Indiana Property Tax Benefits This Form Must Be Printed 2024-2026

Understanding Indiana Property Tax Benefits

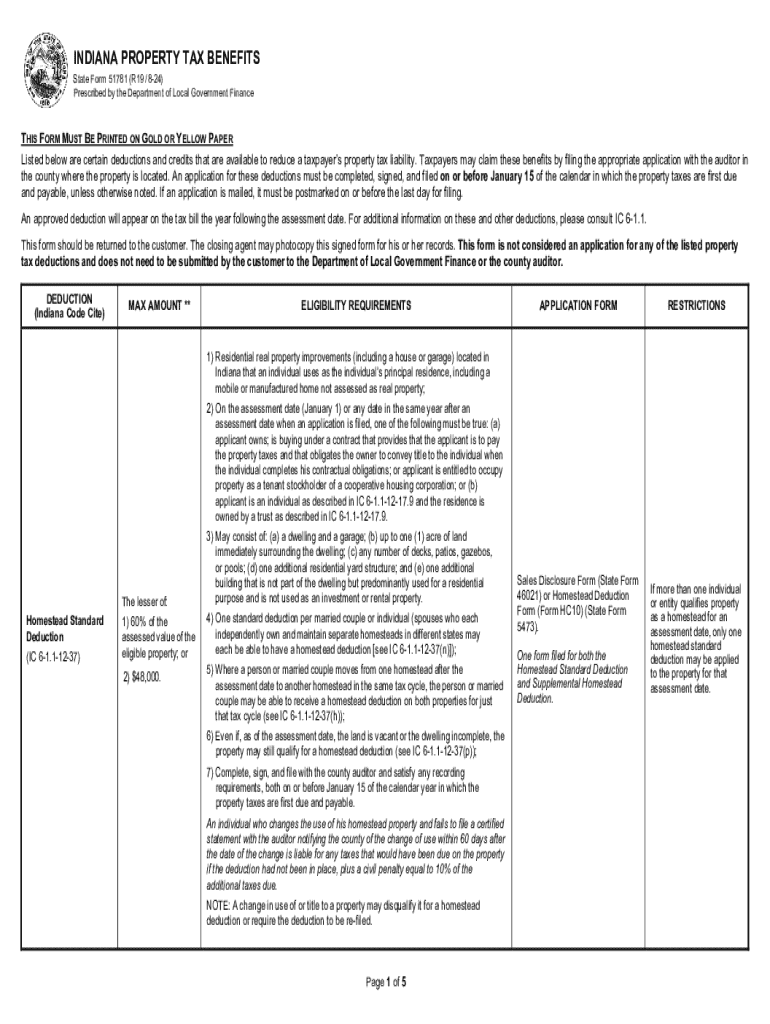

The Indiana Property Tax Benefits form is designed to assist homeowners in understanding the various tax benefits available to them. These benefits can include deductions for property taxes, exemptions for certain types of properties, and credits for low-income households. Familiarizing yourself with these benefits can lead to significant savings on your property tax obligations.

Steps to Complete the Indiana Property Tax Benefits Form

Completing the Indiana Property Tax Benefits form involves several key steps:

- Gather necessary documentation, including proof of income and property ownership.

- Carefully read the instructions provided with the form to understand eligibility criteria.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your completed form for any errors or omissions.

- Submit the form to your local county assessor's office by the specified deadline.

Eligibility Criteria for Indiana Property Tax Benefits

To qualify for Indiana property tax benefits, certain eligibility criteria must be met. Typically, these criteria include:

- Homeownership status: Applicants must own and occupy the property for which they are seeking benefits.

- Income limits: Some benefits may have income restrictions that determine eligibility.

- Property type: Specific types of properties, such as primary residences, may qualify for different benefits.

Required Documents for Indiana Property Tax Benefits

When applying for Indiana property tax benefits, you will need to provide several documents to support your application. Commonly required documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of property ownership, like a deed or mortgage statement.

- Any previous tax statements or notices regarding property taxes.

Form Submission Methods for Indiana Property Tax Benefits

There are various methods available for submitting the Indiana Property Tax Benefits form. These methods include:

- Online submission through the Indiana Department of Revenue's website, if available.

- Mailing the completed form to your local county assessor's office.

- In-person submission at your local county assessor's office during business hours.

Important Filing Deadlines for Indiana Property Tax Benefits

Being aware of filing deadlines is crucial to ensure that you do not miss out on potential tax benefits. The deadlines for submitting the Indiana Property Tax Benefits form typically include:

- March 1: Deadline for submitting applications for property tax deductions.

- Annual deadlines may vary, so it is essential to check with your local county office for specific dates.

Create this form in 5 minutes or less

Find and fill out the correct indiana property tax benefits this form must be printed

Create this form in 5 minutes!

How to create an eSignature for the indiana property tax benefits this form must be printed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax Indiana?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For those dealing with tax Indiana, it streamlines the process of signing tax documents, ensuring compliance and efficiency.

-

How can airSlate SignNow help with filing tax Indiana documents?

With airSlate SignNow, you can easily prepare, send, and sign tax Indiana documents online. This eliminates the need for physical paperwork, making it faster and more convenient to manage your tax filings.

-

What are the pricing options for airSlate SignNow for tax Indiana users?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling tax Indiana documents. These plans are designed to be cost-effective, ensuring you get the best value for your eSignature needs.

-

What features does airSlate SignNow offer for tax Indiana compliance?

airSlate SignNow includes features such as customizable templates, secure storage, and audit trails, which are essential for tax Indiana compliance. These tools help ensure that your documents are properly managed and legally binding.

-

Can I integrate airSlate SignNow with other software for tax Indiana management?

Yes, airSlate SignNow integrates seamlessly with various software applications that are commonly used for tax Indiana management. This allows for a more streamlined workflow and enhances productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with tax Indiana?

By using airSlate SignNow, businesses can save time and reduce errors when handling tax Indiana documents. The platform's user-friendly interface and automation features simplify the signing process, making it easier to stay organized.

-

Is airSlate SignNow secure for handling sensitive tax Indiana information?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive tax Indiana information. With encryption and secure access controls, you can trust that your documents are safe.

Get more for Indiana Property Tax Benefits This Form Must Be Printed

Find out other Indiana Property Tax Benefits This Form Must Be Printed

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF