Mo Tax Exemption Form 2015

What is the Mo Tax Exemption Form

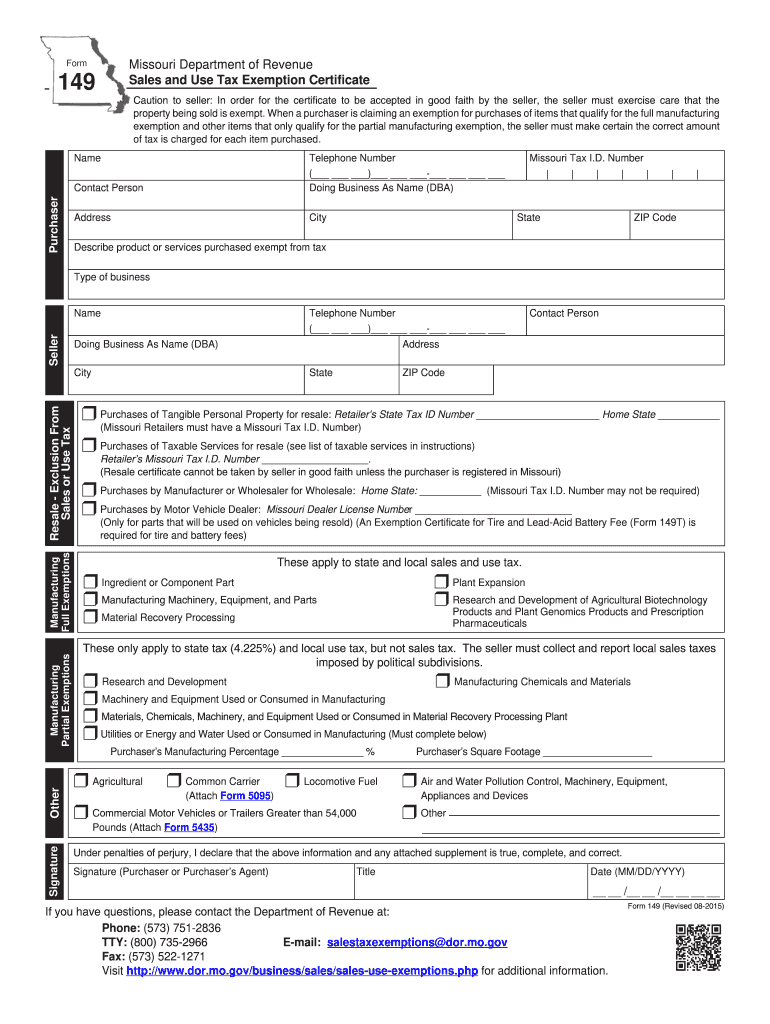

The Mo Tax Exemption Form is a document used by individuals and businesses in Missouri to claim exemptions from certain state taxes. This form is essential for those who qualify based on specific criteria, such as non-profit organizations, government entities, or specific types of businesses that meet the state's requirements. By submitting this form, eligible parties can reduce their tax liabilities, ensuring compliance with Missouri tax laws while benefiting from available exemptions.

How to Obtain the Mo Tax Exemption Form

To obtain the Mo Tax Exemption Form, individuals can visit the Missouri Department of Revenue's official website or contact their local tax office. The form is typically available for download in a PDF format, allowing users to print and fill it out. In some cases, individuals may also request a physical copy by mail. It is important to ensure that the correct version of the form is used, as there may be updates or changes to the requirements over time.

Steps to Complete the Mo Tax Exemption Form

Completing the Mo Tax Exemption Form involves several key steps:

- Gather necessary information, including your business details, tax identification number, and any supporting documentation that verifies your eligibility for the exemption.

- Carefully fill out the form, ensuring all sections are completed accurately. Pay attention to any specific instructions provided on the form.

- Review the completed form for any errors or omissions. It is crucial to double-check all information to avoid delays in processing.

- Submit the form according to the instructions provided, whether online, by mail, or in person at the appropriate tax office.

Legal Use of the Mo Tax Exemption Form

The Mo Tax Exemption Form is legally binding when completed and submitted according to Missouri tax regulations. It must be filled out truthfully, as providing false information can lead to penalties or disqualification from the exemption. The form serves as a formal request for tax relief and must comply with state laws governing tax exemptions. Understanding the legal implications of this form is essential for ensuring that the exemption is valid and enforceable.

Eligibility Criteria

Eligibility for the Mo Tax Exemption Form varies based on the type of exemption being claimed. Common criteria include:

- Non-profit organizations that meet specific IRS classifications.

- Government entities at the federal, state, or local level.

- Businesses engaged in certain activities that qualify for tax relief under Missouri law.

It is important for applicants to review the specific eligibility requirements outlined by the Missouri Department of Revenue to ensure compliance and avoid potential issues during the application process.

Form Submission Methods

There are several methods for submitting the Mo Tax Exemption Form, including:

- Online Submission: Some forms may be submitted electronically through the Missouri Department of Revenue's online portal.

- Mail: Completed forms can be sent via postal service to the designated address provided on the form.

- In-Person: Individuals can also submit the form directly at their local tax office, ensuring immediate processing and confirmation of receipt.

Choosing the appropriate submission method can impact the processing time and confirmation of the exemption request.

Quick guide on how to complete mo tax exemption 2015 form

Effortlessly Prepare Mo Tax Exemption Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Handle Mo Tax Exemption Form on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related processes today.

How to Modify and eSign Mo Tax Exemption Form with Ease

- Find Mo Tax Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious document searches, and errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from your preferred device. Modify and eSign Mo Tax Exemption Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo tax exemption 2015 form

Create this form in 5 minutes!

How to create an eSignature for the mo tax exemption 2015 form

How to create an eSignature for the Mo Tax Exemption 2015 Form online

How to generate an electronic signature for the Mo Tax Exemption 2015 Form in Google Chrome

How to generate an electronic signature for putting it on the Mo Tax Exemption 2015 Form in Gmail

How to create an eSignature for the Mo Tax Exemption 2015 Form from your mobile device

How to create an electronic signature for the Mo Tax Exemption 2015 Form on iOS

How to make an electronic signature for the Mo Tax Exemption 2015 Form on Android

People also ask

-

What is the Mo Tax Exemption Form?

The Mo Tax Exemption Form is a document used in Missouri to claim exemption from state taxes. This form allows eligible individuals and organizations to save on taxes, making it essential for businesses seeking to optimize their financial benefits.

-

How can airSlate SignNow help with the Mo Tax Exemption Form?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Mo Tax Exemption Form. Utilizing our service simplifies the process, enabling you to complete your tax exemption claims efficiently and securely.

-

Is there a cost involved in using airSlate SignNow for the Mo Tax Exemption Form?

Yes, there are subscription plans available for airSlate SignNow, but they are designed to be cost-effective compared to traditional methods. Each plan offers various features to assist you in managing your Mo Tax Exemption Form with ease.

-

What features does airSlate SignNow offer for the Mo Tax Exemption Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage the Mo Tax Exemption Form and ensure all parties can verify their signatures effortlessly.

-

How secure is the transmission of the Mo Tax Exemption Form with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols, ensuring that your Mo Tax Exemption Form and sensitive information are protected throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the Mo Tax Exemption Form?

Yes, airSlate SignNow offers numerous integrations with popular business applications, enhancing your workflow. You can easily link your existing systems to facilitate the processing and management of the Mo Tax Exemption Form.

-

What are the benefits of using airSlate SignNow for the Mo Tax Exemption Form?

Using airSlate SignNow for your Mo Tax Exemption Form can lead to signNow time savings and reduced paperwork hassles. It enables faster turnaround times and improves accuracy, ensuring you meet tax deadlines without stress.

Get more for Mo Tax Exemption Form

Find out other Mo Tax Exemption Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy