Sales Tax Chart 2009

What is the Sales Tax Chart

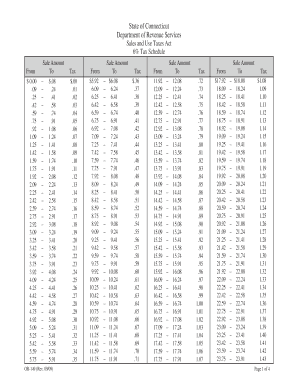

The sales tax chart is a vital document that outlines the applicable sales tax rates for various goods and services in Connecticut. It serves as a reference for businesses and individuals to determine the correct tax amount to charge or pay. This chart is essential for compliance with state tax regulations and helps ensure accurate tax reporting. Understanding the sales tax chart can prevent costly errors and penalties associated with incorrect tax calculations.

How to Use the Sales Tax Chart

To effectively use the sales tax chart, first identify the specific goods or services you are dealing with. Each item will have a designated tax rate. Locate the item in the chart and note the corresponding rate. Multiply the cost of the item by the tax rate to calculate the total sales tax. This process ensures that you apply the correct tax amount when completing transactions, whether for personal purchases or business sales.

Steps to Complete the Sales Tax Chart

Completing the sales tax chart involves several key steps. Begin by gathering all necessary information about the items or services being sold. Next, refer to the sales tax chart to find the applicable rates. Calculate the sales tax for each item by multiplying the price by the tax rate. Finally, ensure that all calculations are accurate and reflect the most current tax rates to maintain compliance with state laws.

Legal Use of the Sales Tax Chart

The legal use of the sales tax chart is crucial for businesses operating in Connecticut. It is important to apply the correct sales tax rates as outlined in the chart to avoid legal issues. Utilizing the chart in conjunction with proper documentation helps ensure compliance with state tax laws. Businesses must keep accurate records of sales tax collected and remitted to the state to maintain transparency and accountability.

Key Elements of the Sales Tax Chart

Key elements of the sales tax chart include the item descriptions, applicable tax rates, and any exemptions that may apply. Each entry typically provides a clear categorization of goods and services, making it easier to determine the correct tax rate. Understanding these elements is essential for accurate tax calculations and compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for sales tax returns in Connecticut are critical for businesses to observe. Typically, sales tax returns are due on a quarterly basis, with specific dates set by the state. Missing these deadlines can result in penalties and interest on unpaid taxes. It is advisable to stay informed about these important dates to ensure timely filing and payment of sales tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Submitting the sales tax chart can be done through various methods, including online, by mail, or in person. The online method is often the most efficient, allowing for quick submission and confirmation. For those who prefer traditional methods, mailing the completed form is an option, though it may take longer for processing. In-person submission is also available at designated state offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete sales tax chart 100382647

Effortlessly prepare Sales Tax Chart on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary format and securely archive it online. airSlate SignNow provides you with all the resources you need to swiftly create, modify, and electronically sign your documents without delays. Manage Sales Tax Chart on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest method to alter and eSign Sales Tax Chart with ease

- Obtain Sales Tax Chart and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign Sales Tax Chart and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales tax chart 100382647

Create this form in 5 minutes!

How to create an eSignature for the sales tax chart 100382647

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct sales tax chart and how can it help my business?

The ct sales tax chart is a comprehensive guide that details the sales tax rates applicable to various goods and services within Connecticut. Using this chart helps businesses ensure compliance with tax regulations, streamline accounting processes, and avoid potential penalties. By integrating this data with airSlate SignNow, signing and managing tax-related documents becomes efficient and accurate.

-

How does airSlate SignNow simplify sales tax documentation?

airSlate SignNow simplifies sales tax documentation by providing a user-friendly platform for electronically signing and storing tax forms. By integrating the ct sales tax chart, users can easily calculate the applicable rates while preparing documents. This reduces errors and accelerates the approval process, ultimately saving time and resources.

-

Is airSlate SignNow cost-effective for small businesses handling sales tax?

Yes, airSlate SignNow offers a cost-effective solution that benefits small businesses managing sales tax documentation. With our platform, you can efficiently utilize the ct sales tax chart to ensure accurate tax calculations without incurring hefty software fees. This makes it an ideal choice for small businesses looking to manage their tax forms economically.

-

What key features does airSlate SignNow offer for sales tax management?

airSlate SignNow includes features such as document tracking, electronic signatures, and customizable templates, all tailored to facilitate tax document management. By leveraging the ct sales tax chart within these features, users can ensure they apply the correct tax rates on their transactions effortlessly. This enhances the overall accuracy and efficiency of tax-related processes.

-

Can I integrate airSlate SignNow with other accounting software for sales tax purposes?

Yes, airSlate SignNow supports integration with various accounting software, allowing you to streamline your sales tax management process. By using the ct sales tax chart alongside your accounting tools, you can ensure seamless data flow and accurate tax calculations. This integration enhances productivity, making it easier to manage your tax obligations.

-

How often is the ct sales tax chart updated?

The ct sales tax chart is regularly updated to reflect changes in tax rates and regulations in Connecticut. This ensures businesses using airSlate SignNow have access to the most current information for their sales tax calculations. Staying updated with the chart is crucial for compliance and avoiding costly errors in taxation.

-

What benefits does airSlate SignNow provide in using the ct sales tax chart?

Using airSlate SignNow with the ct sales tax chart provides several benefits, such as improved accuracy in tax documentation and faster processing times. By automating calculations and leveraging electronic signatures, businesses can streamline their sales tax workflow. This results in less manual work, reduced errors, and a more efficient tax management system.

Get more for Sales Tax Chart

Find out other Sales Tax Chart

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form