CRA Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc 2012

What is the CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

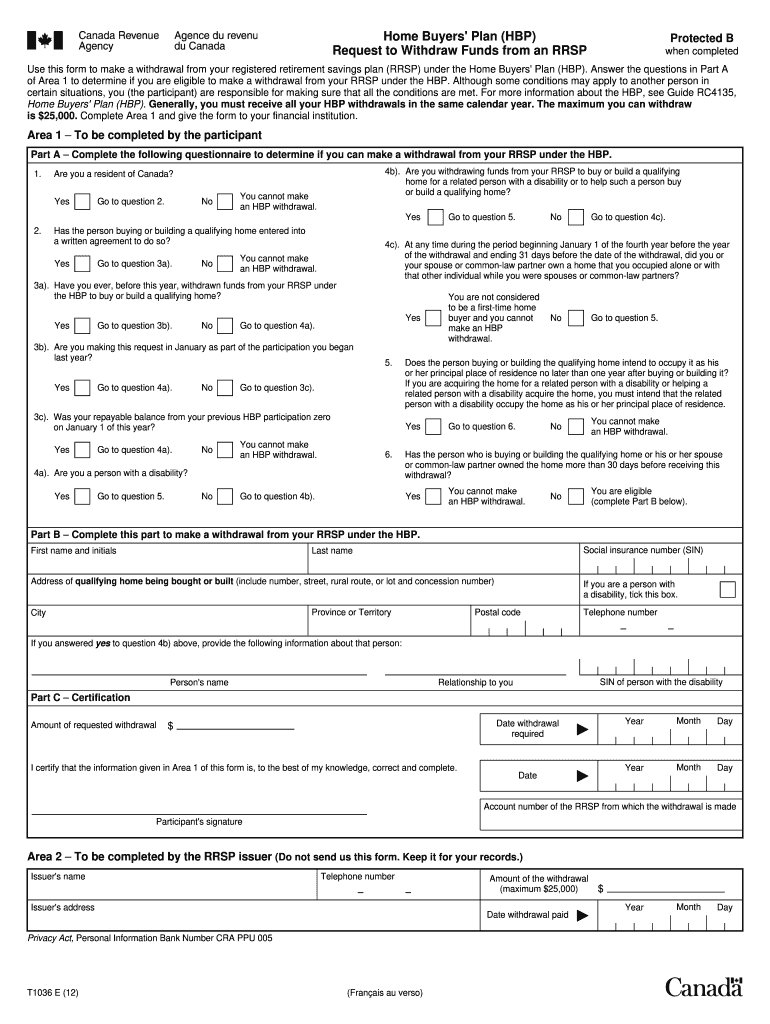

The CRA Form T1036 12e is a document issued by the Agence Du Revenu Du Canada, commonly referred to as CRA. This form is primarily used for specific tax-related purposes, such as applying for a tax credit or benefit. It is essential for individuals who need to report certain financial information to the Canadian tax authority. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and for maximizing potential benefits.

How to use the CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

Using the CRA Form T1036 12e involves several key steps. First, ensure that you have the most current version of the form, as outdated versions may not be accepted. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form accurately, providing all necessary details to avoid delays or rejections. Once completed, submit the form according to the guidelines specified by the CRA, which may include online submission, mailing, or in-person delivery.

Steps to complete the CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

Completing the CRA Form T1036 12e involves a systematic approach:

- Gather all necessary documents and information, such as identification and financial records.

- Download or obtain the latest version of the form from the CRA website.

- Carefully read the instructions to understand the sections of the form.

- Fill in your personal information accurately, ensuring all details are correct.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate channels as outlined by the CRA.

Key elements of the CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

The CRA Form T1036 12e includes several key elements that are critical for its validity:

- Personal Information: This section requires your name, address, and identification details.

- Financial Information: You must provide accurate financial data relevant to your tax situation.

- Signature: A valid signature is necessary to certify the authenticity of the information provided.

- Date: Including the date of submission is important for record-keeping and compliance.

Legal use of the CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

The legal use of the CRA Form T1036 12e is governed by Canadian tax laws. This form must be completed accurately to ensure that it is considered legally binding. Providing false information can lead to penalties, including fines or legal action. It is crucial to maintain compliance with the CRA's regulations to avoid any potential issues with tax authorities.

Eligibility Criteria

To use the CRA Form T1036 12e, individuals must meet specific eligibility criteria. Generally, this includes being a resident of Canada and having the necessary financial information to report. Certain tax credits or benefits may have additional requirements, such as income thresholds or specific circumstances. It is advisable to review the eligibility guidelines provided by the CRA to ensure compliance.

Quick guide on how to complete cra form t1036 12e agence du revenu du canada cra arc gc

A speedy guide on how to prepare your CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

Finding the correct template can be a daunting task when you need to submit formal international paperwork. Even if you have the necessary document, it can be cumbersome to swiftly fill it out in accordance with all the specifications if you work with physical copies instead of handling everything digitally. airSlate SignNow is the online eSignature tool that assists you in overcoming these challenges. It allows you to select your CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc and promptly fill it out and sign it on-site without the need to reprint documents in case of any errors.

Here are the steps you need to follow to prepare your CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc using airSlate SignNow:

- Click the Get Form button to upload your document to our editor immediately.

- Begin with the first blank section, enter the information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc necessitates it.

- Utilize the right-side pane to add more fields for you or others to fill out if needed.

- Review your answers and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Complete the editing process by clicking the Done button and choosing your file-sharing options.

Once your CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc is prepared, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can safely archive all your completed documents in your account, organized into folders based on your choices. Don’t waste time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct cra form t1036 12e agence du revenu du canada cra arc gc

Create this form in 5 minutes!

How to create an eSignature for the cra form t1036 12e agence du revenu du canada cra arc gc

How to generate an eSignature for the Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc online

How to create an eSignature for your Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc in Chrome

How to generate an eSignature for signing the Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc in Gmail

How to make an eSignature for the Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc right from your smart phone

How to create an eSignature for the Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc on iOS

How to generate an electronic signature for the Cra Form T1036 12e Agence Du Revenu Du Canada Cra Arc Gc on Android devices

People also ask

-

What is CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc?

CRA Form T1036 12e is a document issued by the Agence Du Revenu Du Canada that allows individuals to request funds from their Registered Retirement Savings Plan (RRSP) to purchase their first home. It's essential for first-time home buyers in Canada to understand this form to efficiently manage their home-buying process.

-

How can airSlate SignNow help with completing CRA Form T1036 12e?

airSlate SignNow provides an intuitive platform for eSigning and managing documents, making it easy to complete and submit CRA Form T1036 12e. With its user-friendly interface, you can quickly fill out the form, collect necessary signatures, and ensure secure submission to the Agence Du Revenu Du Canada.

-

What are the key features of airSlate SignNow for handling CRA Form T1036 12e?

Key features of airSlate SignNow include seamless eSigning, document templates, and real-time tracking for CRA Form T1036 12e. These capabilities streamline the process, making it easier to handle signatures and manage workflows efficiently.

-

Is there a cost associated with using airSlate SignNow for CRA Form T1036 12e?

Yes, there is a cost associated with using airSlate SignNow, but it offers a variety of pricing plans to accommodate different needs. The investment provides access to a powerful tool that simplifies the completion and signing of CRA Form T1036 12e, ensuring you save time and effort.

-

Can I integrate airSlate SignNow with other tools while using CRA Form T1036 12e?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your experience while dealing with CRA Form T1036 12e. Whether you use CRM systems or project management tools, you can streamline your workflow seamlessly.

-

What benefits does airSlate SignNow provide for businesses processing CRA Form T1036 12e?

Businesses leveraging airSlate SignNow for CRA Form T1036 12e can benefit from increased efficiency, reduced paperwork, and faster turnaround times for document signing. These advantages not only save valuable time but also enhance overall productivity.

-

Is airSlate SignNow secure for sensitive documents like CRA Form T1036 12e?

Yes, airSlate SignNow prioritizes security, ensuring that sensitive documents, such as CRA Form T1036 12e, are handled safely. The platform employs encryption and secure servers to protect your data, so you can eSign with confidence.

Get more for CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

Find out other CRA Form T1036 12e Agence Du Revenu Du Canada Cra arc Gc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors