CT or 149 2019-2026

Understanding the CT OR 149

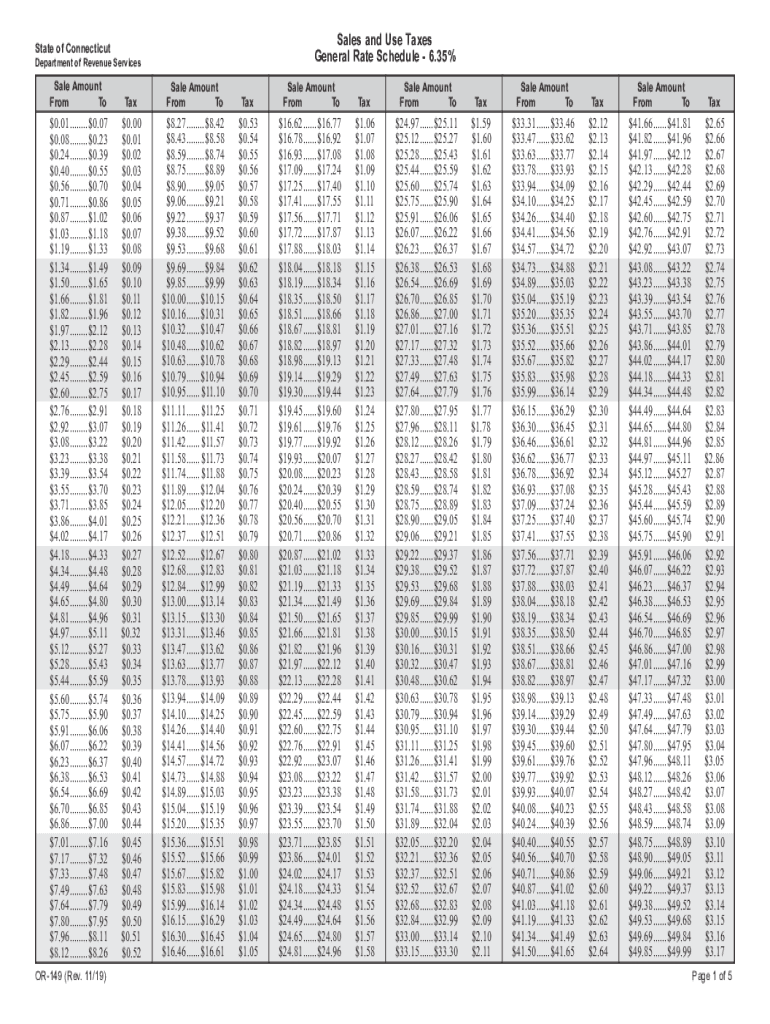

The CT OR 149 is a crucial form used for reporting sales tax in Connecticut. It serves as a comprehensive tool for businesses to accurately calculate and report their sales tax obligations. This form is essential for compliance with state tax regulations, ensuring that businesses meet their tax responsibilities while avoiding potential penalties. Understanding the purpose and requirements of the CT OR 149 is vital for any business operating in Connecticut.

Steps to Complete the CT OR 149

Completing the CT OR 149 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records and documentation. Next, calculate the total sales and applicable sales tax for the reporting period. Fill out the form with the required information, ensuring that all figures are accurate. After completing the form, review it for any errors before submission. Finally, submit the CT OR 149 by the designated deadline to avoid any late fees or penalties.

Legal Use of the CT OR 149

The legal use of the CT OR 149 is governed by Connecticut state tax laws. This form must be filled out correctly to be considered valid. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or penalties. Businesses should maintain copies of their submitted forms for their records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for businesses using the CT OR 149. Typically, the form is due on a quarterly basis, but specific deadlines may vary. Businesses should mark their calendars with these important dates to ensure timely submission. Failing to file by the deadline can result in penalties and interest on unpaid taxes, making it essential to adhere to the established schedule.

Required Documents

To successfully complete the CT OR 149, businesses must gather several required documents. These include sales records, receipts, and any other documentation that supports the sales tax calculations. Accurate record-keeping is essential, as it provides the necessary information to fill out the form correctly. Having these documents readily available can streamline the completion process and ensure compliance with state regulations.

Examples of Using the CT OR 149

Understanding practical applications of the CT OR 149 can help businesses navigate their sales tax obligations. For instance, a retail store may use the form to report sales tax collected from customers during a specific quarter. Similarly, an online business selling goods in Connecticut must also complete the CT OR 149 to report sales tax accurately. These examples illustrate the form's importance across various business models and industries.

Quick guide on how to complete ct or 149

Effortlessly Prepare CT OR 149 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage CT OR 149 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Edit and Electronically Sign CT OR 149 with No Hassle

- Locate CT OR 149 and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign CT OR 149 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct or 149

Create this form in 5 minutes!

How to create an eSignature for the ct or 149

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is the printable 6 sales tax chart?

The printable 6 sales tax chart is a comprehensive guide that outlines the sales tax rates applicable to various jurisdictions. This chart is designed to simplify the process of calculating sales tax for businesses, making it easier to comply with tax regulations.

-

How can I access the printable 6 sales tax chart?

You can easily access the printable 6 sales tax chart by visiting our website and downloading it directly. This free resource is available for all users and can be printed for quick reference when needed.

-

Is the printable 6 sales tax chart updated regularly?

Yes, we frequently update the printable 6 sales tax chart to reflect any changes in tax rates or regulations. By keeping this chart current, we ensure that businesses have the most accurate information to manage their sales tax obligations.

-

What are the benefits of using the printable 6 sales tax chart?

Using the printable 6 sales tax chart provides clarity on various tax rates, helping businesses save time and avoid mistakes during transactions. It enhances compliance and improves the accuracy of sales tax calculations, ultimately benefiting your business’s financial health.

-

Can the printable 6 sales tax chart be integrated with other tools?

While the printable 6 sales tax chart itself is a standalone document, it can be used alongside various accounting and invoicing software. Utilizing this chart in conjunction with our eSignature solutions facilitates a more efficient workflow when handling sales tax-related documents.

-

Is there a cost associated with the printable 6 sales tax chart?

No, the printable 6 sales tax chart is completely free to download and print. We believe in providing essential resources to help businesses thrive without adding extra costs.

-

Who should use the printable 6 sales tax chart?

The printable 6 sales tax chart is designed for small business owners, accountants, and finance professionals who need to calculate sales tax accurately. It serves as a useful tool for anyone looking to simplify their sales tax management process.

Get more for CT OR 149

- Cracking the code 3rd edition pdf form

- Letter of intent for apartment form

- Pony club d2 test sheet form

- Special adhesive stamp online form

- Unit 3 parallel and perpendicular lines answer key form

- Proof of surviving legal heirs sample with fill up form

- Laboratory data review checklist for air samples alaska dec alaska form

- Fairview hospital catering request form all function forms

Find out other CT OR 149

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement