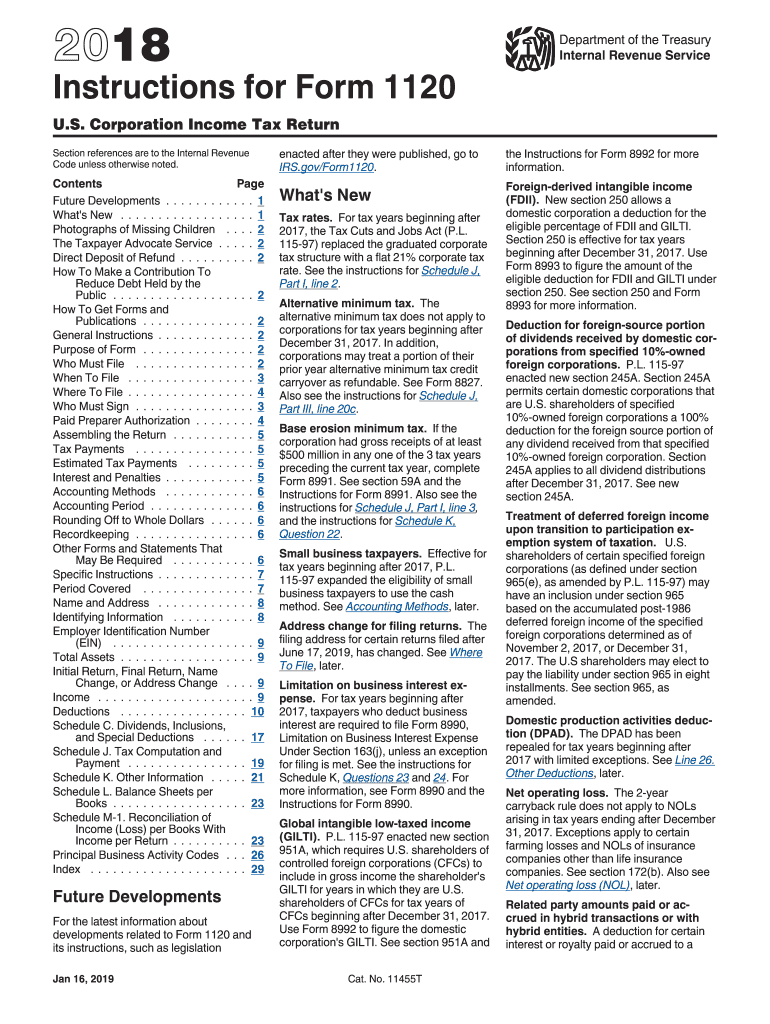

Form 1120 Instructions 2018

What is the Form 1120 Instructions

The Form 1120 instructions provide detailed guidance for corporations filing their annual income tax return in the United States. This form is essential for C corporations, which are taxed separately from their owners. The instructions outline the necessary steps to complete the form accurately, ensuring compliance with IRS regulations. Key areas covered include how to report income, deductions, credits, and other pertinent financial information. Understanding these instructions is crucial for businesses to avoid penalties and ensure proper tax reporting.

Steps to complete the Form 1120 Instructions

Completing the Form 1120 requires careful attention to detail. The following steps outline the process:

- Gather all necessary financial documents, including income statements and expense records.

- Review the Form 1120 instructions thoroughly to understand each section.

- Fill out the form, starting with basic information such as the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts and other income sources.

- Calculate allowable deductions for business expenses, such as salaries, rent, and utilities.

- Determine tax credits applicable to your corporation.

- Review the completed form for accuracy before submission.

Legal use of the Form 1120 Instructions

The legal use of Form 1120 instructions is paramount for ensuring compliance with federal tax laws. Corporations must adhere to the guidelines provided to avoid legal repercussions. This includes accurately reporting all income and expenses, as misrepresentation can lead to audits and penalties. Additionally, corporations must ensure that they file the form by the designated deadlines to maintain good standing with the IRS. Understanding the legal implications of the form helps businesses operate within the law and fosters trust with stakeholders.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also apply for an automatic six-month extension, but this does not extend the time to pay any taxes owed. Keeping track of these important dates is essential to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting Form 1120. The form can be filed electronically through the IRS e-file system, which is often the quickest method. Alternatively, businesses can mail a paper copy of the form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for Form 1120. It is important for corporations to choose a submission method that aligns with their needs, ensuring that they meet all filing requirements and deadlines.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 1120. These guidelines include instructions on the types of income that must be reported, allowable deductions, and how to calculate the corporate tax rate. Corporations must also be aware of any changes in tax laws that may affect their filing. It is advisable for businesses to regularly review the IRS website or consult tax professionals to stay informed about any updates or changes to the guidelines that could impact their tax obligations.

Quick guide on how to complete irs form 1120 instructions 2018 2019

Discover the most efficient method to complete and sign your Form 1120 Instructions

Are you still losing time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to accomplish and endorse your Form 1120 Instructions and similar forms for public services. Our intelligent eSignature service equips you with all the necessary tools to handle documents swiftly and in compliance with official regulations - robust PDF editing, management, protection, signing, and sharing functionalities, all available within a user-friendly interface.

Only a few steps are needed to fill out and sign your Form 1120 Instructions:

- Insert the editable template into the editor using the Get Form button.

- Review what information you need to enter in your Form 1120 Instructions.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is signNow or Obscure areas that are no longer relevant.

- Press Sign to generate a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Form 1120 Instructions in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our solution also enables convenient file sharing. There’s no need to print your forms when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 instructions 2018 2019

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 instructions 2018 2019

How to generate an eSignature for the Irs Form 1120 Instructions 2018 2019 online

How to make an eSignature for your Irs Form 1120 Instructions 2018 2019 in Google Chrome

How to generate an eSignature for putting it on the Irs Form 1120 Instructions 2018 2019 in Gmail

How to make an electronic signature for the Irs Form 1120 Instructions 2018 2019 right from your smartphone

How to generate an eSignature for the Irs Form 1120 Instructions 2018 2019 on iOS devices

How to generate an eSignature for the Irs Form 1120 Instructions 2018 2019 on Android

People also ask

-

What is form 1120 2013, and why is it important?

Form 1120 2013 is the U.S. Corporation Income Tax Return that corporations use to report their income, gains, losses, deductions, and credits. It is important for ensuring compliance with tax regulations and to accurately report financial information to the IRS. Properly filling out form 1120 2013 can prevent potential legal issues and penalties.

-

How can airSlate SignNow help with form 1120 2013?

airSlate SignNow simplifies the e-signature process for form 1120 2013, allowing you to securely send the document to stakeholders for their signatures. With its user-friendly interface, you can efficiently manage document workflows, ensuring that all necessary parties sign off quickly and securely. This helps streamline the tax filing process for corporations.

-

What features does airSlate SignNow offer for managing form 1120 2013?

AirSlate SignNow offers features such as customizable templates, secure e-signatures, and document tracking that can assist in managing form 1120 2013. Users can create templates that simplify the preparation of this form for future use, while document tracking ensures that all signatures are collected in a timely manner. These features enhance overall workflow efficiency.

-

Is airSlate SignNow a cost-effective solution for handling form 1120 2013?

Yes, airSlate SignNow provides a cost-effective solution for handling form 1120 2013 with its competitive pricing plans. By offering various subscription tiers, businesses can choose a plan that fits their budget and needs, ensuring that they pay only for the features they utilize. This makes it accessible for small and large businesses alike.

-

Can I integrate airSlate SignNow with my existing accounting software for form 1120 2013?

Yes, airSlate SignNow offers seamless integrations with a variety of accounting software, making it easy to manage form 1120 2013 alongside your other financial documents. This integration streamlines the process of preparing and filing taxes, allowing for better data consistency and management. It helps eliminate redundant data entry and minimizes errors.

-

How secure is airSlate SignNow when handling sensitive documents like form 1120 2013?

AirSlate SignNow prioritizes security and ensures that all documents, including form 1120 2013, are protected with advanced encryption and compliance with industry standards. With features such as multi-factor authentication and secure access controls, users can trust that their sensitive information is kept safe from unauthorized access. This is crucial when dealing with financial filings.

-

Can I use airSlate SignNow to send reminders for filing form 1120 2013?

Absolutely! AirSlate SignNow allows users to set reminders for important tasks, including the filing of form 1120 2013. This feature helps ensure that users do not miss deadlines, contributing to timely tax submissions. Automated reminders can enhance compliance and reduce the stress of managing important financial documents.

Get more for Form 1120 Instructions

- Worksheet sa ii 20122013 form

- Ach form 100106446

- Application for gold seal license d 1 form oregon gov oregon

- Tutoring student information form the homeschool connection llc thehomeschoolconnection

- Jet application form 296768243

- Enayusa form

- Reasonable suspicion testing checklist form

- Criminal history record check billing form

Find out other Form 1120 Instructions

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online