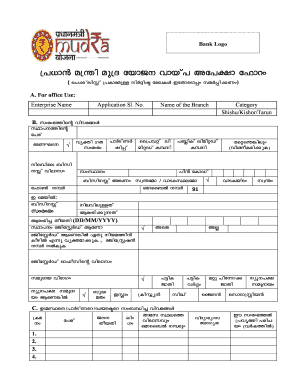

Mudra Loan Details Malayalam Form

What is the Mudra Loan Details Malayalam

The Mudra loan is a financial product designed to support small businesses and entrepreneurs in India. It aims to provide funding to micro, small, and medium enterprises (MSMEs) to help them grow and thrive. The Mudra loan details in Malayalam encompass various aspects, including eligibility criteria, loan amounts, and repayment terms. The loans are categorized into three types: Shishu, Kishore, and Tarun, which cater to different stages of business development. Understanding these details is essential for applicants seeking to leverage this financial support for their ventures.

How to obtain the Mudra Loan Details Malayalam

To obtain the Mudra loan details in Malayalam, applicants can access resources provided by financial institutions and government websites. These resources typically include downloadable PDFs that outline the loan features, eligibility requirements, and application procedures. It is advisable to refer to official sources to ensure the information is accurate and up-to-date. Additionally, local banks and financial institutions may offer guidance in Malayalam, making it easier for applicants to understand the process and requirements.

Steps to complete the Mudra Loan Details Malayalam

Completing the Mudra loan application involves several key steps. First, gather all necessary documents, such as identification proof, business plan, and financial statements. Next, fill out the loan application form, ensuring that all details are accurate and complete. After submitting the application, it may take some time for the bank to process the request. Applicants should keep track of their application status and be prepared to provide any additional information if required. It is crucial to follow up with the bank to ensure a smooth approval process.

Key elements of the Mudra Loan Details Malayalam

The key elements of the Mudra loan details include the loan amount, which can range from fifty thousand to ten lakh rupees, depending on the type of loan. Interest rates vary based on the lending institution and the applicant's creditworthiness. Repayment periods typically range from three to five years. Additionally, the Mudra loan scheme does not require collateral, making it accessible for many entrepreneurs. Understanding these elements is vital for making informed decisions about borrowing and repayment.

Eligibility Criteria

Eligibility for the Mudra loan varies based on the type of loan being applied for. Generally, applicants must be Indian citizens and should have a viable business plan. The business should fall under the micro, small, or medium enterprise category. Specific eligibility criteria may also include a minimum age requirement and a good credit history. It is important for applicants to review these criteria carefully to ensure they meet the necessary conditions before applying.

Application Process & Approval Time

The application process for the Mudra loan involves submitting a completed application form along with required documents to the chosen financial institution. The approval time can vary, typically ranging from a few days to several weeks, depending on the bank's processing speed and the completeness of the application. Applicants are encouraged to provide all requested information to expedite the review process. Once approved, the funds are usually disbursed quickly, allowing entrepreneurs to access the capital needed for their businesses.

Quick guide on how to complete mudra loan details malayalam

Complete Mudra Loan Details Malayalam seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents quickly without holdups. Manage Mudra Loan Details Malayalam on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to adjust and electronically sign Mudra Loan Details Malayalam with ease

- Find Mudra Loan Details Malayalam and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Mudra Loan Details Malayalam and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mudra loan details malayalam

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mudra loan and how does it work in Malayalam?

A Mudra loan is a government initiative aimed at providing financial support to small businesses in India. It helps entrepreneurs access funds to start or expand their business ventures. For detailed information in Malayalam, it is important to explore the specific guidelines and eligibility criteria associated with Mudra loans.

-

What are the eligibility criteria for applying for a Mudra loan in Malayalam?

Eligibility for a Mudra loan includes being a small business owner, having a viable business plan, and being a resident of India. The applicant must provide sufficient documentation to validate their business operations. For comprehensive mudra loan details malayalam, applicants should refer to official guidelines published by the government.

-

How can I apply for a Mudra loan online in Malayalam?

To apply for a Mudra loan online, visit the official portal or authorized bank websites that offer Mudra loans. You will need to fill out the application form and submit the required documents. Detailed instructions in Malayalam can ensure a smooth application process from start to finish.

-

What types of Mudra loans are available in Malayalam?

Mudra loans are categorized into three types: Shishu, Kishor, and Tarun, tailored for different funding needs. The Shishu loan provides up to ₹50,000, while Kishor offers ₹50,000 to ₹5 lakh, and Tarun caters to amounts between ₹5 lakh and ₹10 lakh. Each category serves specific business purposes, as explained in mudra loan details malayalam.

-

What are the interest rates for Mudra loans in Malayalam?

Interest rates for Mudra loans typically range from 8% to 12%, but they can vary based on the lending institution and the applicant's profile. It is advisable to compare rates from multiple banks to get the best deal. Further insights about current rates can help prospective borrowers understand the financial commitments involved.

-

What documents are required to secure a Mudra loan in Malayalam?

Key documents for a Mudra loan application include proof of identity, business registration documents, financial statements, and a business plan. Ensuring that all paperwork is complete and accurate can enhance the chances of approval. For a detailed list of required documents in mudra loan details malayalam, refer to trusted financial websites.

-

What are the benefits of Mudra loans for small businesses in Malayalam?

Mudra loans provide various benefits such as easy access to finance, no collateral requirement, and simplified application processes. They encourage entrepreneurship and help stimulate small business growth across the country. Understanding these advantages is crucial for aspiring business owners looking for funding options.

Get more for Mudra Loan Details Malayalam

- Michigan warranty deed from two trustees to an individual form

- Blank quit claim deed form

- Notice of unpaid balance and right to file lien form

- New mexico promissory note in connection with sale of vehicle or automobile form

- Pennsylvania residential rental lease agreement form

- Ga closing statement form

- Executors deed form

- Motorcycle bill of sale oklahoma form

Find out other Mudra Loan Details Malayalam

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors