Payroll Form

What is the Payroll Form

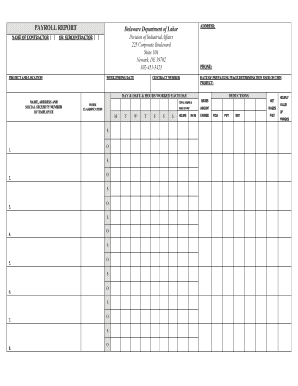

The payroll form is a crucial document used by businesses to report employee wages and taxes withheld. This form ensures compliance with federal and state regulations while providing a clear record of employee compensation. It typically includes details such as employee names, Social Security numbers, wages earned, and tax deductions. Understanding its purpose is essential for both employers and employees to ensure accurate reporting and compliance with legal requirements.

How to Use the Payroll Form

Using the payroll form involves several steps to ensure accurate reporting. First, gather all necessary employee information, including names, Social Security numbers, and pay rates. Next, calculate the total wages for the pay period, along with any deductions for taxes and benefits. Once the form is filled out, it should be reviewed for accuracy before submission. Employers must retain copies for their records and provide employees with their individual payroll reports as required.

Steps to Complete the Payroll Form

Completing the payroll form requires careful attention to detail. Follow these steps for accuracy:

- Collect employee information: Ensure all necessary data is available, including personal and financial details.

- Calculate gross wages: Determine the total earnings for each employee during the pay period.

- Deduct taxes and other withholdings: Calculate federal, state, and local taxes, along with any other deductions.

- Complete the form: Fill in all required fields accurately, ensuring compliance with regulations.

- Review and verify: Double-check all entries for accuracy before finalizing the form.

Legal Use of the Payroll Form

The payroll form must be used in accordance with various legal frameworks to ensure its validity. Compliance with the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) guidelines is essential. This includes accurately reporting wages, maintaining records, and adhering to deadlines for submission. Failure to comply can result in penalties, making it critical for businesses to understand the legal implications of their payroll reporting.

Key Elements of the Payroll Form

Several key elements must be included in the payroll form to ensure it meets legal standards. These elements typically consist of:

- Employee identification: Names and Social Security numbers.

- Wage details: Hourly rates or salaries, along with total hours worked.

- Tax information: Federal and state tax withholdings, including any additional deductions.

- Employer information: Name, address, and Employer Identification Number (EIN).

Form Submission Methods

Submitting the payroll form can be done through various methods, depending on the employer's preference and regulatory requirements. Common submission methods include:

- Online submission: Many states and the IRS allow electronic filing for convenience and efficiency.

- Mail: Traditional mailing of paper forms is still an option, though it may take longer for processing.

- In-person: Some employers may opt to submit forms directly to local tax offices.

Quick guide on how to complete payroll form

Complete Payroll Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and seamlessly. Handle Payroll Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Payroll Form effortlessly

- Locate Payroll Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of sending the form, whether by email, SMS, or invite link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and electronically sign Payroll Form to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll form and how can airSlate SignNow simplify its management?

A payroll form is a document used to gather employee information for processing payroll. airSlate SignNow makes managing payroll forms easy by providing a secure, digital platform for sending, signing, and storing these documents. With our user-friendly interface, you can streamline your payroll processes, saving time and reducing errors.

-

How does airSlate SignNow help in automating payroll form collection?

airSlate SignNow allows businesses to automate the collection of payroll forms through customizable templates and workflows. This means you can easily create a payroll form, send it out for signatures, and track its status in real-time. Automation minimizes manual work and increases efficiency in processing payroll.

-

What are the pricing options for using airSlate SignNow for payroll forms?

airSlate SignNow offers a variety of pricing plans to fit different business needs, including options for small businesses and larger enterprises. Each plan includes access to payroll form templates and unlimited signing, allowing you to choose the best fit for your requirements. For detailed pricing, it's best to visit our website to compare features.

-

Can I integrate airSlate SignNow with my existing payroll software?

Yes, airSlate SignNow seamlessly integrates with various payroll software systems. This integration allows for automatic data transfer from your payroll forms, reducing the risk of errors and ensuring that your payroll information is always up-to-date. Check our integration page for specific software compatibility.

-

What security measures are in place for payroll forms in airSlate SignNow?

airSlate SignNow places a high priority on security, implementing encryption and data protection protocols to safeguard your payroll forms. Our platform complies with major regulations to ensure your documents are stored and transmitted securely. This commitment to security gives you peace of mind when managing sensitive payroll information.

-

Are there any limitations to using airSlate SignNow for payroll forms?

While airSlate SignNow provides extensive features for handling payroll forms, some limitations may exist based on your chosen plan. For instance, specific plans may cap the number of templates or have limitations on integration capabilities. Review our plan details to find one that suits your payroll form needs.

-

How can airSlate SignNow improve the efficiency of processing payroll forms?

Using airSlate SignNow to process payroll forms can signNowly improve efficiency by reducing the time spent on manual paperwork. The electronic signing feature ensures quicker turnaround times, while automated reminders help prevent delays. All this adds up to a more streamlined payroll process for your organization.

Get more for Payroll Form

Find out other Payroll Form

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself