Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms 2022

What is the Low Income Taxpayer Clinic?

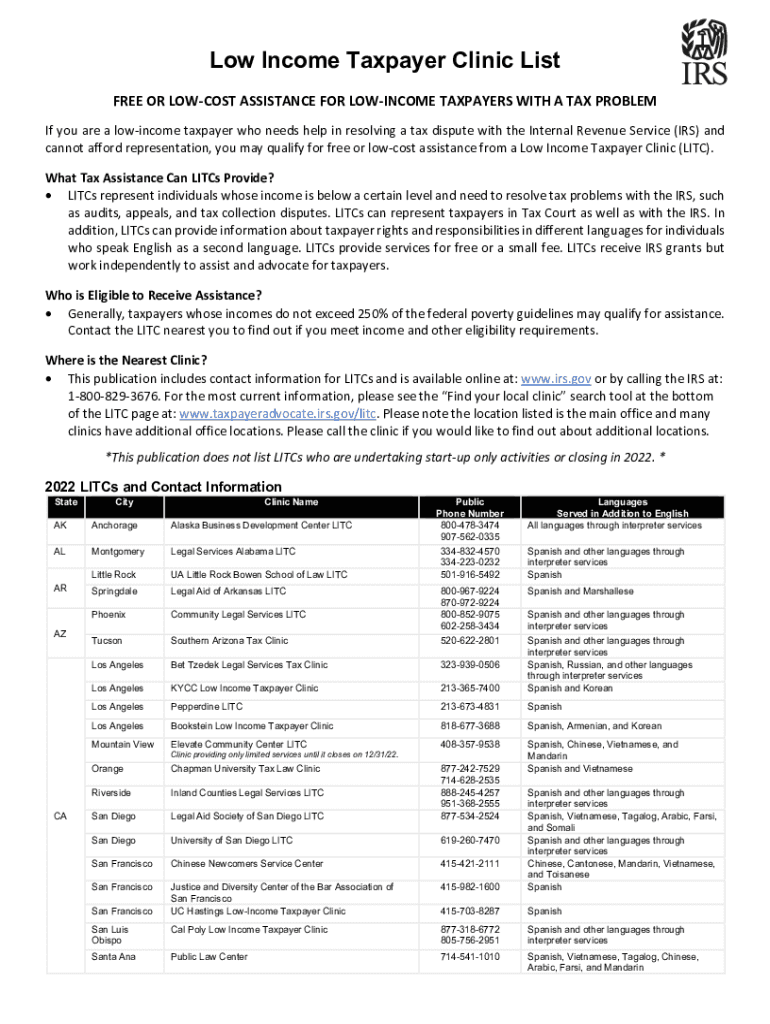

The Low Income Taxpayer Clinic (LITC) program, administered by the Internal Revenue Service (IRS), provides assistance to low-income taxpayers who are facing issues related to their tax obligations. These clinics offer free or low-cost legal representation and education to taxpayers who cannot afford to hire a private attorney. LITCs help with a variety of issues, including audits, appeals, and collection matters. They also provide outreach and education about taxpayer rights and responsibilities, ensuring that individuals understand their options when dealing with the IRS.

Steps to Complete the 2022 IRS Publication 4134 Income Clinic Form

Completing the 2022 IRS Publication 4134 Income Clinic Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including your income information and any correspondence from the IRS. Next, fill out the form with your personal details, ensuring that all information is correct and complete. It is important to review the form for any errors before submission. Once completed, you can submit the form electronically through a secure platform or by mail, depending on your preference and the guidelines provided by the IRS. Utilizing a digital solution can streamline this process, allowing for easy tracking and management of your submission.

Legal Use of the Low Income Taxpayer Clinic Form

The 2022 IRS Publication 4134 form is legally binding when completed correctly, as it adheres to the requirements set forth by the IRS. To ensure its legal validity, the form must be signed by the taxpayer and, if applicable, by a representative from the clinic. The use of electronic signatures is permitted under the ESIGN Act, provided that the eSignature solution used complies with legal standards. This means that utilizing a reliable digital platform can enhance the legitimacy and security of the form submission process.

Eligibility Criteria for Low Income Taxpayer Clinics

To qualify for assistance from a Low Income Taxpayer Clinic, individuals must meet specific income criteria, which are typically set at or below 250 percent of the federal poverty level. Additionally, the taxpayer must have a tax dispute with the IRS, such as an audit or collection issue. It is essential for applicants to provide documentation that verifies their income and tax-related issues to ensure eligibility for the services offered by the clinic.

Required Documents for the 2022 IRS Publication 4134 Form

When preparing to complete the 2022 IRS Publication 4134 form, certain documents are necessary to provide a comprehensive overview of your tax situation. These documents may include:

- Your most recent tax return

- Income statements, such as W-2s or 1099s

- Any correspondence received from the IRS

- Proof of income eligibility, such as pay stubs or benefit statements

Having these documents ready will facilitate a smoother completion process and help ensure that all required information is accurately reported.

Form Submission Methods

The 2022 IRS Publication 4134 form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the IRS. The primary submission methods include:

- Online Submission: Using a secure digital platform to complete and submit the form electronically.

- Mail Submission: Printing the completed form and sending it to the designated IRS address.

- In-Person Submission: Delivering the form directly to a local IRS office or a participating Low Income Taxpayer Clinic.

Each method has its own advantages, and choosing the right one can enhance the efficiency and security of the submission process.

Quick guide on how to complete low income taxpayer clinicsinternal revenue service irs tax forms

Complete Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms without hassle

- Locate Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize critical sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct low income taxpayer clinicsinternal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the role of the 2022 internal revenue service in eSigning documents?

The 2022 internal revenue service is vital for ensuring that eSigned documents are compliant with tax regulations. Using airSlate SignNow can help you create, send, and manage documents while adhering to requirements set by the IRS. It simplifies the process, making it easy to maintain compliance as you handle transactions.

-

How does airSlate SignNow help with IRS forms for the 2022 internal revenue service?

airSlate SignNow provides templates and tools specifically designed for IRS forms required by the 2022 internal revenue service. This feature allows users to easily fill out, eSign, and submit necessary documentation while ensuring compliance. It streamlines tax-related processes, saving valuable time.

-

Are there any specific integrations for managing 2022 internal revenue service documents?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software that assist with the management of documents related to the 2022 internal revenue service. This includes platforms like QuickBooks and Xero. These integrations allow for easy document sharing and management, enhancing overall efficiency.

-

Is airSlate SignNow cost-effective for small businesses dealing with the 2022 internal revenue service?

Absolutely! airSlate SignNow is a cost-effective solution tailored for small businesses addressing tasks related to the 2022 internal revenue service. By reducing paperwork and streamlining document management, it helps small businesses save on operational costs while ensuring compliance with tax regulations.

-

What features of airSlate SignNow are beneficial for the 2022 internal revenue service?

Key features of airSlate SignNow that benefit users engaging with the 2022 internal revenue service include secure eSigning, document templates, and audit trails. These features ensure documents are signed efficiently, stay organized, and provide necessary proof of compliance with IRS regulations. This enhances the overall experience for businesses and their clients.

-

Can airSlate SignNow assist with audit queries from the 2022 internal revenue service?

Yes, airSlate SignNow can assist you with audit queries from the 2022 internal revenue service by providing detailed audit trails for all eSigned documents. This helps maintain transparency and accountability during audits. With the ability to retrieve documents easily, you can respond to IRS requests swiftly and efficiently.

-

How does airSlate SignNow ensure document security for the 2022 internal revenue service?

airSlate SignNow employs advanced encryption and security protocols to protect documents related to the 2022 internal revenue service. This means that all sensitive data is secure during transmission and storage, preventing unauthorized access. Compliance with industry standards ensures that your documents are safe and reliable.

Get more for Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms

- Landscaping contractor package new york form

- Commercial contractor package new york form

- Excavation contractor package new york form

- New york contractor 497321842 form

- Concrete mason contractor package new york form

- Demolition contractor package new york form

- Security contractor package new york form

- Insulation contractor package new york form

Find out other Low Income Taxpayer ClinicsInternal Revenue Service IRS Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors