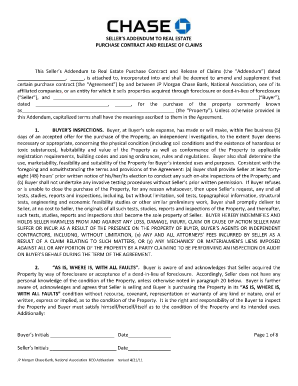

Lien Release Customer Research Jpmchase Form

What is the lien release customer research JPMorgan Chase?

The lien release customer research JPMorgan Chase refers to the process and documentation involved when a borrower pays off their loan, allowing the lender to formally release their claim on the property. This document serves as proof that the borrower has fulfilled their financial obligations, and it is crucial for clearing the title of the property. Understanding the lien release process is essential for homeowners and borrowers, as it impacts their credit and property ownership status.

How to obtain the lien release customer research JPMorgan Chase

To obtain the lien release from JPMorgan Chase, borrowers should first ensure that their loan is fully paid off. Once confirmed, they can contact the JPMorgan Chase lien release department directly. It is advisable to have relevant information on hand, such as loan account numbers and personal identification. Borrowers may also need to fill out specific forms or provide documentation to facilitate the release process. Following up with the department can help ensure that the lien release is processed in a timely manner.

Steps to complete the lien release customer research JPMorgan Chase

Completing the lien release process involves several key steps:

- Confirm that your loan is fully paid off.

- Gather necessary documentation, including loan account details and identification.

- Contact the JPMorgan Chase lien release department to request the release.

- Submit any required forms or documentation as instructed by the department.

- Follow up to ensure the lien release is processed and obtain a copy of the release document.

Legal use of the lien release customer research JPMorgan Chase

The legal use of the lien release document is vital for property transactions. Once issued, the lien release serves as a legal declaration that the lender no longer has a claim on the property. This document is necessary for homeowners when selling or refinancing their property, as it clears any encumbrances. It is important to ensure that the lien release is properly recorded with the appropriate local authorities to protect ownership rights.

Required documents for the lien release customer research JPMorgan Chase

When requesting a lien release from JPMorgan Chase, borrowers typically need to provide several documents, including:

- Proof of loan payoff, such as a final payment statement.

- Identification documents, such as a driver's license or passport.

- Any specific forms requested by the JPMorgan Chase lien release department.

Having these documents ready can streamline the process and help ensure a smooth experience when obtaining the lien release.

Who issues the lien release customer research JPMorgan Chase?

The lien release is issued by the JPMorgan Chase lien release department. This department is responsible for managing the documentation related to lien releases and ensuring that all legal requirements are met. Once a loan is paid off, the department verifies the payment and processes the release, providing borrowers with the necessary documentation to confirm that their lien has been removed.

Quick guide on how to complete lien release customer research jpmchase

Effortlessly Prepare Lien Release Customer Research Jpmchase on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Lien Release Customer Research Jpmchase from any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Lien Release Customer Research Jpmchase Smoothly

- Locate Lien Release Customer Research Jpmchase and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Lien Release Customer Research Jpmchase to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lien release customer research jpmchase

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for conducting lien release customer research with JPMorgan Chase?

The lien release customer research with JPMorgan Chase involves collecting and analyzing data related to lien releases. Utilizing airSlate SignNow can streamline this process by allowing you to send and eSign necessary documents quickly. Our platform enhances communication and reduces turnaround times, making it easier to manage lien releases efficiently.

-

How does airSlate SignNow support lien release processes?

airSlate SignNow provides an intuitive platform for managing lien release documentation. By facilitating eSigning and document sharing, it allows for faster processing of lien release customer research with JPMorgan Chase. This organization reduces errors and enhances the overall efficiency of your operations.

-

What features does airSlate SignNow offer for lien release documentation?

airSlate SignNow offers features such as customizable templates, in-app signing, and automated workflows for lien release documentation. These tools simplify the lien release customer research process with JPMorgan Chase, enabling you to customize your requests and gather necessary information effectively. Additionally, our user-friendly interface ensures a seamless experience.

-

Are there any integration options available with airSlate SignNow for JPMorgan Chase?

Yes, airSlate SignNow supports integration with various applications, enhancing your lien release customer research with JPMorgan Chase. This integration allows you to seamlessly connect your existing tools with our platform, optimizing the document workflow. By integrating with CRM and document management systems, you can streamline all aspects of lien releases.

-

Is there a cost associated with using airSlate SignNow for lien release processes?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective. The investment in our platform greatly improves the efficiency of your lien release customer research with JPMorgan Chase. We offer several pricing plans, allowing you to choose one that suits your business needs.

-

What are the benefits of using airSlate SignNow for lien release customer research?

Using airSlate SignNow for your lien release customer research with JPMorgan Chase provides numerous benefits, including enhanced speed, accuracy, and security. Our eSigning solution allows you to access documents anytime, anywhere, thereby reducing delays in processing. Ultimately, these advantages contribute to better customer satisfaction and streamlined business operations.

-

How secure is the data within airSlate SignNow during lien release processes?

The security of data within airSlate SignNow is our top priority. Our platform employs advanced encryption protocols to ensure that all documents related to lien release customer research with JPMorgan Chase are kept safe and secure. You can trust that your sensitive information is protected throughout the signing process.

Get more for Lien Release Customer Research Jpmchase

Find out other Lien Release Customer Research Jpmchase

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document