Internal Revenue Service Form 8288 a Copy B 2018

What is the Internal Revenue Service Form 8288 A Copy B

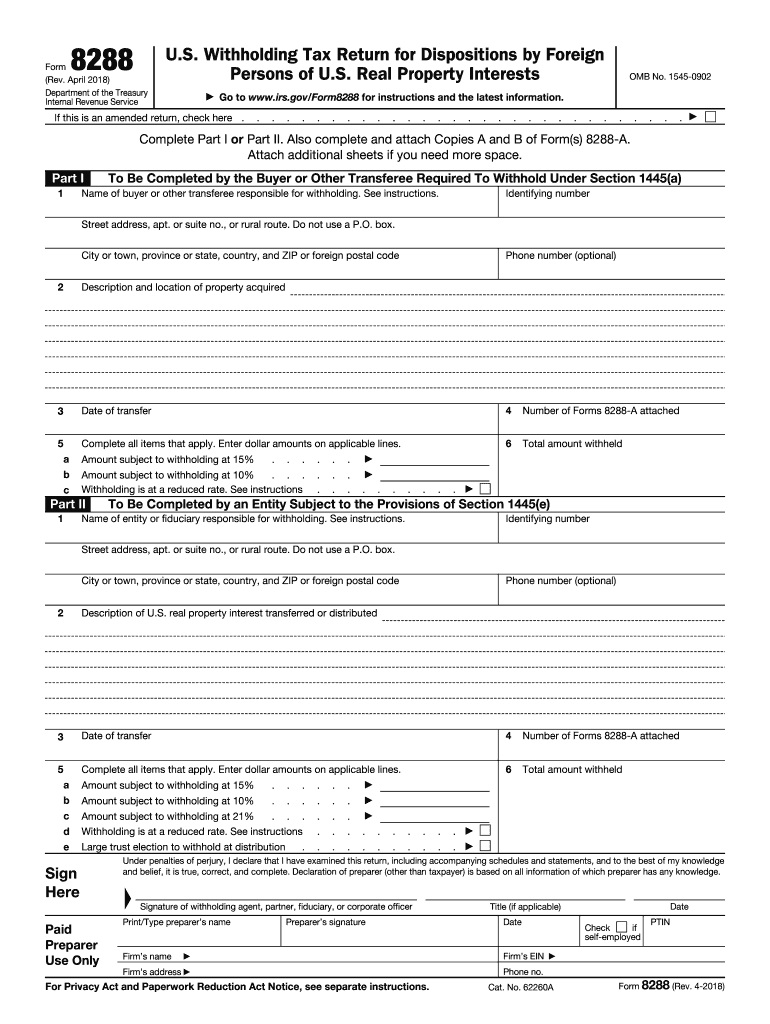

The Internal Revenue Service Form 8288 A Copy B is a crucial document used in the context of the Foreign Investment in Real Property Tax Act (FIRPTA). This form is specifically designed for withholding tax purposes when a foreign person sells or disposes of U.S. real property interests. It serves as a notification to the IRS regarding the amount of tax withheld on the sale proceeds. The form must be filed by the buyer or transferee to ensure compliance with U.S. tax laws, and it helps the IRS track tax obligations related to foreign transactions involving real estate.

How to use the Internal Revenue Service Form 8288 A Copy B

Using Form 8288 A Copy B involves several key steps. First, the buyer or transferee must determine if the seller is a foreign person. If so, the buyer is required to withhold a percentage of the gross sales price as tax. The next step is to complete the form accurately, ensuring that all required information is provided, including the seller's details and the amount withheld. Once completed, the form should be submitted to the IRS along with the withheld tax payment. It is essential to retain a copy for personal records and provide a copy to the seller as well.

Steps to complete the Internal Revenue Service Form 8288 A Copy B

Completing Form 8288 A Copy B requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Determine the total sales price of the property and calculate the withholding amount, which is typically fifteen percent of the sales price.

- Fill out the form by entering the seller's information, the amount withheld, and any additional required details.

- Review the completed form for accuracy to avoid potential issues with the IRS.

- Submit the form to the IRS along with the payment of the withheld tax, ensuring it is sent to the correct address.

Filing Deadlines / Important Dates

Filing deadlines for Form 8288 A Copy B are critical to ensure compliance with IRS regulations. The form must be filed with the IRS within twenty days of the sale or transfer of the property. It is essential to adhere to this timeline to avoid penalties. Additionally, the withheld tax payment must be submitted simultaneously with the form. Staying informed about these deadlines helps facilitate a smooth transaction and prevents unnecessary complications.

Legal use of the Internal Revenue Service Form 8288 A Copy B

The legal use of Form 8288 A Copy B is governed by FIRPTA regulations. This form is legally required when a foreign seller disposes of U.S. real property interests. Failure to file the form or to withhold the appropriate amount can result in significant penalties for the buyer. It is important to understand the legal implications of using this form, as it ensures compliance with U.S. tax laws and protects both the buyer and seller from potential legal issues.

Penalties for Non-Compliance

Non-compliance with the filing requirements of Form 8288 A Copy B can lead to severe penalties. If the buyer fails to withhold the required tax or does not file the form on time, the IRS may impose fines and interest on the unpaid tax amount. Additionally, the buyer may be held liable for the tax amount that should have been withheld. Understanding these potential penalties emphasizes the importance of timely and accurate filing of the form to avoid financial repercussions.

Quick guide on how to complete form 8288 2018 2019

Discover the easiest method to complete and endorse your Internal Revenue Service Form 8288 A Copy B

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to finalize and endorse your Internal Revenue Service Form 8288 A Copy B and comparable forms for public services. Our advanced electronic signature solution equips you with all the necessary tools to manage documentation swiftly and in compliance with official standards - comprehensive PDF editing, organizing, securing, endorsing, and sharing functionalities all conveniently accessible within an intuitive interface.

Only a few simple steps are needed to fill out and endorse your Internal Revenue Service Form 8288 A Copy B:

- Load the editable template into the editor using the Get Form button.

- Review the information you need to enter in your Internal Revenue Service Form 8288 A Copy B.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Checkbox, and Cross tools to fill in the sections with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal fields that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task using the Done button.

Store your completed Internal Revenue Service Form 8288 A Copy B in the Documents section of your profile, download it, or send it to your chosen cloud storage. Our solution also provides flexible form sharing options. There’s no need to print your forms when you have to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a shot now!

Create this form in 5 minutes or less

Find and fill out the correct form 8288 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form 8288 2018 2019

How to create an electronic signature for the Form 8288 2018 2019 online

How to create an electronic signature for your Form 8288 2018 2019 in Google Chrome

How to make an electronic signature for putting it on the Form 8288 2018 2019 in Gmail

How to create an eSignature for the Form 8288 2018 2019 from your smartphone

How to make an eSignature for the Form 8288 2018 2019 on iOS devices

How to generate an eSignature for the Form 8288 2018 2019 on Android OS

People also ask

-

What is the Internal Revenue Service Form 8288 A Copy B used for?

The Internal Revenue Service Form 8288 A Copy B is primarily used by foreign individuals and entities to report the withholding tax on the sale of U.S. real estate. It ensures compliance with U.S. tax laws and is essential for non-resident sellers to properly report their transactions. Understanding its use is crucial for anyone engaging in real estate transactions in the United States.

-

How can airSlate SignNow help me sign the Internal Revenue Service Form 8288 A Copy B?

airSlate SignNow simplifies the process of signing important documents like the Internal Revenue Service Form 8288 A Copy B. With our intuitive platform, you can securely eSign this form and send it directly to the relevant parties, ensuring a swift and hassle-free experience. Our user-friendly interface makes it easy for everyone, regardless of technical expertise.

-

Is airSlate SignNow affordable for small businesses needing to handle the Internal Revenue Service Form 8288 A Copy B?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses that need to manage documents like the Internal Revenue Service Form 8288 A Copy B. Our cost-effective solutions ensure that you can access essential eSigning features without breaking the bank. Explore our plans to find one that suits your budget and needs.

-

Can I integrate airSlate SignNow with other software to manage the Internal Revenue Service Form 8288 A Copy B?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to manage documents like the Internal Revenue Service Form 8288 A Copy B efficiently. Whether you use CRM systems or accounting software, our integrations enhance your workflow and ensure all documents are in one place for easy access and management.

-

What security measures does airSlate SignNow implement for the Internal Revenue Service Form 8288 A Copy B?

At airSlate SignNow, the security of your documents, including the Internal Revenue Service Form 8288 A Copy B, is our top priority. We utilize advanced encryption methods and secure cloud storage to protect sensitive information. Additionally, our platform complies with industry standards to ensure your data remains safe and confidential.

-

Can I track the status of my Internal Revenue Service Form 8288 A Copy B with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Internal Revenue Service Form 8288 A Copy B. You will receive notifications when the document is viewed, signed, or completed, enabling you to stay informed throughout the process. This feature enhances your ability to manage important transactions efficiently.

-

What types of documents can I eSign besides the Internal Revenue Service Form 8288 A Copy B?

In addition to the Internal Revenue Service Form 8288 A Copy B, airSlate SignNow supports eSigning a wide range of documents, including contracts, agreements, and forms across various industries. Our platform is designed to handle any document that requires a signature, making it a versatile tool for all your eSigning needs. Experience the convenience of managing multiple document types in one place.

Get more for Internal Revenue Service Form 8288 A Copy B

Find out other Internal Revenue Service Form 8288 A Copy B

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free