Missouri W3 Form

What is the Missouri W3

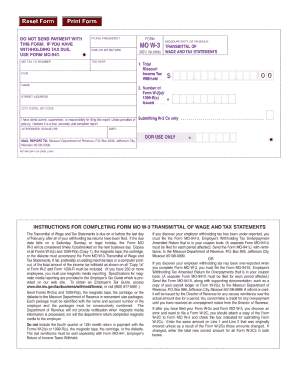

The Missouri W3 form is a crucial document used by employers in the state of Missouri to report annual wage and tax information for their employees. This form serves as a summary of all W-2 forms issued by an employer within a calendar year. It is essential for ensuring that the state receives accurate data regarding employee earnings and withholdings, which is necessary for tax purposes.

How to use the Missouri W3

Using the Missouri W3 form involves compiling data from all W-2 forms issued by the employer. Employers must complete the W3 by providing their business information, including the employer identification number (EIN), total wages paid, and total taxes withheld. Once completed, the form must be submitted to the Missouri Department of Revenue, either electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to complete the Missouri W3

Completing the Missouri W3 form requires a systematic approach to ensure accuracy. Here are the steps involved:

- Gather all W-2 forms issued to employees for the tax year.

- Calculate the total wages paid to employees and the total state income tax withheld.

- Fill out the Missouri W3 form with the required employer and wage information.

- Review the form for any errors or omissions.

- Submit the completed form to the Missouri Department of Revenue by the filing deadline.

Legal use of the Missouri W3

The Missouri W3 form is legally required for employers to report annual wage and tax information. Failure to file this form can result in penalties and interest on unpaid taxes. Moreover, ensuring the accuracy of the information reported helps maintain compliance with state tax laws and protects the employer from potential audits or legal issues.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines when filing the Missouri W3 form. Typically, the form is due by January thirty-first of the year following the tax year being reported. It is essential for employers to adhere to this deadline to avoid penalties and ensure timely processing of tax information.

Form Submission Methods (Online / Mail / In-Person)

The Missouri W3 form can be submitted through various methods to accommodate different employer preferences. Employers may choose to file electronically using the Missouri Department of Revenue's online portal, which is often the preferred method due to its efficiency. Alternatively, the form can be mailed to the appropriate state office or submitted in person at designated locations, ensuring that it is received by the filing deadline.

Quick guide on how to complete missouri w3

Effortlessly Prepare Missouri W3 on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Missouri W3 on any device using airSlate SignNow's applications for Android or iOS and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Missouri W3 with Ease

- Obtain Missouri W3 and select Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Missouri W3 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri w3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri W3 form, and why is it important?

The Missouri W3 form is a crucial document used for reporting annual withholding tax payments made by employers to the state of Missouri. It summarizes total wages, taxes withheld, and employees for the tax year. Completing the Missouri W3 accurately ensures compliance with state tax regulations and helps avoid potential penalties.

-

How can airSlate SignNow help with the Missouri W3 form?

airSlate SignNow streamlines the process of preparing and signing the Missouri W3 form by offering a user-friendly platform to manage your documents electronically. You can easily create, send for eSignature, and store your forms securely. This enhances efficiency and ensures that your W3 submissions are accurate and timely.

-

What are the pricing options for using airSlate SignNow for Missouri W3 forms?

airSlate SignNow offers several pricing plans, catering to different business needs and sizes. Whether you're a small business or a larger organization, you'll find a plan that fits your budget while enabling you to handle Missouri W3 forms and other documents effectively. Check the website for detailed pricing information and choose the best plan for your requirements.

-

Is airSlate SignNow compliant with Missouri tax regulations?

Yes, airSlate SignNow is designed to comply with various legal and tax regulations, including those pertaining to the Missouri W3 form. The platform ensures that all electronically signed documents maintain their legal validity. This enables users to confidently submit their Missouri W3 forms knowing that they meet state requirements.

-

Can I integrate airSlate SignNow with other software for payroll processing?

Absolutely! airSlate SignNow offers seamless integrations with various payroll and accounting software platforms, making it easier to manage your Missouri W3 submissions alongside your payroll processes. This integration helps streamline your operations, saving time and minimizing errors when preparing necessary tax documents.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides robust features for document management, including customizable templates, automated workflows, and real-time tracking. Users can easily send documents for eSignature, set reminders for pending signatures, and access completed forms, like the Missouri W3, from any device. This enhances your overall document handling efficiency.

-

How secure is airSlate SignNow when handling sensitive documents like the Missouri W3?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents such as the Missouri W3 form. The platform uses advanced encryption and security measures to protect your data and documents. This ensures that your information is safe during transmission and storage.

Get more for Missouri W3

Find out other Missouri W3

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now