INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 2021

What is the Indiana property tax benefits state form 51781?

The Indiana property tax benefits state form 51781 is a document used by Indiana residents to apply for property tax benefits. This form is essential for homeowners seeking to reduce their property tax burden through various exemptions and deductions offered by the state. By completing this form, eligible applicants can access benefits that may include homestead exemptions and other financial relief options related to property taxation.

How to use the Indiana property tax benefits state form 51781

Using the Indiana property tax benefits state form 51781 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including proof of residency and any relevant financial information. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate local tax authority. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Indiana property tax benefits state form 51781

Completing the Indiana property tax benefits state form 51781 requires attention to detail. Follow these steps for successful completion:

- Obtain the form from your local tax office or download it from the Indiana Department of Revenue website.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the property for which you are applying for tax benefits, including its location and assessed value.

- Indicate the specific tax benefits you are applying for, such as homestead exemptions.

- Attach any required documentation to support your application, such as proof of income or residency.

- Review the completed form for accuracy and sign it before submission.

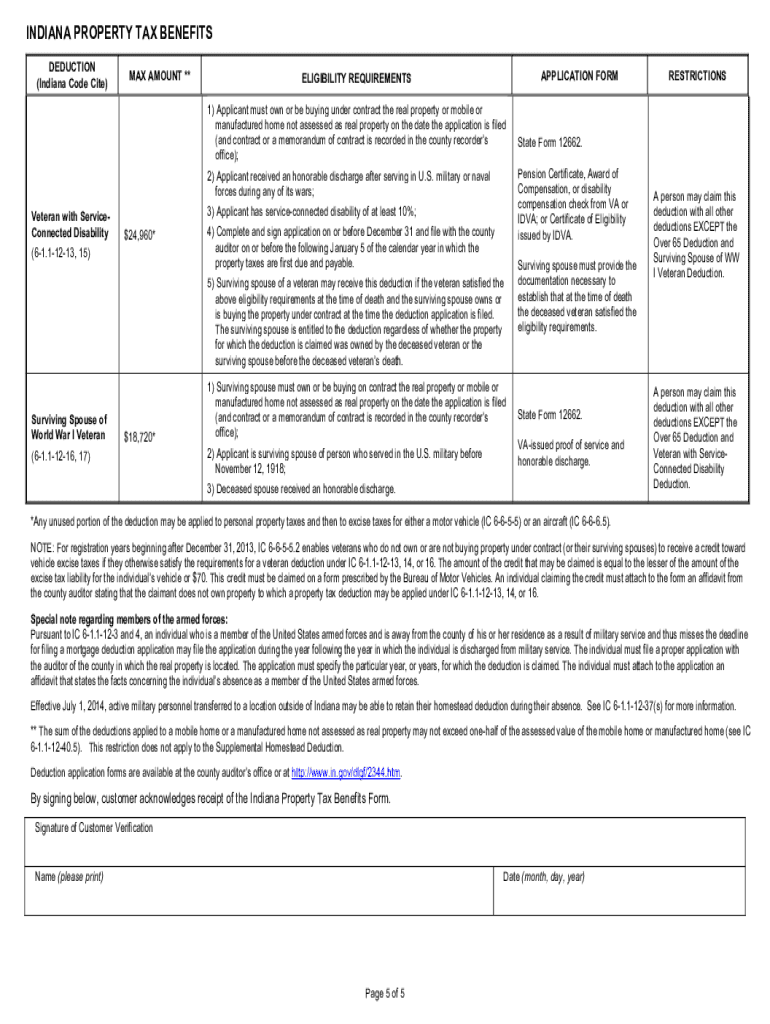

Eligibility criteria for the Indiana property tax benefits state form 51781

Eligibility for the Indiana property tax benefits state form 51781 varies based on specific criteria set by the state. Generally, applicants must be homeowners residing in the property for which they are seeking benefits. Additional factors may include income level, age, and disability status. It is essential to review the eligibility requirements outlined by the Indiana Department of Revenue to ensure that you qualify before submitting the form.

Form submission methods for the Indiana property tax benefits state form 51781

The Indiana property tax benefits state form 51781 can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form to the designated tax office address.

- In-person submission at your local tax office during business hours.

It is important to check with your local tax authority for specific submission guidelines and deadlines.

Key elements of the Indiana property tax benefits state form 51781

Key elements of the Indiana property tax benefits state form 51781 include essential information that must be provided for the application to be processed. These elements typically consist of:

- Applicant's personal information, such as name and address.

- Details about the property, including its location and assessed value.

- Specific tax benefits being requested, such as homestead exemptions.

- Supporting documentation that verifies eligibility, such as income statements or residency proof.

Accurate completion of these elements is crucial for a successful application.

Quick guide on how to complete indiana property tax benefits state form 51781 r1

Effortlessly Prepare INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal sustainable alternative to traditional printed and signed papers, allowing you to find the right template and securely keep it on the web. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Method to Alter and eSign INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 with Ease

- Obtain INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign INDIANA PROPERTY TAX BENEFITS State Form 51781 R1 to ensure excellent communication at every stage of the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana property tax benefits state form 51781 r1

Create this form in 5 minutes!

How to create an eSignature for the indiana property tax benefits state form 51781 r1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana state form 51781 used for?

The Indiana state form 51781 is a tax form used for specific financial reporting in the state of Indiana. It allows businesses to accurately report income and deductions to ensure compliance with state tax regulations. Understanding how to properly fill out this form is essential for any business operating in Indiana.

-

How can airSlate SignNow help with the Indiana state form 51781?

airSlate SignNow streamlines the process of signing and submitting the Indiana state form 51781 by allowing users to digitally sign and send documents securely. Our platform makes it easy to manage and track your forms, reducing the time spent on paperwork. With airSlate SignNow, you can ensure timely and compliant submission of your forms.

-

Is there a cost associated with using airSlate SignNow for the Indiana state form 51781?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to select the best option for managing forms like the Indiana state form 51781. Our plans provide excellent value by facilitating efficient document management and eSigning. You can check our website for specific pricing details and features included.

-

Are there any features in airSlate SignNow that specifically cater to the Indiana state form 51781?

Certainly! airSlate SignNow includes features such as customizable templates and automated workflows, specifically advantageous for processing the Indiana state form 51781. You can create templates for this form to ensure consistency and accuracy, thereby reducing errors in your submissions. This makes managing your tax documents more efficient.

-

Can I track the status of the Indiana state form 51781 once sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of the Indiana state form 51781 after it has been sent for eSignature. You'll receive notifications when the form is viewed, signed, and completed. This feature ensures you are always informed about the progress of your documents, providing peace of mind.

-

What integrations does airSlate SignNow offer that can assist with the Indiana state form 51781?

airSlate SignNow integrates seamlessly with various applications such as CRM systems, cloud storage, and productivity tools, which can assist with processing the Indiana state form 51781. These integrations simplify document management and help you keep all relevant information in one place. Connect your favorite tools to enhance your workflow.

-

Is there a mobile app for airSlate SignNow to handle the Indiana state form 51781?

Yes, airSlate SignNow offers a mobile app that enables you to handle the Indiana state form 51781 on the go. With the mobile app, you can sign, send, and manage documents from your smartphone or tablet, providing you with flexibility and convenience. This ensures that you can complete your tasks anytime, anywhere.

Get more for INDIANA PROPERTY TAX BENEFITS State Form 51781 R1

- Rutgers number in household and college worksheet form

- Bni orchard form

- Solutions intermediate progress test unit 6 answer key form

- Work completion form

- Es0005 group overtime agreement this form is to be used when a group of employees are to be working overtime hours and the

- Jenny eather writing form

- Trespass letter guilford county sheriffs office form

- Fire watch checklist form

Find out other INDIANA PROPERTY TAX BENEFITS State Form 51781 R1

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template