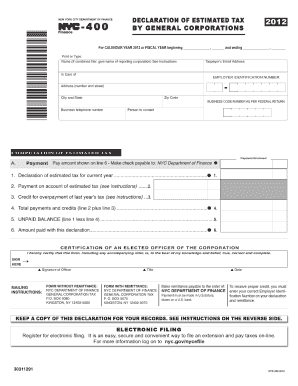

Nyc 400 Form

What is the NYC 400 Form

The NYC 400 form is a crucial document used for various purposes in New York City, primarily related to tax filings and compliance. This form is designed to gather essential information from taxpayers, allowing them to report their income, deductions, and credits accurately. Understanding the NYC 400 form is vital for residents and businesses to ensure they meet their tax obligations and avoid penalties.

How to Obtain the NYC 400 Form

Obtaining the NYC 400 form is straightforward. Taxpayers can access the form through the official New York City Department of Finance website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, some local tax offices may provide physical copies of the form for those who prefer in-person assistance.

Steps to Complete the NYC 400 Form

Completing the NYC 400 form involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including income statements, previous tax returns, and any relevant financial records.

- Carefully read the instructions provided with the form to understand the requirements and sections.

- Fill out each section of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Sign and date the form as required.

Legal Use of the NYC 400 Form

The NYC 400 form is legally binding when filled out correctly and submitted to the appropriate authorities. To ensure its legal validity, it is essential to comply with all relevant tax laws and regulations. This includes providing accurate information and maintaining records that support the claims made on the form. Failure to comply may result in penalties or legal repercussions.

Form Submission Methods

Taxpayers can submit the NYC 400 form through various methods, depending on their preference and convenience:

- Online Submission: Many taxpayers opt for online submission through the NYC Department of Finance website, which offers a secure portal for electronic filing.

- Mail: The form can be printed and mailed to the designated tax office. It is advisable to use certified mail to track the submission.

- In-Person: Taxpayers may also choose to submit the form in person at local tax offices, where they can receive immediate assistance if needed.

Eligibility Criteria

Eligibility to use the NYC 400 form typically depends on the taxpayer's residency status and the nature of their income. Generally, individuals and businesses earning income within New York City are required to file this form. Specific criteria may vary based on factors such as income level, filing status, and any applicable deductions or credits. It is essential for taxpayers to review these criteria before completing the form.

Quick guide on how to complete nyc 400 form

Effortlessly complete Nyc 400 Form on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly without delays. Handle Nyc 400 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Nyc 400 Form without hassle

- Find Nyc 400 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Nyc 400 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 400 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form NYC 400, and why is it important?

The form NYC 400 is a crucial document for businesses operating in New York City, as it provides detailed information about your income and expenses for tax purposes. Completing this form accurately ensures compliance with local tax regulations and helps prevent potential penalties.

-

How does airSlate SignNow support the completion of form NYC 400?

airSlate SignNow simplifies the process of completing the form NYC 400 by allowing users to fill out, sign, and send documents electronically. This streamlines the workflow, reducing the time spent on paperwork and helping to keep your business organized.

-

Is there a cost associated with using airSlate SignNow for form NYC 400?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. The pricing is competitive and designed to provide a cost-effective solution for managing documents like form NYC 400, thereby maximizing your return on investment.

-

What features does airSlate SignNow offer for processing form NYC 400?

airSlate SignNow includes features like customizable templates, automated reminders, and secure eSignature capabilities specifically tailored for documents such as form NYC 400. These features enhance efficiency and ensure a seamless completion process.

-

Can airSlate SignNow integrate with other software for managing form NYC 400?

Yes, airSlate SignNow offers various integrations with popular applications that can help manage your form NYC 400 and associated documents. This allows you to streamline your workflows and improve collaboration across your business tools.

-

What benefits does airSlate SignNow offer when handling form NYC 400?

Utilizing airSlate SignNow for your form NYC 400 provides numerous benefits, including faster processing times, reduced paper usage, and improved accuracy. By digitizing this process, businesses can focus more on their core operations rather than paperwork.

-

How secure is airSlate SignNow when handling sensitive information like form NYC 400?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information on documents like form NYC 400. You can trust that your data is safe while performing eSignature transactions and document management.

Get more for Nyc 400 Form

- Teacher reference form hawaii baptist academy

- Schedule c employer transition plan service canada servicecanada gc form

- Mad 378 form

- Seaview authorization form

- Mortality review form

- Michigan request notice form

- Half fare supplemental application form indygo

- Release to return to work release to return to work form 440 3245

Find out other Nyc 400 Form

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF