Primerica Forms

What is the Primerica 1099 Form?

The Primerica 1099 form is a tax document issued by Primerica to report various types of income received by independent contractors or agents. This form is crucial for individuals who have earned income through Primerica's services, as it provides the necessary information for accurate tax reporting. The 1099 form typically includes details such as the total amount earned during the tax year, which is essential for filing federal and state tax returns. Understanding this form is vital for ensuring compliance with IRS regulations.

How to Obtain the Primerica 1099 Form

To obtain the Primerica 1099 form, individuals can follow a straightforward process. Typically, Primerica sends out these forms electronically or via mail to all eligible contractors by the end of January each year. If you have not received your form, you can access it through the Primerica shareholder services portal or by contacting Primerica's customer service directly. It is important to ensure that your contact information is up to date with Primerica to receive your tax documents promptly.

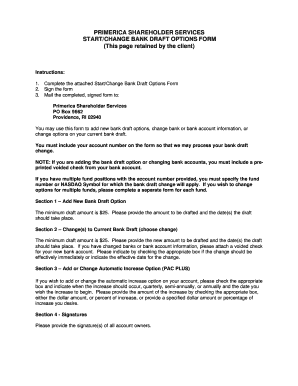

Steps to Complete the Primerica 1099 Form

Completing the Primerica 1099 form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including income statements and any deductions. Next, fill out the form by entering your personal information, such as your name, address, and taxpayer identification number. Then, report the total income earned as indicated on your earnings statements. Finally, review the completed form for any errors before submitting it to the IRS along with your tax return.

Legal Use of the Primerica 1099 Form

The Primerica 1099 form is legally binding when filled out correctly and submitted to the IRS. It must be completed in accordance with IRS guidelines to ensure that the reported income is accurately reflected. Failure to report income can lead to penalties and interest charges from the IRS. It is essential to understand the legal implications of this form, as it serves as a record of income that can be audited by tax authorities.

IRS Guidelines for the Primerica 1099 Form

The IRS has specific guidelines regarding the use and submission of 1099 forms, including those issued by Primerica. These guidelines outline the types of income that must be reported and the deadlines for submission. It is important for individuals to familiarize themselves with these regulations to avoid potential penalties. For instance, the IRS requires that 1099 forms be submitted by January thirty-first of the following year, ensuring timely reporting of income.

Form Submission Methods

Individuals can submit the Primerica 1099 form through various methods, including online, by mail, or in person. For electronic submissions, using a tax preparation software that supports e-filing can streamline the process. If submitting by mail, ensure that the form is sent to the correct IRS address based on your state of residence. In-person submissions may be less common but can be done at local IRS offices during tax season. Each method has its own requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete primerica forms

Accomplish Primerica Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed material, as you can easily locate the needed form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Primerica Forms on any device using airSlate SignNow Android or iOS applications and optimize any document-related process today.

The easiest method to alter and eSign Primerica Forms effortlessly

- Locate Primerica Forms and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invite link—or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Primerica Forms and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the primerica forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process of how to get 1099 from Primerica?

To get your 1099 from Primerica, you should log into your Primerica account. Navigate to the tax documents section where you can find your 1099 easily. Make sure to download it for your records and verify that your information is accurate.

-

When should I expect my 1099 from Primerica?

Typically, Primerica sends out 1099 forms by January 31st each year. If you do not receive it by this date, you may need to check your online account or contact Primerica support for assistance on how to get your 1099 from Primerica.

-

Are there any fees associated with how to get 1099 from Primerica?

There are no fees for obtaining your 1099 from Primerica. Accessing your tax documents online is free of charge. Just ensure to have your account credentials handy for a smooth retrieval process.

-

What if I lost my 1099 from Primerica, how can I request a new one?

If you have lost your 1099 from Primerica, you can easily request a new copy through your online account. Alternatively, you can contact Primerica's customer service for assistance on how to get a duplicate of your 1099.

-

Can I access my 1099 from Primerica online?

Yes, you can access your 1099 from Primerica online. By logging into your Primerica account, you can find and download your tax forms securely. This is the most efficient way to obtain your 1099.

-

Is there a deadline for filing taxes with a 1099 from Primerica?

Yes, the deadline for filing your taxes using a 1099 from Primerica aligns with the general tax filing deadlines. It is crucial to have your 1099 in hand to ensure accurate reporting, particularly if you’re unsure how to get 1099 from Primerica promptly.

-

What should I do if my 1099 from Primerica has incorrect information?

If your 1099 from Primerica contains incorrect information, you should immediately contact Primerica support. They can guide you on the process to rectify any discrepancies, ensuring you know how to get your correct 1099 from Primerica.

Get more for Primerica Forms

- H files t5001r 1 t5001e rfrp printing demande de dispense de lapplication de larticle 105 du rglement de limpt sur le revenu form

- Cra form t1036 12e agence du revenu du canada cra arc gc

- Application to register a charityunder the income tax act form

- Gst71 form

- Directorstrustees and like officials worksheet form

- T5 income form

- 2000 t3ret fillable form 2012

- Imm 5721e document checklist for a temporary resident visa in cic gc form

Find out other Primerica Forms

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free