Loan Application Sinhala 2013

Key elements of the bank application form

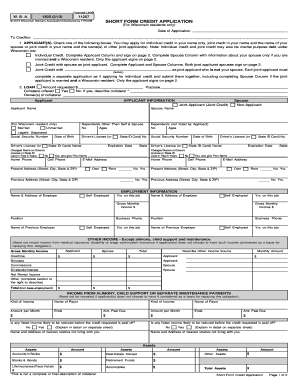

The bank application form typically requires several essential elements to ensure a comprehensive understanding of the applicant's financial background. Key components include:

- Personal Information: This includes the applicant's full name, address, date of birth, and Social Security number.

- Employment Details: Information about the applicant's current employment status, employer's name, job title, and income.

- Financial Information: Details regarding the applicant's assets, liabilities, and any existing loans or credit lines.

- Loan Purpose: A section where the applicant specifies the intended use of the loan, such as home purchase, debt consolidation, or business expansion.

- Signature: A space for the applicant's signature, which is crucial for the validation of the application.

Steps to complete the bank application form

Filling out the bank application form involves a series of straightforward steps to ensure accuracy and completeness:

- Gather necessary documents, such as identification and proof of income.

- Carefully read the instructions provided with the form.

- Fill in personal information accurately, ensuring all details match official documents.

- Provide employment and financial information, double-checking for accuracy.

- Clearly state the purpose of the loan and any additional information required.

- Review the completed application for any errors or omissions.

- Sign and date the form before submission.

Eligibility criteria for the bank application form

Determining eligibility for a loan application typically involves several criteria that applicants must meet:

- Age: Applicants must be at least eighteen years old.

- Credit History: A review of the applicant's credit score and history is essential for assessing risk.

- Income: Proof of stable income is necessary to ensure the applicant can repay the loan.

- Residency: Applicants usually need to be U.S. residents or citizens.

- Debt-to-Income Ratio: A calculation of the applicant's monthly debt payments compared to their gross monthly income.

Required documents for the bank application form

To complete the bank application form, applicants must provide specific documents to support their application. Commonly required documents include:

- Identification: A government-issued ID, such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Employment Verification: A letter from the employer or a recent employment contract.

- Credit History: A recent credit report may be requested to assess creditworthiness.

- Asset Documentation: Statements for any assets, such as savings accounts, investments, or property.

Form submission methods for the bank application form

Submitting the bank application form can be done through various methods, ensuring convenience for applicants. Common submission methods include:

- Online Submission: Many banks offer a secure online portal for applicants to fill out and submit their forms digitally.

- Mail: Applicants can print the completed form and send it via postal service to the bank's designated address.

- In-Person: Some applicants may prefer to visit a local branch to submit their application directly to a bank representative.

Legal use of the bank application form

The legal use of the bank application form is governed by various regulations that ensure its validity and security. Key aspects include:

- Compliance with Federal Laws: The application must adhere to laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA).

- Data Protection: Banks are required to handle personal information in compliance with privacy regulations, safeguarding applicant data.

- Signature Requirements: The applicant's signature is essential for the legal binding of the application, confirming their intent to apply for the loan.

Quick guide on how to complete loan application sinhala

Easily Create Loan Application Sinhala on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Loan Application Sinhala on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven procedure today.

The Simplest Method to Edit and Electronically Sign Loan Application Sinhala Effortlessly

- Find Loan Application Sinhala and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Loan Application Sinhala and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan application sinhala

Create this form in 5 minutes!

How to create an eSignature for the loan application sinhala

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank application form?

A bank application form is a document that individuals need to complete when applying for a bank account or financial service. Using airSlate SignNow, you can easily create, send, and eSign bank application forms efficiently. This streamlines the onboarding process for both customers and financial institutions.

-

How does airSlate SignNow improve the bank application form process?

airSlate SignNow enhances the bank application form process by allowing users to fill out and eSign documents securely online. This reduces the time and effort required to complete traditional paper forms. Additionally, it ensures greater accuracy and compliance in handling sensitive banking information.

-

Is airSlate SignNow affordable for small businesses handling bank application forms?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses dealing with bank application forms. Our pricing plans are designed to fit various budgets, providing essential features to streamline document management without breaking the bank. You can choose a plan that best suits your business needs.

-

What features does airSlate SignNow offer for bank application forms?

airSlate SignNow includes a variety of features for bank application forms, such as customizable templates, automated workflows, and secure eSigning capabilities. These tools help businesses manage their documents efficiently, ensuring a smooth application process for their customers. Enhanced security protocols also protect sensitive information.

-

Can I integrate airSlate SignNow with other applications for bank application forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enabling you to enhance your workflow for bank application forms. Whether you're using CRM systems, cloud storage, or other business tools, our integrations help keep your processes connected and efficient. This integration capability maximizes productivity and minimizes manual work.

-

What benefits can my business expect from using airSlate SignNow for bank application forms?

Using airSlate SignNow for bank application forms can signNowly reduce processing time and improve customer satisfaction. The platform provides an intuitive interface for users, making it easy to fill in and sign documents quickly. Additionally, increased efficiency leads to cost savings and a better overall experience for both staff and clients.

-

How secure is the information provided on bank application forms through airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive information on bank application forms. Our platform employs robust encryption and secure access protocols to ensure that all data is protected during transmission and storage. We adhere to strict compliance standards to safeguard customer and institutional information.

Get more for Loan Application Sinhala

Find out other Loan Application Sinhala

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile