Irs Form Schedule H 2018

What is the IRS Form Schedule H

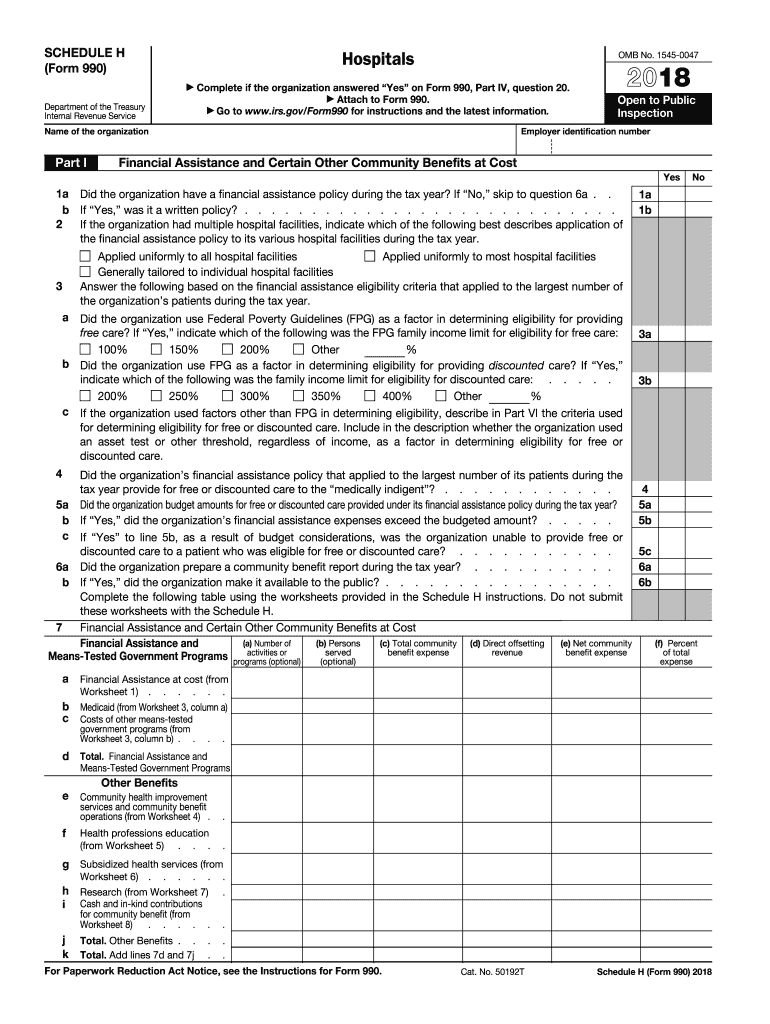

The IRS Form Schedule H is a tax form used by certain tax-exempt organizations to report their compliance with the requirements for maintaining tax-exempt status. This form is specifically designed for organizations that provide housing assistance and is part of the Form 990 series. It helps the IRS monitor how these organizations operate and ensures they adhere to the regulations governing tax-exempt entities.

How to use the IRS Form Schedule H

To effectively use the IRS Form Schedule H, organizations must first determine if they are required to file it based on their activities and revenue. Once eligibility is established, organizations can fill out the form by providing detailed information about their housing assistance programs, including the number of individuals served and the types of services provided. It is essential to ensure that all information is accurate and complete to avoid potential issues with the IRS.

Steps to complete the IRS Form Schedule H

Completing the IRS Form Schedule H involves several key steps:

- Gather necessary documentation, including financial records and details about housing assistance programs.

- Access the form through the IRS website or tax preparation software.

- Fill out the required sections, ensuring all fields are completed accurately.

- Review the form for completeness and accuracy before submission.

- Submit the form along with the main Form 990 by the designated filing deadline.

Legal use of the IRS Form Schedule H

The legal use of the IRS Form Schedule H is crucial for maintaining tax-exempt status. Organizations must file this form accurately to demonstrate compliance with IRS regulations. Failure to file or inaccuracies in reporting can lead to penalties, including the potential loss of tax-exempt status. It is important for organizations to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Schedule H align with the deadlines for Form 990. Typically, organizations must file their returns by the 15th day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is essential to file the form on time to avoid penalties.

Required Documents

When preparing to file the IRS Form Schedule H, organizations should gather several key documents, including:

- Financial statements detailing income and expenses related to housing assistance.

- Records of individuals served and the types of assistance provided.

- Previous years' Form 990 filings, if applicable.

- Any additional documentation required by the IRS to support claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form Schedule H can be submitted through various methods. Organizations may choose to file electronically using IRS-approved software, which is often the fastest and most efficient method. Alternatively, forms can be mailed to the appropriate IRS address, depending on the organization's location and filing status. In-person submissions are generally not available for this form, making electronic or mail submissions the primary options.

Quick guide on how to complete 2017 irs h form 2018

Discover the easiest method to complete and endorse your Irs Form Schedule H

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to finish and sign your Irs Form Schedule H as well as other forms for public services. Our advanced electronic signature solution provides all the tools you need to handle documents swiftly while meeting formal standards - comprehensive PDF editing, managing, securing, signing, and sharing features available within an intuitive interface.

Only a few steps are needed to complete and sign your Irs Form Schedule H:

- Upload the editable template to the editor using the Get Form option.

- Identify the information required for your Irs Form Schedule H.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout irrelevant fields.

- Select Sign to produce a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and finalize your work by clicking the Done button.

Store your completed Irs Form Schedule H in the Documents directory within your account, download it, or transfer it to your preferred cloud storage. Our solution also offers flexible file sharing. There’s no need to print your forms when you need to send them to the relevant public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 irs h form 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the 2017 irs h form 2018

How to create an eSignature for your 2017 Irs H Form 2018 online

How to generate an electronic signature for your 2017 Irs H Form 2018 in Chrome

How to generate an electronic signature for signing the 2017 Irs H Form 2018 in Gmail

How to generate an electronic signature for the 2017 Irs H Form 2018 straight from your smartphone

How to generate an eSignature for the 2017 Irs H Form 2018 on iOS devices

How to make an electronic signature for the 2017 Irs H Form 2018 on Android OS

People also ask

-

What is the purpose of IRS Form Schedule H?

IRS Form Schedule H is used by household employers to report wages paid and calculate employment taxes. It allows individuals to report their household employee's earnings and any associated tax liabilities, which is essential for compliance with federal tax regulations.

-

How can airSlate SignNow assist with IRS Form Schedule H?

airSlate SignNow streamlines the process of managing IRS Form Schedule H by allowing you to create, send, and eSign the required documents quickly. Our platform ensures that all necessary information is captured accurately, helping you stay compliant and organized.

-

Is there a cost associated with using airSlate SignNow for IRS Form Schedule H?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. Our cost-effective solution enables you to manage IRS Form Schedule H and other documents without breaking the bank, with options for businesses of all sizes.

-

What features does airSlate SignNow offer for managing IRS Form Schedule H?

airSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and seamless document tracking specifically designed for IRS Form Schedule H. These features enhance your document management process and ensure legal compliance.

-

Can I integrate airSlate SignNow with my existing accounting software for IRS Form Schedule H?

Absolutely! airSlate SignNow offers integrations with several popular accounting software solutions, facilitating efficient management of IRS Form Schedule H and other financial documents. This integration helps streamline your workflow and keeps everything organized.

-

How does airSlate SignNow ensure the security of IRS Form Schedule H documents?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your IRS Form Schedule H documents, ensuring that sensitive information remains confidential and compliant with regulations.

-

What benefits will I gain from using airSlate SignNow for IRS Form Schedule H?

Using airSlate SignNow to manage IRS Form Schedule H offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our user-friendly platform simplifies the entire process, allowing you to focus on your household business.

Get more for Irs Form Schedule H

Find out other Irs Form Schedule H

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile