Tax Benefits Form

Understanding Tax Benefits

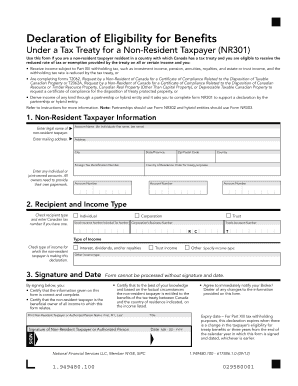

The tax benefits associated with the NR301 form are essential for non-resident individuals claiming tax treaty benefits in Canada. These benefits can include reduced withholding tax rates on various types of income, such as dividends, interest, and royalties. By utilizing the NR301 form, eligible taxpayers can ensure they are not overtaxed and can maximize their financial returns.

Eligibility Criteria for Tax Benefits

To qualify for tax benefits under the NR301 form, individuals must meet specific criteria. Generally, applicants must be residents of a country that has a tax treaty with Canada. Additionally, they must provide proof of residency, which may include tax residency certificates or other official documentation. Understanding these eligibility requirements is crucial for successfully claiming benefits.

Steps to Complete the NR301 Form

Completing the NR301 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and details about the income for which you are claiming benefits. Next, fill out the form with accurate personal information and details regarding the income type. Finally, review the form for completeness and submit it to the appropriate Canadian tax authority. Properly completing these steps is vital for a successful application.

Required Documents for Submission

When submitting the NR301 form, certain documents are required to support your claim for tax benefits. These may include:

- Proof of residency in the treaty country, such as a tax residency certificate.

- Documentation of the income type for which the tax benefits are being claimed.

- Any additional forms or statements as specified by the Canadian tax authority.

Ensuring that all required documents are included can help prevent delays in processing your claim.

Form Submission Methods

The NR301 form can be submitted through various methods, including online, by mail, or in person. For online submissions, individuals may need to use specific tax software that supports the form. Mailing the completed form requires sending it to the designated Canadian tax office, while in-person submissions can be made at local tax offices. Choosing the appropriate submission method can streamline the process and ensure timely handling of your application.

IRS Guidelines for Non-Residents

Non-residents claiming benefits through the NR301 form must also adhere to IRS guidelines regarding foreign income. It is essential to report any income earned from Canadian sources on U.S. tax returns, even if taxes are withheld in Canada. Familiarizing yourself with these guidelines can help avoid complications and ensure compliance with both U.S. and Canadian tax laws.

Quick guide on how to complete tax benefits

Effortlessly Prepare Tax Benefits on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Tax Benefits on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

The Easiest Way to Modify and eSign Tax Benefits with Ease

- Locate Tax Benefits and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of your documents or redact confidential information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the data and click the Done button to save your modifications.

- Decide how you'd like to share your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Benefits and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax benefits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nr301 feature in airSlate SignNow?

The nr301 feature in airSlate SignNow streamlines the electronic signature process, allowing users to quickly sign and send documents. With this feature, businesses can enhance their workflow efficiency while ensuring legal compliance. It is designed for ease of use, making it accessible to all types of users.

-

How does airSlate SignNow's pricing work for the nr301 solution?

AirSlate SignNow offers flexible pricing plans for the nr301 solution based on your business needs. You can choose from monthly or annual subscriptions, each tailored to accommodate different volumes of document signing. Additionally, all plans come with a free trial, letting you explore nr301's features risk-free.

-

What are the key benefits of using the nr301 feature?

The nr301 feature in airSlate SignNow provides numerous benefits, including increased efficiency in document signing and enhanced security. By using nr301, businesses can reduce turnaround times and improve client satisfaction. It also supports team collaboration, making it easier to manage multiple signers.

-

Can I integrate the nr301 feature with other tools?

Yes, the nr301 feature is designed to integrate seamlessly with several popular business applications. airSlate SignNow supports integrations with platforms like Salesforce, Google Drive, and Dropbox. This flexibility ensures that you can incorporate nr301 into your existing workflow without any disruptions.

-

Is the nr301 feature secure for sensitive documents?

Absolutely, the nr301 feature in airSlate SignNow prioritizes the security of your sensitive documents. It utilizes encryption and complies with industry-standard security practices to protect data integrity. With nr301, you can share and sign documents confidently, knowing that your information is safeguarded.

-

How user-friendly is the nr301 solution for new users?

The nr301 solution is designed with user-friendliness in mind, making it accessible for individuals of all skill levels. The intuitive interface allows new users to quickly navigate through the document signing process. Additionally, airSlate SignNow provides comprehensive resources and support to assist users in maximizing their experience.

-

What types of documents can I handle with the nr301 feature?

With the nr301 feature, you can handle a variety of document types, from contracts and agreements to forms and invoices. This versatility allows businesses to utilize airSlate SignNow for numerous applications. Whether you need simple signatures or more complex workflows, nr301 can accommodate your needs.

Get more for Tax Benefits

- Form 3581 tax deposit refund and transfer request form 3581 tax deposit refund and transfer request

- Form 3800 tax computation for certain children with unearned income form 3800 tax computation for certain children with

- California individual forms availability

- Nyc early intervention program assistive technolog form

- California schedule d 1 sales of business property california schedule d 1 sales of business property form

- Form 1041 701765086

- Get ca schedule k 1 565 us legal forms

- Credentialing application for practitioners standa form

Find out other Tax Benefits

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter