941c Form

What is the 941c?

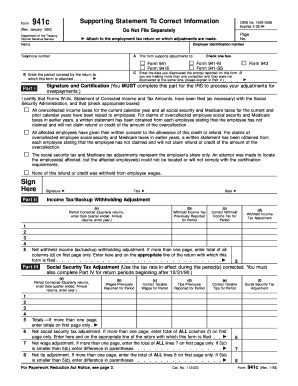

The 941c form is a tax document used by employers in the United States to report adjustments to their payroll taxes. Specifically, it is utilized to correct errors made on previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. This form is essential for ensuring that the IRS has accurate information regarding the taxes withheld from employees' wages and the employer's contributions. By filing the 941c, businesses can rectify discrepancies related to wages, tax liabilities, and credits, thereby maintaining compliance with federal tax regulations.

Steps to complete the 941c

Completing the 941c form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information: Collect details from the original Form 941 that needs correction, including the employer's identification number (EIN), tax period, and the specific adjustments required.

- Fill out the form: Enter the corrected amounts in the appropriate sections of the 941c. Ensure that all figures are accurate and reflect the intended adjustments.

- Review the form: Double-check all entries for accuracy. Mistakes can lead to further complications or penalties.

- Sign and date the form: The authorized individual must sign and date the 941c to validate the submission.

- Submit the form: Choose the appropriate submission method, whether online, by mail, or in-person, as per IRS guidelines.

Legal use of the 941c

The 941c form is legally recognized for making corrections to previously filed payroll tax returns. To ensure that the adjustments are valid, it must be completed accurately and submitted within the specified timeframes set by the IRS. Compliance with federal tax laws is crucial, as improper use of the form can lead to penalties or legal issues. The information provided on the 941c must align with the employer's financial records and the IRS requirements to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 941c form typically align with the quarterly deadlines for Form 941. Employers must be aware of these dates to avoid late fees and penalties. Generally, Form 941 is due on the last day of the month following the end of each quarter. For example, the deadlines for 2023 are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Adjustments made using the 941c should be filed as soon as discrepancies are identified, ideally within the same timeframe as the original Form 941 submission.

Who Issues the Form

The 941c form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement of tax laws in the United States. Employers must use the form to report corrections related to their payroll taxes, ensuring that all adjustments are communicated to the IRS. This helps maintain accurate tax records and compliance with federal regulations.

Examples of using the 941c

There are several scenarios where an employer might need to file a 941c form:

- Correcting wage amounts: If an employer discovers that they reported incorrect wages for an employee, they can use the 941c to amend the reported figures.

- Adjusting tax liabilities: If the employer overpaid or underpaid payroll taxes, the 941c allows for the necessary adjustments to be made.

- Updating tax credits: Employers may need to correct claims for tax credits that were inaccurately reported on the original Form 941.

These adjustments help ensure that the employer's tax filings are accurate and reflect the true financial obligations to the IRS.

Quick guide on how to complete 941c

Complete 941c effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow supplies you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Administer 941c on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to alter and eSign 941c with ease

- Find 941c and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to secure your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign 941c and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941c form and how does airSlate SignNow assist with it?

The 941c form is a payroll tax form used by employers to correct errors on previously filed Form 941. airSlate SignNow simplifies the process of eSigning and sending this critical document, ensuring compliance and accuracy. With airSlate SignNow, you can easily fill out, sign, and send the 941c form, streamlining your payroll management.

-

How much does it cost to use airSlate SignNow for handling the 941c form?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. Depending on the plan, you can manage documents including the 941c form for a cost-effective monthly fee. Check our pricing page to find the best option for your business requirements and take advantage of our affordable eSigning solutions.

-

What features does airSlate SignNow offer for the 941c form?

airSlate SignNow provides multiple features to facilitate the handling of the 941c form, such as customizable templates, secure cloud storage, and real-time tracking of documents. These features enhance your efficiency and ensure that important forms like the 941c are completed and filed accurately. The user-friendly interface makes it easy for anyone to manage their documentation with confidence.

-

Can I integrate airSlate SignNow with other software for processing the 941c?

Yes, airSlate SignNow seamlessly integrates with various software solutions to enhance your workflow for processing the 941c form. Whether you use CRM systems, accounting software, or other document management tools, airSlate SignNow can help streamline your processes. These integrations ensure that you can handle your payroll documentation effectively and efficiently.

-

What are the benefits of using airSlate SignNow for the 941c form?

Using airSlate SignNow for the 941c form offers numerous benefits, including enhanced accuracy, reduced processing time, and improved compliance with payroll regulations. By going digital, you eliminate the risks of lost paperwork, speeding up your payroll processes signNowly. This makes airSlate SignNow a reliable choice for businesses looking to optimize their documentation practices.

-

Is airSlate SignNow secure for signing the 941c form?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for signing sensitive documents like the 941c form. Our platform employs advanced encryption, multi-factor authentication, and certified digital signatures to ensure that your information remains protected. You can trust airSlate SignNow to handle your payroll documents with the utmost security.

-

How easy is it to get started with airSlate SignNow for the 941c form?

Getting started with airSlate SignNow for handling the 941c form is incredibly easy. Simply sign up for an account, choose a pricing plan that suits your business, and you can begin uploading, signing, and sending documents right away. The intuitive interface ensures that users, regardless of tech experience, can navigate the platform effortlessly.

Get more for 941c

Find out other 941c

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word