Form 3 Partnership Return 2013

What is the Form 3 Partnership Return

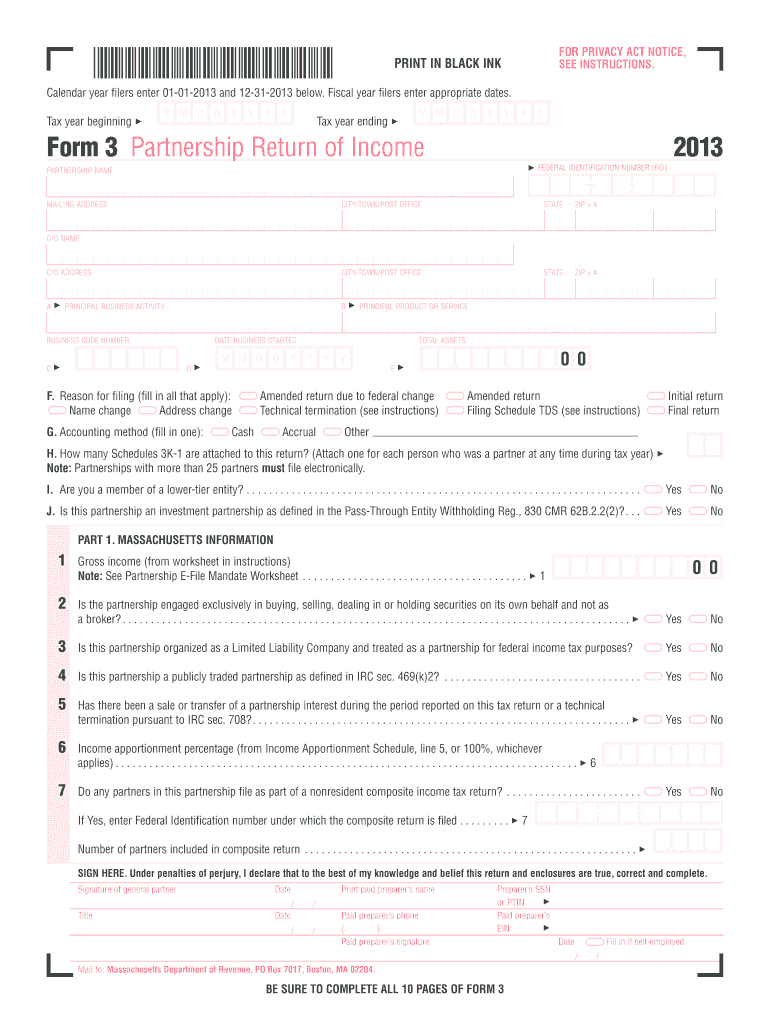

The Form 3 Partnership Return is a tax document used by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). This form is essential for partnerships operating in the United States, as it provides a comprehensive overview of the partnership's financial activities for the tax year. Unlike individual tax returns, the Form 3 does not calculate tax liability directly; instead, it informs the IRS of the partnership's income and allows for the allocation of that income to individual partners for their personal tax filings.

Steps to complete the Form 3 Partnership Return

Completing the Form 3 Partnership Return involves several key steps to ensure accuracy and compliance with IRS regulations. Start by gathering all necessary financial records, including income statements, expense reports, and any relevant documentation that supports your claims. Next, fill out the form with precise information about your partnership’s income and deductions. It is crucial to ensure that all entries are accurate and reflect the partnership's financial situation. After completing the form, review it thoroughly for any errors or omissions before signing and submitting it. Finally, keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Legal use of the Form 3 Partnership Return

The Form 3 Partnership Return must be completed in accordance with IRS guidelines to ensure its legal validity. This means adhering to specific instructions regarding the information required, the format of the entries, and the deadlines for submission. Partnerships are legally obligated to file this form annually, and failure to do so can result in penalties. Additionally, partnerships must ensure that all partners are informed about their respective shares of income and deductions, as these figures will impact their individual tax returns.

Filing Deadlines / Important Dates

Timely filing of the Form 3 Partnership Return is critical to avoid penalties. The IRS typically requires that partnerships file their returns by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships may file for an extension, which can grant up to six additional months to submit the return. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Partnerships have several options for submitting the Form 3 Partnership Return. The form can be filed electronically through IRS-approved e-filing systems, which offer a quick and efficient way to submit tax documents. Alternatively, partnerships may choose to mail a paper copy of the form to the appropriate IRS address. In-person submissions are generally not available for tax forms, but partnerships can consult with tax professionals for guidance on the best filing method. Regardless of the method chosen, it is essential to retain confirmation of submission for record-keeping purposes.

Required Documents

To complete the Form 3 Partnership Return accurately, partnerships must gather several key documents. These include financial statements detailing income and expenses, prior year tax returns, and any supporting documentation for deductions claimed. Additionally, partnerships should have records of distributions made to partners, as these figures need to be reported on the return. Having all necessary documents organized and accessible will streamline the process of completing the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 3 partnership return 2013

Your assistance manual on how to set up your Form 3 Partnership Return

If you’re curious about how to generate and send your Form 3 Partnership Return, here are a few brief guidelines on how to facilitate tax processing.

To begin, you merely need to create your airSlate SignNow account to revolutionize the way you manage documentation online. airSlate SignNow is an extremely user-friendly and effective document solution that allows you to modify, draft, and complete your income tax papers effortlessly. With its editor, you can alternate among text, checkboxes, and eSignatures and revert to adjust responses where necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to achieve your Form 3 Partnership Return in just a few moments:

- Set up your account and begin working on PDFs within minutes.

- Utilize our directory to access any IRS tax form; browse different versions and schedules.

- Click Get form to launch your Form 3 Partnership Return in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to incorporate your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Kindly be aware that submitting in paper form can increase errors in returns and slow down reimbursements. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 3 partnership return 2013

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

Can I fill out an income tax return for FY 2012-2013?

According to section 139 (1) of the Income Tax Act, 1961:Every person —

Create this form in 5 minutes!

How to create an eSignature for the form 3 partnership return 2013

How to make an eSignature for the Form 3 Partnership Return 2013 in the online mode

How to generate an eSignature for your Form 3 Partnership Return 2013 in Chrome

How to make an electronic signature for putting it on the Form 3 Partnership Return 2013 in Gmail

How to make an electronic signature for the Form 3 Partnership Return 2013 straight from your smartphone

How to create an eSignature for the Form 3 Partnership Return 2013 on iOS

How to create an electronic signature for the Form 3 Partnership Return 2013 on Android OS

People also ask

-

What is the Form 3 Partnership Return and why is it important?

The Form 3 Partnership Return is a tax document required for reporting the income, deductions, and credits of partnerships to the IRS. It is essential for ensuring compliance with tax regulations and helps in accurately calculating each partner's share of the partnership's income. Using airSlate SignNow can simplify the process of preparing and submitting your Form 3 Partnership Return.

-

How can airSlate SignNow assist with filing the Form 3 Partnership Return?

airSlate SignNow streamlines the process of preparing and electronically signing the Form 3 Partnership Return. Our platform offers templates and easy collaboration tools, allowing partners to review and sign documents quickly, ensuring timely submission to the IRS. This efficiency can signNowly reduce the stress involved in tax season.

-

Is airSlate SignNow cost-effective for small partnerships needing to file the Form 3 Partnership Return?

Yes, airSlate SignNow is designed to be a cost-effective solution for small partnerships managing their Form 3 Partnership Return. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features for document management and eSigning. This makes it an excellent choice for small teams.

-

What features does airSlate SignNow offer for managing the Form 3 Partnership Return?

airSlate SignNow provides a range of features specifically beneficial for managing the Form 3 Partnership Return, including customizable templates, automated workflows, and secure cloud storage. These tools help ensure that all partners can efficiently collaborate and keep track of document versions, reducing errors and enhancing accuracy.

-

Can I integrate airSlate SignNow with accounting software for the Form 3 Partnership Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools, making it easier to manage and file the Form 3 Partnership Return. This integration enables you to import data directly from your accounting system, minimizing manual entry and ensuring that your tax documents are accurate and up-to-date.

-

How secure is my data when using airSlate SignNow for the Form 3 Partnership Return?

Security is a top priority at airSlate SignNow. When using our platform for the Form 3 Partnership Return, your data is protected with industry-leading encryption methods and secure access controls. We ensure that your sensitive information remains confidential while you prepare, sign, and submit your tax documents.

-

What are the benefits of using airSlate SignNow for the Form 3 Partnership Return compared to traditional methods?

Using airSlate SignNow for the Form 3 Partnership Return offers several advantages over traditional filing methods. It provides a faster, more efficient way to prepare and sign documents electronically, reducing paper use and storage needs. Additionally, the ability to track document status in real-time enhances collaboration and ensures timely filing.

Get more for Form 3 Partnership Return

Find out other Form 3 Partnership Return

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile