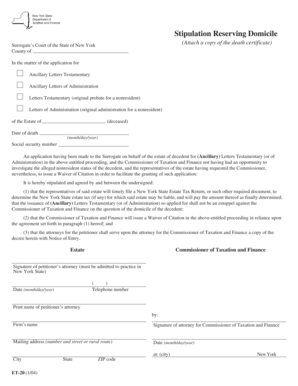

Stipulation Reserving Domicile Form

What is the Stipulation Reserving Domicile

The stipulation reserving domicile is a legal document used to establish an individual's permanent residence for legal purposes. This form is particularly relevant in cases involving divorce, child custody, or estate planning, where the determination of a person's domicile can affect jurisdiction and legal rights. By completing this form, individuals can clarify their intent to maintain a specific domicile, which can influence various legal proceedings.

How to use the Stipulation Reserving Domicile

Using the stipulation reserving domicile involves several key steps. First, individuals must gather necessary information regarding their current residence and any relevant legal matters. Next, the form should be filled out accurately, ensuring that all required fields are completed. After filling out the form, it is advisable to have it reviewed by a legal professional to ensure compliance with local laws. Finally, the completed form should be submitted to the appropriate court or agency as required.

Steps to complete the Stipulation Reserving Domicile

Completing the stipulation reserving domicile involves a systematic approach:

- Gather personal information, including your full name, current address, and any relevant case numbers.

- Clearly state your intention to reserve your domicile in the designated section of the form.

- Include any additional information that may support your claim, such as proof of residence or identification.

- Review the form for accuracy and completeness.

- Sign the document in the presence of a notary public if required.

- Submit the completed form to the appropriate legal entity.

Key elements of the Stipulation Reserving Domicile

Several key elements are essential for the stipulation reserving domicile to be effective:

- Identification: Clearly identify the parties involved, including full names and addresses.

- Intent: Explicitly state the intent to reserve domicile, which must be clear and unambiguous.

- Supporting Documentation: Attach any necessary documents that validate the claim of domicile, such as utility bills or lease agreements.

- Signatures: Ensure that all parties sign the document, as required by law.

Legal use of the Stipulation Reserving Domicile

The legal use of the stipulation reserving domicile is crucial in various situations, such as custody disputes or tax matters. Courts often rely on this document to determine jurisdiction and applicable laws. Properly executed, it can serve as a binding agreement that outlines an individual's residency status, which can influence legal rights and obligations. It is important to ensure that the stipulation complies with state-specific laws to maintain its legal validity.

State-specific rules for the Stipulation Reserving Domicile

Each state may have unique rules and requirements regarding the stipulation reserving domicile. It is essential to familiarize yourself with your state’s regulations, as these can dictate how the form must be completed, the necessary supporting documentation, and the submission process. Consulting with a legal professional familiar with state laws can help ensure compliance and avoid potential issues.

Quick guide on how to complete stipulation reserving domicile

Complete Stipulation Reserving Domicile easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the features needed to create, modify, and eSign your documents swiftly without delays. Handle Stipulation Reserving Domicile on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Stipulation Reserving Domicile without hassle

- Locate Stipulation Reserving Domicile and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details carefully, then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors requiring new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Stipulation Reserving Domicile and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stipulation reserving domicile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form et 20 in airSlate SignNow?

Form et 20 is a specific document template available in airSlate SignNow designed for streamlined eSigning and document management. It enables users to fill out and sign forms electronically, enhancing efficiency and reducing paper usage.

-

How does airSlate SignNow handle form et 20 pricing?

AirSlate SignNow offers competitive pricing plans tailored to different business needs, including access to tools for managing form et 20. Customers can choose a plan that aligns with their usage and required features, providing flexibility and cost-effectiveness.

-

What features does form et 20 include?

The form et 20 template includes essential features such as customizable fields, secure eSigning options, and automated workflows. These features ensure that businesses can easily configure the form to meet their specific needs and streamline their document processes.

-

How can form et 20 benefit my business?

By utilizing form et 20, businesses can signNowly improve their workflow efficiency and reduce turnaround time for document approvals. The ease of access to digital forms helps in minimizing errors and enhances collaboration among team members.

-

Can I integrate form et 20 with other platforms?

Yes, airSlate SignNow supports integrations with various applications, allowing you to seamlessly use form et 20 with your favorite tools. This integration capability enhances your document management system, providing a more cohesive workflow.

-

Is there a mobile app for managing form et 20?

Absolutely! AirSlate SignNow offers a mobile app that allows you to create, send, and manage form et 20 on the go. This flexibility ensures you can handle important documents anytime and anywhere, improving productivity.

-

What security measures are in place for form et 20?

AirSlate SignNow takes security seriously, implementing robust measures such as encryption and compliance with industry standards. This ensures that your form et 20 and all associated data are securely stored and protected against unauthorized access.

Get more for Stipulation Reserving Domicile

Find out other Stipulation Reserving Domicile

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online