Form 8815 Exclusion of Interest from Series EE AndForm 8815 Exclusion of Interest from Series EE AndEE BondsTreasuryDirect2020 F 2022

Understanding Form 8815 for Series EE Bonds

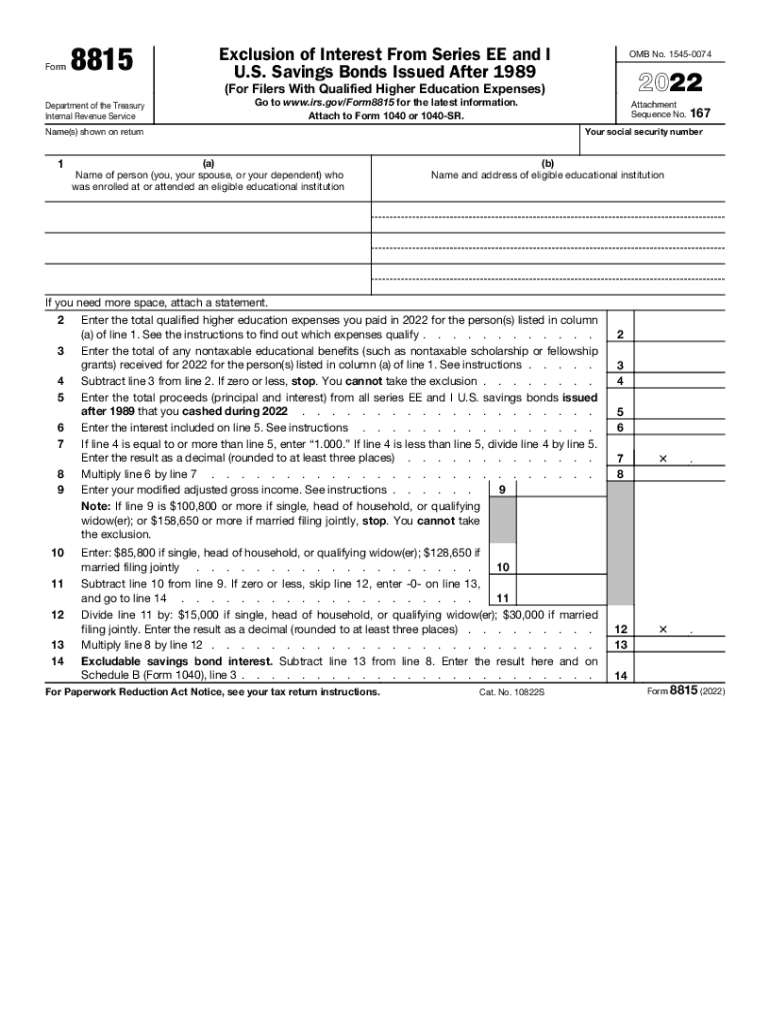

Form 8815, also known as the Exclusion of Interest From Series EE Bonds, allows eligible taxpayers to exclude interest from their taxable income when they redeem their Series EE bonds. This form is particularly relevant for individuals who use the proceeds from these bonds to pay for qualified education expenses. The exclusion can significantly reduce the tax burden for those who qualify, making it essential to understand the criteria and process involved.

Steps to Complete Form 8815

Completing Form 8815 involves several key steps to ensure accuracy and compliance with IRS guidelines. Begin by gathering necessary information, including your Social Security number, the amount of interest earned on your Series EE bonds, and details about your qualified education expenses. Next, fill out the form, ensuring that you accurately report the interest income and the qualifying expenses. Finally, review the completed form for any errors before submitting it with your tax return.

Eligibility Criteria for Form 8815

To qualify for the exclusion of interest on Series EE bonds using Form 8815, certain criteria must be met. The taxpayer must have a modified adjusted gross income below specific thresholds, which can vary based on filing status. Additionally, the bonds must have been issued after 1989, and the proceeds must be used for qualified education expenses, such as tuition and fees for higher education. Understanding these eligibility requirements is crucial for taxpayers seeking to benefit from this tax exclusion.

Legal Use of Form 8815

Form 8815 is legally recognized by the IRS as a valid means for taxpayers to claim the exclusion of interest from Series EE bonds. To ensure that the form is used correctly, it is important to adhere to IRS regulations regarding eligibility and documentation. Failure to comply with these regulations may result in penalties or the denial of the exclusion, making it essential to follow the guidelines closely when completing and submitting the form.

Filing Deadlines for Form 8815

Filing deadlines for Form 8815 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns, including Form 8815, by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about these deadlines to avoid late filing penalties and ensure that you can take advantage of the tax exclusion.

Form Submission Methods

Form 8815 can be submitted in various ways, depending on the taxpayer's preference. The form can be filed electronically using tax preparation software, which often includes built-in guidance for completing the form correctly. Alternatively, taxpayers may choose to print the form and submit it by mail along with their tax return. In-person submission is also an option at designated IRS offices, although this method is less common. Understanding these submission methods can help streamline the filing process.

Common Mistakes to Avoid with Form 8815

When completing Form 8815, taxpayers should be aware of common mistakes that can lead to issues with the IRS. These include incorrect reporting of interest income, failure to meet the eligibility criteria, and missing documentation for qualified education expenses. Additionally, not double-checking the form for accuracy before submission can result in errors that may delay processing or lead to penalties. Taking the time to review the form carefully can help ensure a smooth filing experience.

Quick guide on how to complete form 8815 exclusion of interest from series ee andform 8815 exclusion of interest from series ee andee bondstreasurydirect2020

Complete Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F effortlessly

- Obtain Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Forget about mislaid or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8815 exclusion of interest from series ee andform 8815 exclusion of interest from series ee andee bondstreasurydirect2020

Create this form in 5 minutes!

People also ask

-

What is a Series EE savings bond value chart?

A Series EE savings bond value chart is a resource that shows the current worth of Series EE savings bonds based on their issue date and maturity. This chart helps investors determine the cash value of their bonds, making it easier to track their investment growth over time. Accessing this chart is crucial for anyone holding these bonds to plan their financial future.

-

How can I find the current value of my Series EE savings bonds?

You can find the current value of your Series EE savings bonds by referring to the official Series EE savings bond value chart provided by the U.S. Department of the Treasury. This chart provides easy access to bond values based on their denomination and issue date. Regularly checking this chart ensures you stay informed about your bonds’ worth.

-

What factors affect the value of Series EE savings bonds?

The value of Series EE savings bonds is primarily influenced by the interest rate set at the time of purchase and its annual compounding feature. Additionally, the length of time the bond has been held contributes to its value, as bonds increase in worth over 30 years. You can reference the Series EE savings bond value chart to see how these factors play out for your bonds.

-

Are Series EE savings bonds a good investment option?

Yes, Series EE savings bonds can be a good investment option due to their government backing and guaranteed interest. They are designed to be a low-risk way to save for the long term. Checking the Series EE savings bond value chart can help you understand the growth of your investment and decide if it meets your financial goals.

-

How can I redeem my Series EE savings bonds?

You can redeem your Series EE savings bonds at most banks or credit unions, which will use the Series EE savings bond value chart to calculate their worth. It's essential to bring your identification and the physical bonds to facilitate the transaction. Following redemption, the funds are typically available immediately for use.

-

Do Series EE savings bonds earn interest after maturity?

Series EE savings bonds stop earning interest when they signNow maturity, which is typically 30 years from the issue date. This makes it crucial to regularly consult the Series EE savings bond value chart to determine when bonds have signNowed their maximum value. Redeeming them before or after maturity can influence your overall financial strategy.

-

Can I gift Series EE savings bonds to someone else?

Yes, you can gift Series EE savings bonds to others, making them a thoughtful and secure investment gift. When gifting, ensure the recipient understands how to access the Series EE savings bond value chart to stay informed about their bond's value. This is both a practical and meaningful gift option for family and friends.

Get more for Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F

- New york note 497321780 form

- Notice to chairman regarding possibility of processing case on administrative determination for workers compensation new york form

- Fee attorney form

- Notice of option for recording new york form

- Life documents planning package including will power of attorney and living will new york form

- New york legal ny form

- Essential legal life documents for newlyweds new york form

- New york legal ny 497321790 form

Find out other Form 8815 Exclusion Of Interest From Series EE AndForm 8815 Exclusion Of Interest From Series EE AndEE BondsTreasuryDirect2020 F

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template