1099me Form

What is the 1099me?

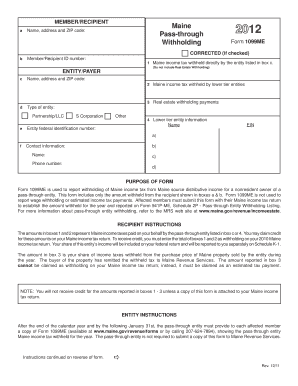

The 1099me form is a specific tax document used primarily in the state of Maine. This form is designed for reporting income received by individuals who are not classified as employees. It serves as a means for businesses to report payments made to independent contractors, freelancers, and other non-employee service providers. Understanding the 1099me is essential for compliance with state and federal tax regulations, ensuring that all income is accurately reported to the IRS.

How to use the 1099me

Utilizing the 1099me form involves several steps to ensure proper completion and submission. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Next, accurately report the total amount paid to the recipient during the tax year. Once the form is completed, it must be provided to the recipient and submitted to the state tax authority. Using digital tools can streamline this process, making it easier to fill out and eSign the document securely.

Steps to complete the 1099me

Completing the 1099me form involves a series of straightforward steps:

- Collect the recipient's information, including their legal name and address.

- Obtain the recipient's taxpayer identification number (TIN) or Social Security number (SSN).

- Enter the total amount paid to the recipient in the designated box.

- Review the form for accuracy, ensuring all details are correct.

- Provide a copy to the recipient and submit the form to the appropriate state authorities.

Legal use of the 1099me

The legal validity of the 1099me form hinges on compliance with both state and federal regulations. It is essential to ensure that all information is accurately reported and that the form is submitted within the required deadlines. Using a reliable eSignature solution can enhance the legal standing of the document, as it provides a digital certificate that verifies the identity of the signer. Compliance with the ESIGN Act and UETA ensures that the electronically signed document holds the same legal weight as a traditional paper form.

Filing Deadlines / Important Dates

Filing deadlines for the 1099me form are crucial for compliance. Typically, the form must be submitted to the state tax authority by January thirty-first of the year following the tax year in which payments were made. Recipients should also receive their copies by this date. It is advisable to keep track of these deadlines to avoid penalties for late submissions.

Who Issues the Form

The 1099me form is typically issued by businesses or individuals who have made payments to non-employee service providers. This includes a wide range of entities, such as sole proprietors, partnerships, and corporations. It is the responsibility of the payer to ensure that the form is completed accurately and submitted on time to both the recipient and the state tax authority.

Quick guide on how to complete 1099me 100007327

Effortlessly Complete 1099me on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage 1099me on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Modify and Electronically Sign 1099me

- Find 1099me and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 1099me and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099me 100007327

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1099me and how does it work?

1099me is a digital solution offered by airSlate SignNow that streamlines the process of managing and sending 1099 forms. It simplifies eSigning, allowing users to fill out and send their forms electronically, ensuring compliance and reducing paper waste.

-

How much does 1099me cost?

The pricing for 1099me can vary depending on the plan selected. airSlate SignNow offers flexible pricing tiers designed to accommodate different business sizes and needs, making it a cost-effective solution for efficiently managing 1099 forms.

-

What features does 1099me provide?

1099me comes equipped with robust features such as template creation, automatic reminders for signatures, and secure storage options. These functionalities enhance the user experience while ensuring that all 1099 forms are handled efficiently and securely.

-

What are the benefits of using 1099me for my business?

Using 1099me provides multiple benefits including time savings, reduced errors, and enhanced compliance with tax regulations. The platform's user-friendly interface makes it easy for businesses to manage their 1099 forms hassle-free.

-

Does 1099me integrate with other applications?

Yes, 1099me integrates seamlessly with a variety of business applications, including accounting software and CRMs. This connectivity enables users to streamline their processes and further enhance productivity in managing 1099 forms.

-

Is 1099me secure and compliant?

Absolutely! 1099me prioritizes security and complies with industry standards to protect sensitive information. With features like encryption and secure access controls, users can trust that their 1099 forms and data are safe.

-

How easy is it to use 1099me for eSigning documents?

Using 1099me for eSigning documents is incredibly straightforward. The platform is designed for ease of use, allowing users to quickly navigate through the signing process without the need for extensive training.

Get more for 1099me

- Link to final agency decision oah docket no 54 minnesota form

- Renewal application for auxiliary grant ag supplemental nutrition assistance program snap form

- Registered agent consent form

- Application for transfer of land form

- School attendance contract template 787755248 form

- Scholarship scholarship contract template form

- School clean contract template form

- School contract template form

Find out other 1099me

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip