Form 1120 REIT U S Income Tax Return for Real Estate Investment Trusts 2018

What is the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

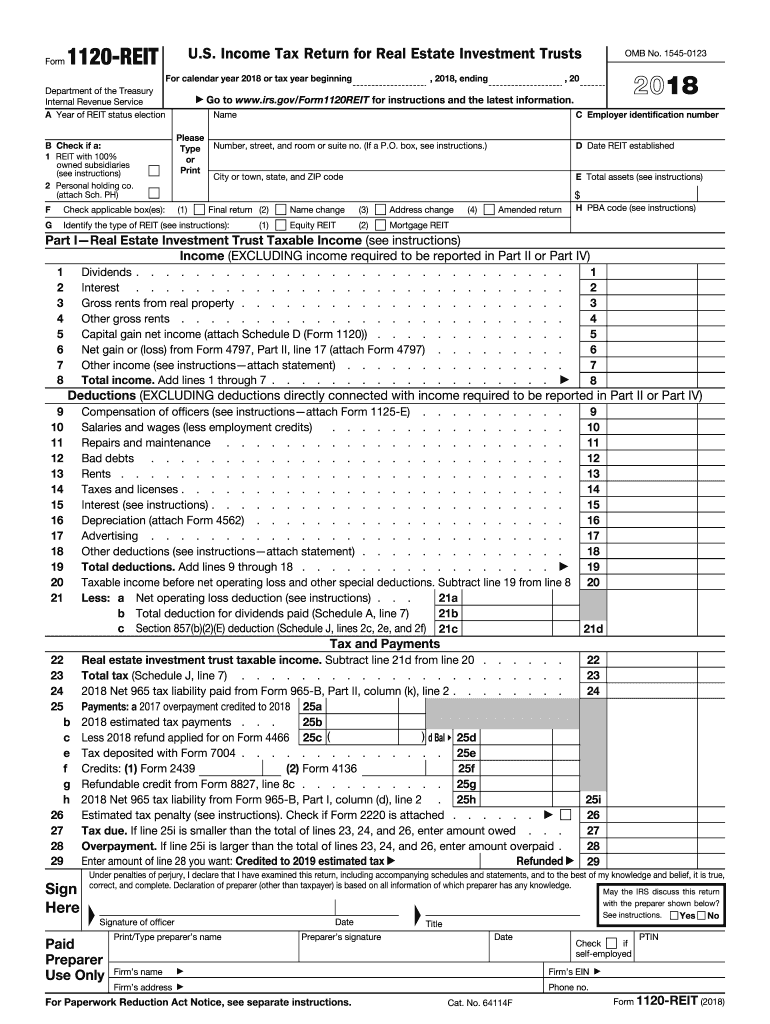

The Form 1120 REIT U S Income Tax Return for Real Estate Investment Trusts is a federal tax form used by Real Estate Investment Trusts (REITs) to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). This form is essential for REITs to maintain their tax-exempt status under the Internal Revenue Code. By filing this form, REITs provide detailed information about their financial performance and compliance with tax regulations.

Steps to complete the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

Completing the Form 1120 REIT involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by entering relevant income, deductions, and credits. Pay close attention to required fields and ensure all calculations are correct. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 REIT are crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the REIT's tax year. For REITs operating on a calendar year basis, this typically means a deadline of April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important for REITs to mark these dates on their calendars to avoid late filing penalties.

Required Documents

To successfully file the Form 1120 REIT, several documents are required. These include financial statements that detail the REIT's income and expenses, tax documents from previous years, and any supporting schedules that provide additional information about deductions and credits. Ensuring all necessary documentation is prepared in advance can streamline the filing process and reduce the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 REIT can be submitted through various methods. Most REITs opt for electronic filing, which is efficient and allows for quicker processing. Alternatively, the form can be mailed to the IRS, ensuring that it is sent to the correct address based on the REIT's location. In-person submission is generally not recommended, as electronic and mail options are more secure and provide confirmation of receipt.

Penalties for Non-Compliance

Failing to file the Form 1120 REIT on time or inaccurately can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, if a REIT does not meet the requirements for tax-exempt status, it may face further financial repercussions, including the loss of that status. It is essential for REITs to adhere to all filing requirements to avoid these penalties.

Quick guide on how to complete 2018 form 1120 reit us income tax return for real estate investment trusts

Uncover the most efficient method to complete and endorse your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

Are you still spending time preparing your formal documents on paper instead of online? airSlate SignNow offers a superior approach to complete and endorse your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts and similar forms for public services. Our intelligent electronic signature solution equips you with everything necessary to manage your paperwork swiftly and in compliance with official standards - comprehensive PDF editing, organizing, securing, endorsing, and sharing tools all available within a user-friendly interface.

Only a few simple steps are needed to complete and endorse your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to input in your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts.

- Move between the fields with the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the gaps with your particulars.

- Refresh the content using Text boxes or Images from the top toolbar.

- Emphasize what is important or Conceal fields that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finished Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers flexible file sharing options. There’s no need to print your forms when you have to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 1120 reit us income tax return for real estate investment trusts

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 1120 reit us income tax return for real estate investment trusts

How to create an electronic signature for the 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts in the online mode

How to generate an eSignature for your 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts in Google Chrome

How to create an electronic signature for signing the 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts in Gmail

How to create an eSignature for the 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts from your smart phone

How to generate an eSignature for the 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts on iOS

How to create an electronic signature for the 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts on Android OS

People also ask

-

What is the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

The Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts is a tax form used by Real Estate Investment Trusts (REITs) to report their income, deductions, and tax liability to the IRS. This form is essential for REITs to comply with U.S. tax laws and maintain their tax-exempt status.

-

How can airSlate SignNow help with the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

airSlate SignNow streamlines the process of preparing and submitting the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts by allowing users to easily create, send, and eSign documents. Our platform simplifies document management, ensuring that your tax return is filed accurately and on time.

-

Is airSlate SignNow cost-effective for filing the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Yes, airSlate SignNow offers a cost-effective solution for managing your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts. With flexible pricing plans, businesses can choose the option that best fits their needs, ensuring they have access to the tools they need without overspending.

-

What features does airSlate SignNow offer for managing Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are all beneficial for managing the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts. These features enhance efficiency and ensure compliance during the tax filing process.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts. This integration helps streamline your workflow and ensures that all financial data is accurately reflected in your tax return.

-

What are the benefits of using airSlate SignNow for the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts?

Using airSlate SignNow for your Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts offers numerous benefits, including improved efficiency, enhanced security, and easy collaboration among team members. Our platform allows for quick document preparation and eSigning, helping you meet tax deadlines with confidence.

-

Is it easy to eSign the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts with airSlate SignNow?

Yes, eSigning the Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts is straightforward with airSlate SignNow. Users can quickly add their signatures electronically, ensuring that the process is both efficient and legally binding.

Get more for Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

- Registration forms create form

- Aftercare indemnity form stellenbosch waldorf school

- Asap towing form

- Agric vijana form

- Oh stec mpu form

- Group insurance enrollment new employee reinstatement please mail original completed form to bbd western canada 5002755

- State of arkansas estimated tax declaration vouche form

- Student confidentiality agreement template form

Find out other Form 1120 REIT U S Income Tax Return For Real Estate Investment Trusts

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF