Form 5272 2020-2026

What is the Form 5272

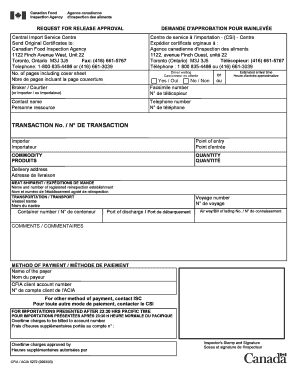

The Form 5272 is a specific document used in the United States for the CFIA request for documentation review. This form is essential for businesses and individuals who need to provide detailed information regarding their compliance with regulatory requirements. It serves as a formal request to review documentation related to product releases and other business activities, ensuring that all necessary information is presented for evaluation.

How to use the Form 5272

Using the Form 5272 involves several steps to ensure accurate completion. First, gather all relevant information required for the form, including details about the product or service in question. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once filled, the form can be submitted electronically or via traditional mail, depending on the requirements specified by the issuing authority. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Form 5272

Completing the Form 5272 involves a systematic approach to ensure all information is accurate and complete. Follow these steps:

- Gather necessary documentation related to your request.

- Carefully read the instructions provided with the form.

- Fill in your personal and business information as required.

- Provide detailed descriptions of the products or services involved.

- Review the form for accuracy before submission.

- Submit the form as per the instructions provided.

Legal use of the Form 5272

The legal use of the Form 5272 is governed by specific regulations that ensure compliance with federal and state laws. When filled out correctly, this form serves as a legally binding document that can be used in various legal contexts. It is essential to understand the legal implications of the information provided in the form, as inaccuracies or omissions may lead to penalties or legal challenges.

Required Documents

When submitting the Form 5272, certain documents are typically required to support your request. These may include:

- Proof of identity, such as a government-issued ID.

- Documentation related to the product or service being reviewed.

- Any previous correspondence related to the CFIA request.

- Financial statements or business records, if applicable.

Form Submission Methods

The Form 5272 can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission through a secure portal.

- Mailing the completed form to the designated office.

- In-person submission at specified locations.

Quick guide on how to complete form 5272

Complete Form 5272 with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form 5272 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 5272 effortlessly

- Obtain Form 5272 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 5272 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5272

Create this form in 5 minutes!

How to create an eSignature for the form 5272

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cfia acia 5272 document, and how does airSlate SignNow help with it?

The cfia acia 5272 document is essential for specific compliance and regulatory approvals within businesses. airSlate SignNow streamlines the process of sending and eSigning such documents, ensuring that you remain compliant while saving time and resources.

-

How much does it cost to use airSlate SignNow for managing cfia acia 5272 forms?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling cfia acia 5272 forms. With its cost-effective solution, you can choose a plan that fits your budget while gaining access to premium features that enhance your document workflow.

-

What features does airSlate SignNow offer for cfia acia 5272 document management?

airSlate SignNow provides various features for cfia acia 5272 document management, including customizable templates, electronic signatures, and secure storage. These tools enhance efficiency and ensure that every step of your document management process is seamless.

-

Can airSlate SignNow integrate with other software for handling cfia acia 5272 documents?

Yes, airSlate SignNow offers robust integrations with various applications, allowing you to manage cfia acia 5272 documents within your existing workflow. These integrations facilitate better collaboration and improve productivity across your teams.

-

What are the benefits of using airSlate SignNow for cfia acia 5272 documents?

Using airSlate SignNow for cfia acia 5272 documents provides numerous benefits, including enhanced security, workflow automation, and a user-friendly interface. These advantages empower businesses to complete their documentation process efficiently while ensuring legal compliance.

-

Is airSlate SignNow suitable for businesses of all sizes managing cfia acia 5272 forms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes dealing with cfia acia 5272 forms. Whether you're a small business or a large enterprise, our platform can scale to meet your needs and improve your document management practices.

-

How does airSlate SignNow ensure the security of cfia acia 5272 documents?

airSlate SignNow prioritizes the security of cfia acia 5272 documents by employing advanced encryption methods and compliance with industry standards. This ensures that your sensitive information is protected, giving you peace of mind while managing important documents.

Get more for Form 5272

Find out other Form 5272

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement