Va Sales Tax Form St 50

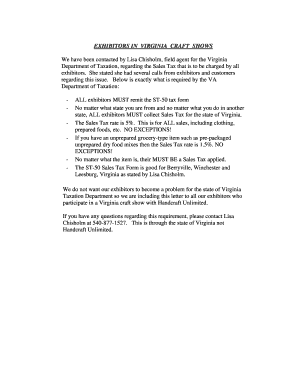

What is the Virginia Sales Tax Form ST-50?

The Virginia Sales Tax Form ST-50 is a document used by businesses in Virginia to report and remit sales tax collected from customers. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately calculate their tax obligations. The ST-50 is specifically designed for use by sellers who make taxable sales, leases, or rentals of tangible personal property or taxable services in Virginia.

How to Use the Virginia Sales Tax Form ST-50

Using the Virginia Sales Tax Form ST-50 involves several steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exemptions that may apply. Next, accurately fill out the form by entering the required information, such as the total sales amount and the sales tax collected. Finally, submit the completed form along with the payment for any taxes owed to the Virginia Department of Taxation by the specified deadline.

Steps to Complete the Virginia Sales Tax Form ST-50

Completing the Virginia Sales Tax Form ST-50 requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period.

- Determine the total sales amount and the taxable sales amount.

- Calculate the total sales tax collected based on the applicable rate.

- Fill in the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors before submission.

- Submit the form and payment to the Virginia Department of Taxation by the due date.

Legal Use of the Virginia Sales Tax Form ST-50

The Virginia Sales Tax Form ST-50 is legally recognized for reporting sales tax obligations in Virginia. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes accurate reporting of sales, timely submission of the form, and compliance with all relevant tax laws. Failure to comply can result in penalties or interest charges.

Key Elements of the Virginia Sales Tax Form ST-50

Several key elements must be included in the Virginia Sales Tax Form ST-50 for it to be considered complete:

- Business Information: This includes the business name, address, and identification number.

- Sales Data: Total sales, taxable sales, and any exempt sales must be reported.

- Sales Tax Calculation: The total sales tax collected must be calculated based on the sales data.

- Signature: The form must be signed by an authorized representative of the business.

Filing Deadlines for the Virginia Sales Tax Form ST-50

Filing deadlines for the Virginia Sales Tax Form ST-50 vary depending on the reporting period. Generally, businesses are required to file the form on a monthly or quarterly basis. Monthly filers must submit their forms by the 20th of the following month, while quarterly filers have a deadline of the 20th of the month following the end of the quarter. It is crucial for businesses to stay informed about their specific filing requirements to avoid penalties.

Quick guide on how to complete va sales tax form st 50

Prepare Va Sales Tax Form St 50 seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Va Sales Tax Form St 50 on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Va Sales Tax Form St 50 with ease

- Find Va Sales Tax Form St 50 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive data using tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Va Sales Tax Form St 50 and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va sales tax form st 50

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the va st 50 and how does it work with airSlate SignNow?

The va st 50 is a powerful feature included in airSlate SignNow that allows users to efficiently manage document workflows. By utilizing the va st 50, businesses can ensure that all necessary signatures are collected seamlessly and quickly. This feature simplifies the eSigning process, enhancing productivity and reducing turnaround time for document approvals.

-

How much does airSlate SignNow cost, and is the va st 50 included?

airSlate SignNow offers various pricing plans to cater to different business needs, and the va st 50 is included in all plans. Whether you are a small business or a large enterprise, our solutions are cost-effective and provide excellent value. You can choose the plan that best fits your requirements while benefiting from the features of the va st 50.

-

What are the key features of airSlate SignNow’s va st 50?

The va st 50 features include templates for fast document creation, personalized workflows, and advanced security measures for your documents. Additionally, it allows users to track the status of their documents in real-time. These capabilities make the va st 50 an essential tool for organizations aiming for efficiency in document management.

-

Can the va st 50 be integrated with other software applications?

Yes, the va st 50 can be seamlessly integrated with various software applications, making it a flexible solution for businesses. Integration with CRM systems, project management tools, and cloud storage services is straightforward, allowing you to connect your existing systems with airSlate SignNow easily. This integration capabilities enhance the effectiveness of the va st 50 in your daily operations.

-

What benefits does using the va st 50 provide for businesses?

Using the va st 50 offers numerous benefits, including improved efficiency, faster turnaround times, and enhanced document security. Businesses can streamline their eSigning processes, reduce paper usage, and ensure compliance with regulations. Overall, the va st 50 contributes to a more organized and effective business operation.

-

Is airSlate SignNow’s va st 50 secure for sensitive documents?

Absolutely, the va st 50 incorporates industry-leading security measures to protect sensitive documents. Features such as encryption, secure storage, and compliance with legal standards ensure that your documents are safe. This level of security instills trust and confidence when using airSlate SignNow for managing important paperwork.

-

How can I get started with the va st 50 on airSlate SignNow?

Getting started with the va st 50 on airSlate SignNow is simple. Just sign up for an account on our website, choose your preferred pricing plan, and explore the features of the va st 50. Our user-friendly interface and comprehensive support resources will guide you through the initial setup and ensure a smooth start.

Get more for Va Sales Tax Form St 50

- Month amp fy form

- Simplified acquisition tabulation source listabstract gsa form

- Writing gsa external directivesgsa form

- Washington passport agency bureau of consular affairs form

- Full text of quota directory of computer software applications form

- Eeo counselor credentials gsa form

- Annual man hour form

- Student and parent handbook willie j form

Find out other Va Sales Tax Form St 50

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free