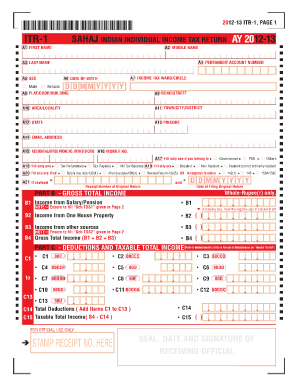

Itr 1 PDF Form

What is the ITR 1 PDF?

The ITR 1 PDF is a specific income tax return form used by individual taxpayers in the United States. This form is designed for residents who earn income from salaries, pensions, or interest. It simplifies the filing process for those with straightforward financial situations, allowing them to report their income and calculate their tax obligations efficiently. The ITR 1 PDF is essential for ensuring compliance with federal tax regulations and is a key document during tax season.

Steps to Complete the ITR 1 PDF

Completing the ITR 1 PDF involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2 forms, 1099s, and any other relevant income statements. Next, follow these steps:

- Open the ITR 1 PDF using a compatible PDF reader.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income sources accurately in the designated sections.

- Calculate your total income and any deductions you may qualify for.

- Review the form for accuracy before submission.

Completing these steps carefully will help ensure a smooth filing process.

Legal Use of the ITR 1 PDF

The ITR 1 PDF is legally recognized as a valid document for tax filing purposes in the United States. To be considered legally binding, the form must be completed accurately and submitted within the designated filing deadlines. Compliance with IRS regulations is crucial, as inaccuracies or omissions can lead to penalties or audits. Ensure that all information is truthful and complete to maintain the integrity of your tax return.

Key Elements of the ITR 1 PDF

Understanding the key elements of the ITR 1 PDF is essential for effective completion. Important sections include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Details: Report all sources of income, including wages, pensions, and interest.

- Deductions: Identify any eligible deductions that can reduce your taxable income.

- Tax Calculation: The form includes a section for calculating your total tax liability based on reported income.

Familiarity with these elements will aid in accurate form completion.

Form Submission Methods

Submitting the ITR 1 PDF can be done through various methods, ensuring convenience for taxpayers. The available submission methods include:

- Online Submission: Utilize the IRS e-file system for quick and secure electronic filing.

- Mail: Print the completed form and send it to the appropriate IRS address based on your location.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or authorized tax preparation locations.

Selecting the right submission method can streamline the filing process and ensure timely compliance.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for avoiding penalties. The typical deadline for submitting the ITR 1 PDF is April fifteenth of each year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission and compliance with IRS regulations.

Required Documents

To complete the ITR 1 PDF accurately, certain documents are necessary. Key documents include:

- W-2 Forms: These forms report wages and tax withheld from your employer.

- 1099 Forms: Required for reporting income from freelance work or interest earnings.

- Proof of Deductions: Documentation for any deductions claimed, such as mortgage interest or student loan interest.

Having these documents on hand will facilitate a smoother filing process and enhance accuracy.

Quick guide on how to complete itr 1 pdf

Effortlessly Prepare Itr 1 Pdf on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Itr 1 Pdf on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Itr 1 Pdf with Ease

- Locate Itr 1 Pdf and click on Get Form to initiate.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Itr 1 Pdf to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr 1 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ITR 1 form filled sample?

An ITR 1 form filled sample is a completed version of the Income Tax Return 1 form used for individuals in India. It serves as a reference to help taxpayers understand how to fill out the form correctly. By reviewing a sample, users can ensure they include all required details and avoid common errors.

-

How can airSlate SignNow help with submitting an ITR 1 form filled sample?

airSlate SignNow allows users to easily upload and send their ITR 1 form filled samples securely. The platform ensures that all your documents are legally binding and compliant with regulations. This simplifies the process of submission and keeps your sensitive information secure.

-

What features does airSlate SignNow offer for managing ITR 1 form filled samples?

With airSlate SignNow, you can annotate, sign, and securely store your ITR 1 form filled samples. The platform also provides templates and workflow automation to streamline documentation processes. These features enhance efficiency and eliminate manual errors.

-

Is airSlate SignNow affordable for small businesses handling ITR 1 form filled samples?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses. The cost-effective solution allows businesses to manage their ITR 1 form filled samples without breaking the bank. Customers can choose from various pricing plans to suit their specific needs.

-

Can I integrate airSlate SignNow with other applications for managing ITR 1 form filled samples?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications like Google Drive, Slack, and Microsoft Office. These integrations facilitate easy access to your ITR 1 form filled samples and improve your overall workflow.

-

What are the benefits of using airSlate SignNow for ITR 1 form filled samples?

Using airSlate SignNow for your ITR 1 form filled samples provides you with a secure, straightforward eSigning solution. It reduces turnaround time for document exchanges and enhances collaboration among stakeholders. Plus, it's user-friendly, making it ideal for both individuals and businesses.

-

How do I get started with airSlate SignNow for my ITR 1 form filled samples?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you can start uploading your ITR 1 form filled samples right away. Our intuitive interface guides you through the signing and sharing processes smoothly.

Get more for Itr 1 Pdf

- Estate closing form

- Sample letter to withdraw offer on house form

- Bank request to release funds of deceased letter form

- Letter invitation to form

- Letter of renunciation of executorship form

- Payoff request template form

- Probate court statement of creditors claim oconee sc form

- Sample letter complaining about movers form

Find out other Itr 1 Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors