it 213 Form 2022

What is the It 213 Form

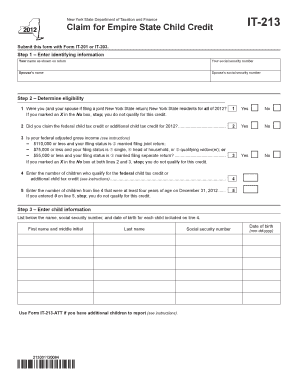

The It 213 form, also known as the New York State IT-213, is a tax form used by individuals to claim a credit for taxes paid to other jurisdictions. This form is essential for residents who have paid taxes to another state or local government and wish to receive a credit against their New York State income tax liability. Understanding the purpose of the It 213 form is crucial for ensuring compliance with tax regulations and maximizing potential tax benefits.

Steps to complete the It 213 Form

Completing the It 213 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of taxes paid to other jurisdictions. Follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Enter the details of the taxes paid to other states, including the amount and the jurisdiction.

- Calculate the credit amount based on the instructions provided on the form.

- Review the completed form for accuracy before submission.

Taking care to follow these steps will help ensure that your It 213 form is filled out correctly.

Legal use of the It 213 Form

The It 213 form is legally recognized as a valid document for claiming tax credits in New York State. To ensure its legal use, it is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing accurate information and supporting documentation. Failure to comply with these regulations may result in penalties or denial of the claimed credit.

Form Submission Methods

The It 213 form can be submitted through various methods, allowing taxpayers flexibility in how they file. The available submission methods include:

- Online: Many taxpayers opt to file electronically through tax preparation software or the New York State Department of Taxation and Finance website.

- Mail: You can print the completed form and mail it to the appropriate address provided in the instructions.

- In-Person: Some taxpayers may choose to submit the form in person at designated tax offices.

Choosing the right submission method can streamline the filing process and ensure timely processing of your tax credit claim.

Key elements of the It 213 Form

The It 213 form includes several key elements that are essential for completing the document accurately. These elements consist of:

- Personal Information: This section requires your name, address, and Social Security number.

- Tax Jurisdiction Details: You must provide information about the jurisdictions where taxes were paid.

- Credit Calculation: This section outlines how to calculate the credit based on taxes paid.

- Signature: Your signature certifies that the information provided is accurate and complete.

Understanding these elements will help ensure that you fill out the It 213 form correctly and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the It 213 form are crucial to ensure compliance and avoid penalties. Typically, the form must be filed by the same deadline as your New York State income tax return. Key dates to remember include:

- Tax Filing Deadline: Generally, this is April 15 of each year, unless it falls on a weekend or holiday.

- Extensions: If you file for an extension on your income tax return, ensure that you also extend the filing of your It 213 form.

Staying aware of these deadlines will help you avoid late fees and ensure that your claims are processed on time.

Quick guide on how to complete it 213 form

Complete It 213 Form effortlessly on any device

Web-based document management has gained traction among companies and individuals. It presents a superb eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without interruptions. Manage It 213 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign It 213 Form without hassle

- Locate It 213 Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign It 213 Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 213 form

Create this form in 5 minutes!

How to create an eSignature for the it 213 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to form it 213 instructions?

AirSlate SignNow offers a range of features that simplify the management of form it 213 instructions, including customizable templates, secure eSigning, and real-time document tracking. These features enable users to streamline their document workflows efficiently. Whether you're sending or signing, our platform ensures a user-friendly experience tailored to meet your needs.

-

How can I get started with form it 213 instructions on airSlate SignNow?

To get started with form it 213 instructions on airSlate SignNow, simply sign up for an account and access our library of templates. You can customize the form to match your requirements and begin sending it out for eSignature immediately. Our intuitive interface makes it easy for anyone to navigate and utilize effectively.

-

Are there any costs associated with using airSlate SignNow for form it 213 instructions?

AirSlate SignNow offers flexible pricing plans that cater to different business needs when managing form it 213 instructions. We provide a variety of options, from free trials to monthly subscriptions, allowing users to choose a plan that fits their budget. Detailed information about pricing can be found on our website.

-

What benefits can I expect from using airSlate SignNow for form it 213 instructions?

Using airSlate SignNow for form it 213 instructions provides numerous benefits, such as enhanced efficiency and reduced turnaround times. By digitizing your document workflows, you can minimize paperwork and streamline processes. Further, our platform ensures secure signing and compliance with legal standards, giving you peace of mind.

-

Can I integrate airSlate SignNow with other tools when handling form it 213 instructions?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your experience when handling form it 213 instructions. Whether you're using CRM systems, cloud storage solutions, or productivity tools, our integrations ensure that your workflow remains uninterrupted and efficient. Check our integrations page for a full list of compatible applications.

-

Is there customer support available for issues related to form it 213 instructions?

Absolutely! We provide dedicated customer support for any issues you may encounter related to form it 213 instructions. Our support team is available via email, chat, or phone to assist you with any questions or challenges. We also offer extensive documentation and tutorials to help you navigate the platform.

-

How secure is airSlate SignNow when handling form it 213 instructions?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like form it 213 instructions. Our platform uses industry-standard encryption and complies with legal regulations to ensure that your data is safe and secure. You can confidently send, sign, and manage documents without worrying about unauthorized access.

Get more for It 213 Form

- Inf1100 form

- Hemochromatosis family letter centers for disease control and cdc form

- 052015 rev ct form

- Cy 321 day care agreement form

- Cdph 278 b cdph ca form

- Supplemental questionnaire to determine entitlement for a us passport state form

- Cacfp meal count form nj

- Form cem 6201b supplemental notice of potential claim dot ca

Find out other It 213 Form

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form