Schedule 2 PDF SCHEDULE 2 Department of the Treasury Internal Revenue 2022-2026

Key elements of the 2 Schedule 2

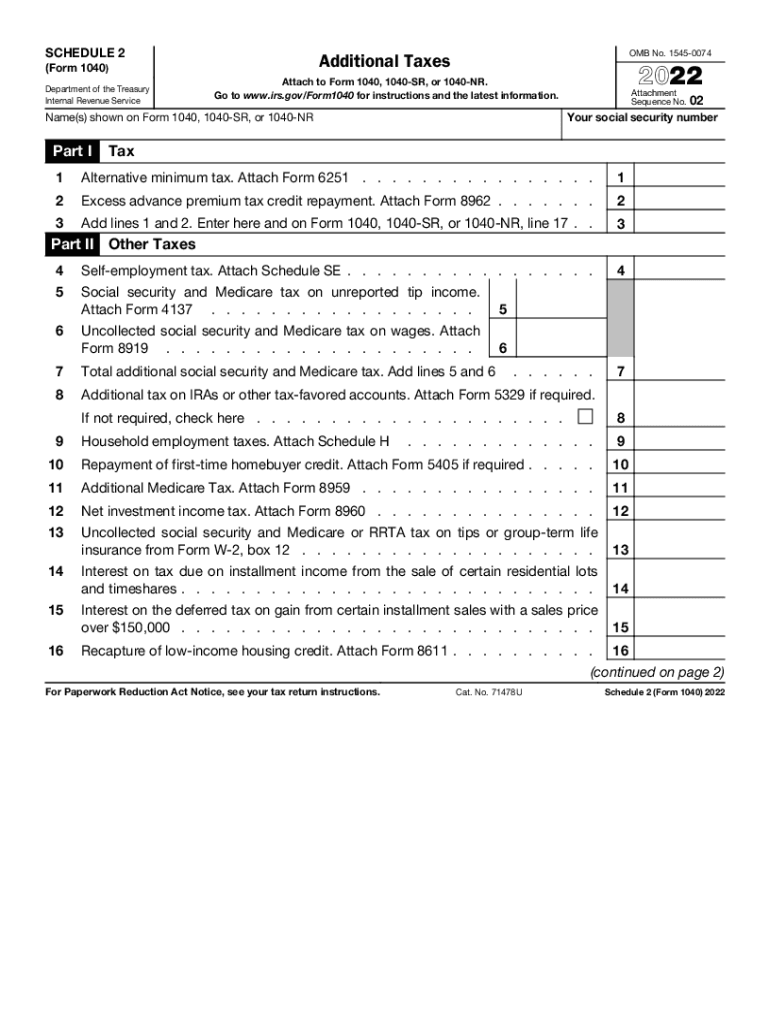

The 2 Schedule 2 is essential for reporting additional taxes that are not included on the main Form 1040. Key elements of this form include:

- Additional taxes: This section includes taxes like self-employment tax, unreported social security and Medicare tax, and additional tax on IRAs or other qualified retirement plans.

- Line items: Each line item on Schedule 2 corresponds to specific tax obligations, ensuring taxpayers report all necessary additional taxes accurately.

- Compatibility: Schedule 2 must be filed alongside Form 1040, and it is crucial for taxpayers who have additional tax liabilities.

Steps to complete the 2 Schedule 2

Completing the 2 Schedule 2 involves several straightforward steps:

- Gather necessary documents: Collect all relevant tax documents, including W-2s, 1099s, and records of any additional taxes owed.

- Fill out the form: Begin by entering your personal information at the top. Proceed to fill in the applicable lines for additional taxes.

- Calculate totals: Ensure that you accurately calculate the total additional taxes owed and transfer this amount to your main Form 1040.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties or delays in processing.

IRS Guidelines for the 2 Schedule 2

The IRS provides specific guidelines for completing the 2 Schedule 2. These guidelines include:

- Eligibility: Ensure that you are required to file Schedule 2 based on your tax situation, including self-employment income or other specific tax obligations.

- Submission methods: Schedule 2 can be submitted electronically or via mail, depending on your filing preferences and requirements.

- Filing deadlines: Be aware of the filing deadlines to avoid penalties. Typically, the deadline aligns with the main Form 1040 submission date.

Legal use of the 2 Schedule 2

The legal use of the 2 Schedule 2 is crucial for compliance with U.S. tax laws. It is important to understand:

- Compliance: Filing Schedule 2 ensures that you are compliant with IRS regulations regarding additional taxes.

- Record-keeping: Maintain copies of your completed Schedule 2 and any supporting documents for your records, as they may be needed for future reference or audits.

- Penalties: Failing to report additional taxes can result in penalties, so accurate completion is vital.

Examples of using the 2 Schedule 2

Understanding how to use the 2 Schedule 2 can be enhanced through practical examples:

- Self-employed individuals: If you are self-employed, you may need to report self-employment tax on Schedule 2.

- Retirement account distributions: If you took early distributions from retirement accounts, you would report any additional taxes due on Schedule 2.

- Unreported taxes: If you have unreported social security or Medicare taxes, these must also be included on this schedule.

Quick guide on how to complete schedule 2pdf schedule 2 department of the treasury internal revenue

Complete Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue with ease

- Obtain Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue to ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 2pdf schedule 2 department of the treasury internal revenue

Create this form in 5 minutes!

People also ask

-

What is the 2020 1040 schedule 2, and why do I need it?

The 2020 1040 schedule 2 is an essential form for reporting additional taxes owed, such as the alternative minimum tax and excess advance premium tax credit. Understanding this schedule can help taxpayers accurately complete their tax returns and avoid potential penalties.

-

How does airSlate SignNow simplify the process of filing the 2020 1040 schedule 2?

airSlate SignNow streamlines the document workflow by allowing users to eSign and send tax forms, including the 2020 1040 schedule 2. Our user-friendly platform ensures that all necessary signatures are collected, making tax filing more efficient.

-

Is airSlate SignNow cost-effective for handling the 2020 1040 schedule 2?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents like the 2020 1040 schedule 2. Our competitive pricing plans ensure businesses can handle their tax filing needs without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software when filing the 2020 1040 schedule 2?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, which enhances the process of filing forms like the 2020 1040 schedule 2. This integration ensures a smoother workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the 2020 1040 schedule 2?

airSlate SignNow provides features such as customizable templates, document sharing, and automated reminders, all tailored to assist in managing the 2020 1040 schedule 2 effectively. These features make the eSigning and submissions process straightforward.

-

How secure is my information when using airSlate SignNow for the 2020 1040 schedule 2?

Security is a top priority at airSlate SignNow. We employ advanced encryption and comply with industry standards to protect your sensitive tax information, including forms like the 2020 1040 schedule 2, throughout the signing and submission process.

-

Can I track the status of my 2020 1040 schedule 2 submission with airSlate SignNow?

Yes, airSlate SignNow allows users to monitor the status of their document submissions in real-time. This feature provides peace of mind, ensuring that your 2020 1040 schedule 2 is processed and signed promptly.

Get more for Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue

- Assignment of lease package new york form

- Lease purchase agreements package new york form

- Satisfaction cancellation or release of mortgage package new york form

- Premarital agreements package new york form

- Painting contractor package new york form

- Framing contractor package new york form

- Foundation contractor package new york form

- Plumbing contractor package new york form

Find out other Schedule 2 pdf SCHEDULE 2 Department Of The Treasury Internal Revenue

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form