Colorado SalesUse Tax Rates DR 1002 Colorado Gov 2017

What is the Colorado SalesUse Tax Rates DR 1002 Colorado gov

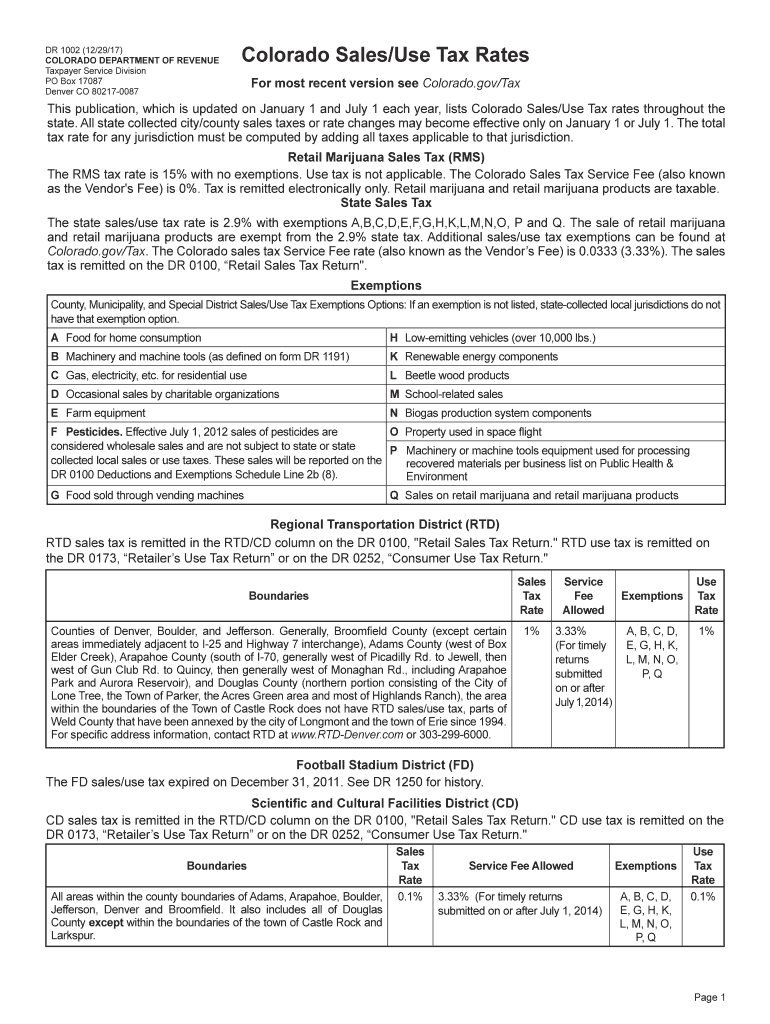

The Colorado SalesUse Tax Rates DR 1002 form is a crucial document used for reporting and calculating sales and use tax obligations in Colorado. This form provides taxpayers with the necessary rates applicable to various goods and services sold within the state. Understanding this form is essential for businesses and individuals to ensure compliance with state tax laws and avoid potential penalties.

How to use the Colorado SalesUse Tax Rates DR 1002 Colorado gov

Using the Colorado SalesUse Tax Rates DR 1002 form involves several steps. First, taxpayers need to identify the applicable tax rates for their specific transactions based on the type of goods or services provided. Once the correct rates are determined, they can calculate the total sales tax due by applying these rates to the sales amounts. This form can be filled out electronically, making it easier to manage and submit tax obligations efficiently.

Steps to complete the Colorado SalesUse Tax Rates DR 1002 Colorado gov

Completing the Colorado SalesUse Tax Rates DR 1002 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant sales information, including transaction amounts and types of goods or services sold.

- Refer to the most recent tax rate schedule provided by the Colorado Department of Revenue.

- Calculate the sales tax by multiplying the sales amount by the applicable tax rate.

- Fill out the form with the calculated tax amounts and any other required information.

- Submit the completed form through the appropriate channels, either electronically or by mail.

Legal use of the Colorado SalesUse Tax Rates DR 1002 Colorado gov

The legal use of the Colorado SalesUse Tax Rates DR 1002 form is governed by state tax laws. To ensure that the form is valid, it must be completed accurately and submitted by the designated deadlines. Compliance with the Colorado Department of Revenue's guidelines is essential for the form to be recognized as legally binding. Utilizing a secure electronic signature solution can further enhance the legal validity of the document.

Key elements of the Colorado SalesUse Tax Rates DR 1002 Colorado gov

Key elements of the Colorado SalesUse Tax Rates DR 1002 form include:

- The identification of the taxpayer and their business information.

- A detailed breakdown of the sales and use tax rates applicable to various goods and services.

- Sections for reporting total sales amounts and calculating the total tax due.

- Signature lines for the taxpayer to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado SalesUse Tax Rates DR 1002 form are critical to avoid penalties. Generally, the form must be submitted by the last day of the month following the end of each reporting period. Taxpayers should stay informed about any changes to these deadlines, especially during tax season, to ensure timely compliance.

Quick guide on how to complete colorado salesuse tax rates dr 1002 coloradogov

Easily prepare Colorado SalesUse Tax Rates DR 1002 Colorado gov on any device

Digital document management has gained widespread acceptance among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents rapidly without delays. Manage Colorado SalesUse Tax Rates DR 1002 Colorado gov on any device with airSlate SignNow's applications for Android or iOS and enhance any document-oriented workflow today.

The simplest way to adjust and eSign Colorado SalesUse Tax Rates DR 1002 Colorado gov effortlessly

- Find Colorado SalesUse Tax Rates DR 1002 Colorado gov and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow covers all your document management needs with just a few clicks from any device you prefer. Edit and eSign Colorado SalesUse Tax Rates DR 1002 Colorado gov and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado salesuse tax rates dr 1002 coloradogov

Create this form in 5 minutes!

How to create an eSignature for the colorado salesuse tax rates dr 1002 coloradogov

How to generate an eSignature for the Colorado Salesuse Tax Rates Dr 1002 Coloradogov online

How to make an eSignature for your Colorado Salesuse Tax Rates Dr 1002 Coloradogov in Chrome

How to create an electronic signature for signing the Colorado Salesuse Tax Rates Dr 1002 Coloradogov in Gmail

How to generate an eSignature for the Colorado Salesuse Tax Rates Dr 1002 Coloradogov from your smartphone

How to generate an electronic signature for the Colorado Salesuse Tax Rates Dr 1002 Coloradogov on iOS devices

How to create an electronic signature for the Colorado Salesuse Tax Rates Dr 1002 Coloradogov on Android

People also ask

-

What are the Colorado SalesUse Tax Rates DR 1002 Colorado gov?

The Colorado SalesUse Tax Rates DR 1002 Colorado gov provides the detailed rates that businesses need to comply with state tax regulations. Understanding these rates is essential for accurate tax calculations during sales transactions. Staying updated with this information ensures your business remains compliant and avoids potential penalties.

-

How does airSlate SignNow support compliance with the Colorado SalesUse Tax Rates DR 1002 Colorado gov?

airSlate SignNow helps businesses maintain compliance by allowing users to easily integrate necessary tax information into their documents. By utilizing features that automatically calculate taxes based on the Colorado SalesUse Tax Rates DR 1002 Colorado gov, businesses can ensure their transactions are accurate and compliant. This reduces the risk of errors in tax collection.

-

Can I customize documents to include Colorado SalesUse Tax Rates DR 1002 Colorado gov information?

Yes, airSlate SignNow allows extensive customization for your documents, including the incorporation of Colorado SalesUse Tax Rates DR 1002 Colorado gov information. Users can create templates that automatically pull in relevant tax rates, ensuring that all parties are informed of applicable taxes during the signing process. This feature streamlines workflows and enhances accuracy.

-

What pricing options are available for airSlate SignNow services?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring affordability while providing essential features. Each plan allows seamless integration of the Colorado SalesUse Tax Rates DR 1002 Colorado gov information, making tax compliance easier. Choosing the right plan will depend on your document volume and collaboration requirements.

-

What features does airSlate SignNow offer for managing sales transactions?

airSlate SignNow provides features like electronic signature, document tracking, and customizable templates, all of which streamline the sales transaction process. Incorporating the Colorado SalesUse Tax Rates DR 1002 Colorado gov into your documents enhances the accuracy of tax rates applied, improving overall compliance. These features are designed to make your workflow efficient and effective.

-

Are there any integrations available with airSlate SignNow that assist with tax calculations?

Yes, airSlate SignNow supports several integrations that facilitate tax calculations, including popular accounting and invoicing software. These integrations allow businesses to automatically import Colorado SalesUse Tax Rates DR 1002 Colorado gov information, enhancing accuracy in financial documents. This minimizes errors and saves time during tax preparation.

-

How does airSlate SignNow ensure the security of my documents related to Colorado tax rates?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your documents, including those containing Colorado SalesUse Tax Rates DR 1002 Colorado gov information. Our platform ensures that all sensitive data is kept safe while allowing for convenient access and collaboration among authorized users.

Get more for Colorado SalesUse Tax Rates DR 1002 Colorado gov

- Medicare insurance verification form

- Pond maintenance agreement lexington county state of south lex co sc form

- South dakota water well completion report denr sd form

- Tb risk assessment worksheet attachment a dhs sd form

- Affidavit of repossession minnesota form

- Wetland determination data form great plains region

- Mn rule 29 form

- Minnesota department of transportation request to sublet form dot state mn

Find out other Colorado SalesUse Tax Rates DR 1002 Colorado gov

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word