Mortgage Interest Form 1098 Changes

What is the Mortgage Interest Form 1098 Changes

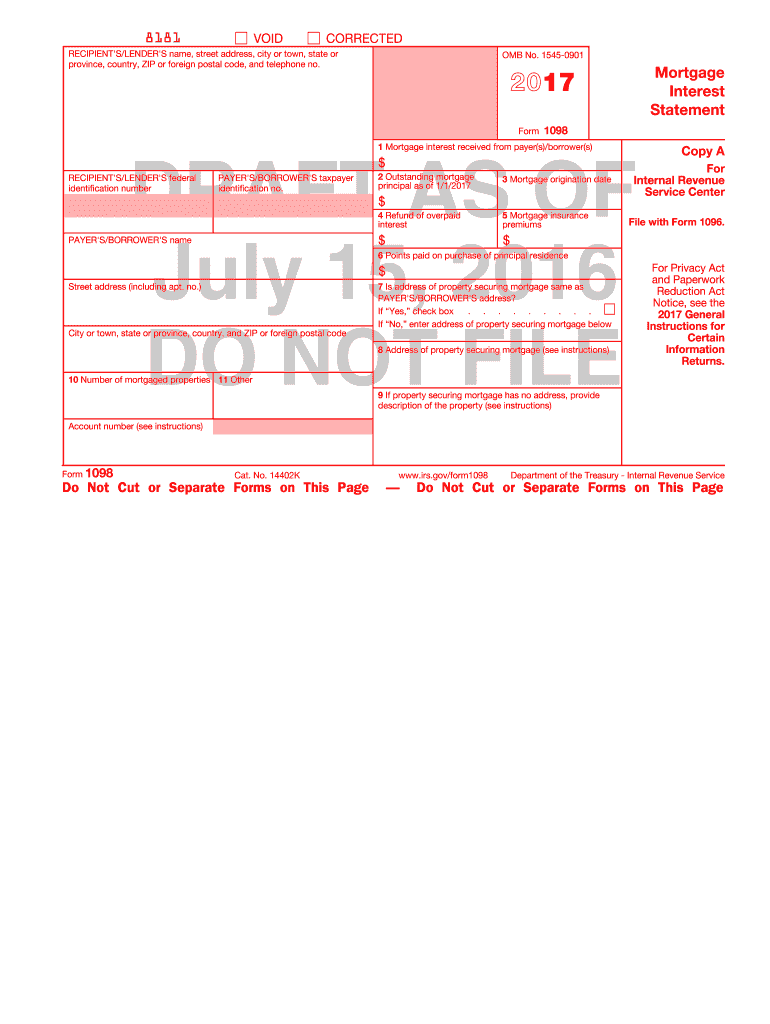

The Mortgage Interest Form 1098 is a tax document used in the United States to report the amount of mortgage interest paid by a borrower to a lender during the tax year. Changes to this form can affect how taxpayers report their mortgage interest deductions. Understanding these changes is crucial for accurate tax filing and ensuring compliance with IRS regulations. The form includes essential information such as the lender's details, the borrower's information, and the total interest paid, which is necessary for taxpayers to claim deductions on their federal income tax returns.

How to use the Mortgage Interest Form 1098 Changes

Using the Mortgage Interest Form 1098 involves several steps to ensure that the information is correctly reported. Taxpayers should first review the form for accuracy, checking that all details, such as the mortgage amount and interest paid, are correctly listed. Next, the information from the form should be transferred to the appropriate sections of the taxpayer's federal income tax return, typically on Schedule A for itemized deductions. It's important to keep a copy of the form for personal records and future reference in case of an audit.

Steps to complete the Mortgage Interest Form 1098 Changes

Completing the Mortgage Interest Form 1098 requires careful attention to detail. Start by gathering all necessary documents, including your mortgage statement and any previous year’s forms for reference. Follow these steps:

- Verify the lender's name and address.

- Confirm your name and address as the borrower.

- Check the total mortgage interest paid for the year.

- Ensure that any points paid on the mortgage are accurately reported.

- Review for any additional information required, such as mortgage insurance premiums.

Once all information is accurate, the form can be submitted to the IRS along with your tax return.

Legal use of the Mortgage Interest Form 1098 Changes

The legal use of the Mortgage Interest Form 1098 is governed by IRS regulations, which stipulate that the information reported must be accurate and truthful. Misreporting or failing to include this form can lead to penalties, including fines or audits. Taxpayers are encouraged to keep all supporting documentation related to the mortgage interest for at least three years after filing, as this may be required for verification purposes. Using digital tools for eSigning and submitting the form can further enhance compliance and security.

Filing Deadlines / Important Dates

Filing deadlines for the Mortgage Interest Form 1098 typically align with the general tax filing deadlines in the United States. Taxpayers must file their federal income tax returns by April 15 each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It's important to ensure that the form is submitted on time to avoid late fees or penalties. Additionally, lenders are required to send out the Mortgage Interest Form 1098 to borrowers by January 31 of the following year, allowing ample time for taxpayers to prepare their returns.

Who Issues the Form

The Mortgage Interest Form 1098 is issued by mortgage lenders or financial institutions that receive mortgage payments. This includes banks, credit unions, and other lending entities. It is the lender's responsibility to provide accurate information regarding the interest paid by the borrower during the tax year. Taxpayers should ensure they receive this form in a timely manner to facilitate their tax preparation. If a borrower does not receive the form, they should contact their lender for assistance.

Quick guide on how to complete mortgage interest form 1098 changes 2016

Complete Mortgage Interest Form 1098 Changes effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle Mortgage Interest Form 1098 Changes on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to adjust and eSign Mortgage Interest Form 1098 Changes with ease

- Find Mortgage Interest Form 1098 Changes and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Mortgage Interest Form 1098 Changes and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I change my address in the Aadhar card?

You can change the following details in Aadhar Card:NameGenderDate of BirthAddressE-mail IDTHINGS TO REMEMBER BEFORE APPLYING FOR AADHAR CARD DETAILS CHANGE:Your Registered Mobile Number is mandatory in the online process.You need to submit Documents for change of – Name, Date of Birth and Address. However, Change in Gender and E-mail ID do not require any document.You have to fill details in both – English and Regional/Local language (Eg. Hindi, Oriya, Bengali etc)Aadhar Card Details are not changed instantly. It is changed after Verification and Validation by the authoritySTEPS TO AADHAR CARD DETAILS CHANGE ONLINE:Click Here for going to the link.Enter your Aadhar Number.Fill Text VerificationClick on Send OTP. OTP is sent on your Registered mobile number.Also Read: Simple Steps to Conduct Aadhar Card Status Enquiry by NameYou will be asked to choose the Aadhar Card Details that you want to change.You can select multiple fields. Select the field and Submit.In next window fill the Correct Detail in both – English and Local language (if asked) and Submit.For Example – Here one has to fill the Email IdNOTE – If you are changing – Name, Date of Birth or Address, you have to upload the scanned documents. Click Here to know the Documents or Check them here.Verify the details that you have filled. If all the details look good then proceed or you can go back and edit once again.You may be asked for BPO Service Provider Selection. Select the provider belonging to your region.At last – You will be given an Update Request Number. Download or Print the document and keep it safe. It is required in checking the status of the complaint in future.So this step completes the process of Aadhar Card details change online.CHECK THE STATUS OF YOUR AADHAR CARD DETAILS CHANGE REQUESTStep 1 – Go the website by Clicking HereStep 2 – Fill the Aadhaar No. and URN – Update Request NumberStep 3 – Click on “Get Status”You are done. The new window on the screen will show the status of your request for change in Aadhar Card Details.

Create this form in 5 minutes!

How to create an eSignature for the mortgage interest form 1098 changes 2016

How to create an electronic signature for the Mortgage Interest Form 1098 Changes 2016 in the online mode

How to make an electronic signature for the Mortgage Interest Form 1098 Changes 2016 in Chrome

How to generate an electronic signature for putting it on the Mortgage Interest Form 1098 Changes 2016 in Gmail

How to make an electronic signature for the Mortgage Interest Form 1098 Changes 2016 from your smart phone

How to make an eSignature for the Mortgage Interest Form 1098 Changes 2016 on iOS devices

How to generate an eSignature for the Mortgage Interest Form 1098 Changes 2016 on Android

People also ask

-

What are the main Mortgage Interest Form 1098 changes for this year?

The Mortgage Interest Form 1098 changes for this year include adjustments in the reporting requirements and thresholds for interest deductions. These changes impact how lenders report mortgage interest paid, aiming for increased clarity and accuracy. Keeping up with these changes can ensure you maximize your tax benefits.

-

How can airSlate SignNow help with handling Mortgage Interest Form 1098 changes?

airSlate SignNow streamlines the process of collecting and eSigning documents related to Mortgage Interest Form 1098 changes. Our easy-to-use platform allows you to quickly send, sign, and store necessary documents securely. This efficiency ensures that you can adapt to any new tax requirements without the hassle.

-

Is there a cost associated with using airSlate SignNow for Mortgage Interest Form 1098 changes?

Yes, airSlate SignNow offers competitive pricing plans tailored to your needs, which may include features beneficial for managing Mortgage Interest Form 1098 changes. These plans provide various levels of access to tools that simplify document handling for your business. Explore our pricing options to find the best fit for your requirements.

-

What features does airSlate SignNow provide to assist with Mortgage Interest Form 1098 changes?

airSlate SignNow features a robust eSignature solution, document templates, and customizable workflows that facilitate the management of Mortgage Interest Form 1098 changes. These tools allow you to easily edit, send, and store documents securely online, ensuring you stay compliant with the latest regulations. The platform's user-friendly interface also enhances productivity for your business.

-

Are there any integrations available for airSlate SignNow concerning Mortgage Interest Form 1098 changes?

Absolutely! airSlate SignNow integrates with numerous business applications, making the handling of Mortgage Interest Form 1098 changes seamless. Popular integrations include CRM systems and accounting software, allowing you to automate document workflows and maintain accurate records without switching platforms. This ensures a smooth process and helps maximize efficiency.

-

How does using airSlate SignNow improve the accuracy of my Mortgage Interest Form 1098 submissions?

Using airSlate SignNow minimizes the potential for errors when preparing your Mortgage Interest Form 1098 submissions. Our platform offers document validation and tracking features that ensure all signed documents are complete and accurate. This level of scrutiny enhances your compliance and helps you avoid costly mistakes during tax season.

-

Can I access my signed Mortgage Interest Form 1098 documents at any time?

Yes, once you use airSlate SignNow to eSign your Mortgage Interest Form 1098 documents, you'll have access to them anytime, anywhere. Our cloud-based storage ensures that your signed documents are securely stored and easily retrievable. This flexibility allows you to manage your important tax documents at your convenience.

Get more for Mortgage Interest Form 1098 Changes

- 200 denver co 80290 form

- Sba form 413 what you need to fill out the sba personal financial

- Email serssrs form

- Article 78 proceeding new york state unified court system form

- Designation of agent for vrs matters form

- Arizona residency affidavit 460804491 form

- The judiciary new jersey legislature form

- Youth amp junior volleyball player medical release form

Find out other Mortgage Interest Form 1098 Changes

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors