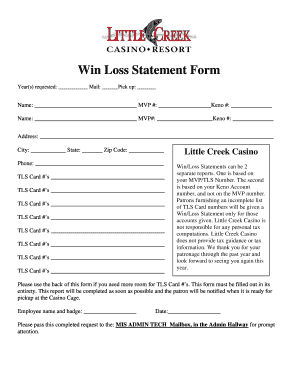

Little Creek Win Loss Statement Form

What is the Little Creek Win Loss Statement

The Little Creek Win Loss Statement is a specialized financial document used primarily by businesses to summarize their financial performance over a specific period. This statement provides a clear overview of income and expenses, helping organizations assess their profitability. It is particularly useful for businesses that need to report their financial results to stakeholders or for tax purposes. By detailing both wins and losses, this form aids in strategic planning and financial analysis.

How to use the Little Creek Win Loss Statement

Using the Little Creek Win Loss Statement involves several straightforward steps. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation. Next, input the data into the designated sections of the form, ensuring accuracy in reporting both revenues and expenditures. After completing the form, review it for any discrepancies and ensure all figures are correctly calculated. Finally, submit the statement to the appropriate parties, whether for internal review or external reporting.

Steps to complete the Little Creek Win Loss Statement

Completing the Little Creek Win Loss Statement requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, including invoices and receipts.

- Identify the reporting period for the statement.

- List all sources of income and their respective amounts.

- Document all expenses, categorizing them appropriately.

- Calculate total income and total expenses.

- Determine the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Little Creek Win Loss Statement

The Little Creek Win Loss Statement holds legal significance in various contexts, particularly for tax reporting and financial disclosures. To ensure its legal validity, the statement must be completed accurately and in compliance with applicable laws. This includes adhering to the relevant regulations concerning financial reporting and maintaining accurate records. When submitted to regulatory bodies or used in legal proceedings, the statement may serve as evidence of a business's financial health.

Key elements of the Little Creek Win Loss Statement

Several key elements are essential for a comprehensive Little Creek Win Loss Statement. These include:

- Income Sources: A detailed list of all revenue streams.

- Expense Categories: Clear categorization of all costs incurred.

- Net Profit or Loss: A calculation indicating the overall financial outcome.

- Reporting Period: The specific timeframe the statement covers.

- Signature: A section for authorized personnel to validate the document.

Examples of using the Little Creek Win Loss Statement

Businesses utilize the Little Creek Win Loss Statement in various scenarios. For instance, a small business may use it to prepare for tax season, ensuring all income and expenses are accurately reported. Additionally, startups often present this statement to potential investors to demonstrate financial viability. Nonprofits may also use it to provide transparency to donors regarding how funds are utilized and the organization's overall financial health.

Quick guide on how to complete little creek win loss statement

Complete Little Creek Win Loss Statement effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Little Creek Win Loss Statement on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Little Creek Win Loss Statement without hassle

- Find Little Creek Win Loss Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Little Creek Win Loss Statement and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the little creek win loss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are littlecreekwinandlossforms and how can they benefit my business?

Littlecreekwinandlossforms are specialized documents designed to streamline the process of filing win and loss claims. By using these forms, businesses can save time, reduce errors, and ensure a smoother claims submission process. airSlate SignNow allows you to create, send, and eSign these forms effortlessly.

-

How much does it cost to use littlecreekwinandlossforms with airSlate SignNow?

Pricing for using littlecreekwinandlossforms with airSlate SignNow varies depending on the subscription plan you choose. We offer flexible pricing options that cater to different business needs, ensuring you only pay for the features you require. Check our pricing page for detailed information.

-

What features do littlecreekwinandlossforms include?

Littlecreekwinandlossforms include essential features such as customizable fields, electronic signatures, and real-time tracking. With airSlate SignNow, you can easily modify these forms to fit your specific requirements and ensure they meet your compliance needs. Our platform is designed to enhance efficiency for all users.

-

Can littlecreekwinandlossforms be integrated with other tools?

Yes, littlecreekwinandlossforms can be seamlessly integrated with various applications using airSlate SignNow. This capability allows you to streamline your workflows and connect with tools such as CRMs, ERP systems, and more. Our integration options make it easy to enhance your productivity.

-

Is it safe to use airSlate SignNow for littlecreekwinandlossforms?

Absolutely! airSlate SignNow prioritizes security when processing littlecreekwinandlossforms. We employ advanced encryption and authentication measures to protect your sensitive information, ensuring that your documents and eSignatures are safe and secure.

-

How can I customize littlecreekwinandlossforms to meet my needs?

Customizing littlecreekwinandlossforms with airSlate SignNow is easy and intuitive. You can drag and drop fields, add company branding, and alter the layout to fit your brand's identity. Our user-friendly interface ensures that you can tailor these forms to effectively serve your business needs.

-

Can I track the status of littlecreekwinandlossforms sent for eSignature?

Yes, with airSlate SignNow, you can easily track the status of littlecreekwinandlossforms that have been sent for eSignature. Our platform provides real-time updates, so you know exactly when a document has been viewed, signed, or completed. This feature helps you manage your workflow effectively.

Get more for Little Creek Win Loss Statement

Find out other Little Creek Win Loss Statement

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free