Ma Form M 8453 2018

What is the Ma Form M 8453

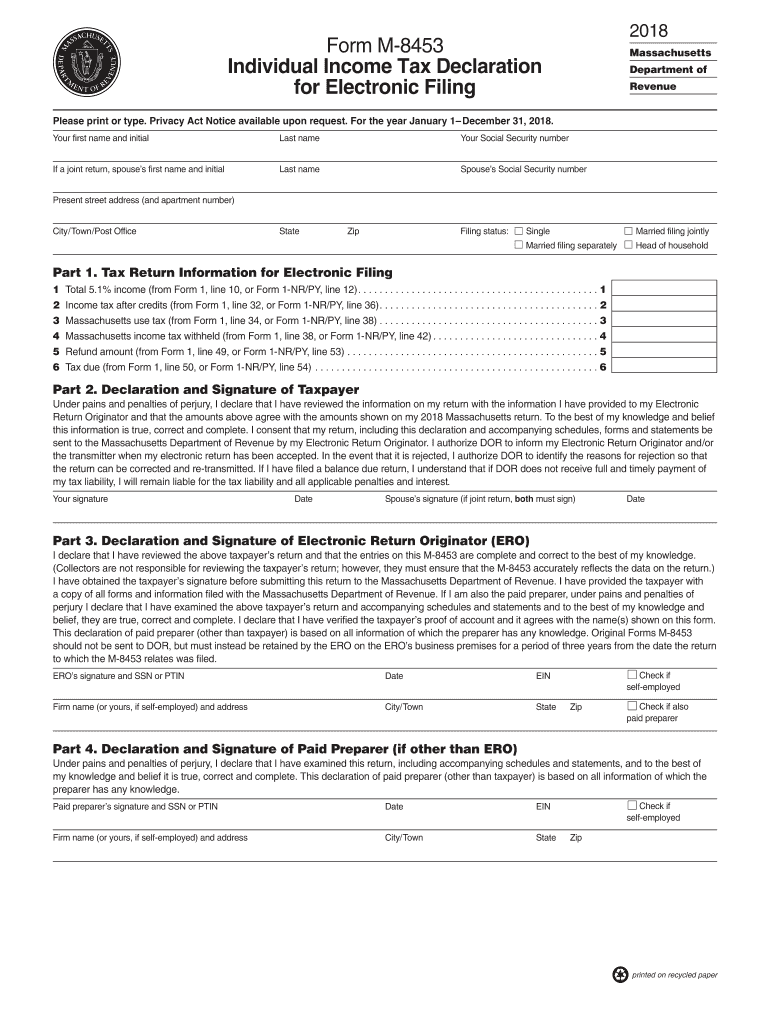

The Ma Form M 8453 is a tax declaration form used by residents of Massachusetts to electronically file their state income tax returns. This form serves as a declaration of the taxpayer's intent to file electronically and includes essential information that verifies the identity of the taxpayer. It is particularly relevant for those who are using e-filing software to submit their tax returns, as it helps to authenticate the submission process.

How to use the Ma Form M 8453

To use the Ma Form M 8453, taxpayers must first complete their state income tax return using approved e-filing software. Once the return is prepared, the taxpayer needs to print the Ma Form M 8453, sign it, and then submit it along with their electronic return. This form acts as an authorization for the e-filing software to submit the tax return on behalf of the taxpayer, ensuring that all information is accurately reported to the Massachusetts Department of Revenue.

Steps to complete the Ma Form M 8453

Completing the Ma Form M 8453 involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and filing status.

- Fill out the form with accurate details as prompted, ensuring all fields are completed.

- Review the information for accuracy to prevent any errors that could delay processing.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the form along with your electronically filed tax return.

Legal use of the Ma Form M 8453

The legal use of the Ma Form M 8453 is governed by the Massachusetts Department of Revenue regulations. This form must be signed by the taxpayer or an authorized representative to be considered valid. By signing the form, the taxpayer certifies that the information provided is true and correct, which is crucial for compliance with state tax laws. Failure to properly complete and submit this form can result in penalties or delays in processing the tax return.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when using the Ma Form M 8453. Generally, the filing deadline for state income tax returns in Massachusetts is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to ensure that the Ma Form M 8453 is submitted alongside the electronic return by this deadline to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ma Form M 8453 can be submitted electronically alongside the e-filed tax return. For those who prefer traditional methods, it can also be printed and mailed to the Massachusetts Department of Revenue. In-person submission is typically not required, as electronic filing is encouraged for efficiency and speed. Taxpayers should ensure that they follow the submission guidelines provided by the Massachusetts Department of Revenue to ensure compliance.

Quick guide on how to complete m 8453 tax form pdf 2018 2019

Your assistance manual on how to prepare your Ma Form M 8453

If you’re eager to discover how to generate and transmit your Ma Form M 8453, here are a few brief suggestions on making tax declaration signNowly simpler.

To start, all you need to do is sign up for your airSlate SignNow account to revamp your document handling online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Ma Form M 8453 in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Ma Form M 8453 in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may elevate return mistakes and prolong refunds. It goes without saying, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct m 8453 tax form pdf 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

Create this form in 5 minutes!

How to create an eSignature for the m 8453 tax form pdf 2018 2019

How to make an eSignature for the M 8453 Tax Form Pdf 2018 2019 in the online mode

How to create an eSignature for the M 8453 Tax Form Pdf 2018 2019 in Google Chrome

How to create an electronic signature for putting it on the M 8453 Tax Form Pdf 2018 2019 in Gmail

How to make an electronic signature for the M 8453 Tax Form Pdf 2018 2019 from your smart phone

How to create an eSignature for the M 8453 Tax Form Pdf 2018 2019 on iOS devices

How to make an electronic signature for the M 8453 Tax Form Pdf 2018 2019 on Android

People also ask

-

What is the m8453 form and its purpose?

The m8453 form is a critical document used in various industries to facilitate official processes and communications. It typically serves as a means for businesses and individuals to submit necessary information or requests in a standardized format. Understanding the m8453 form is essential for ensuring compliance and efficiency in document handling.

-

How can airSlate SignNow help with the m8453 form?

airSlate SignNow provides an efficient platform for sending and electronically signing the m8453 form, streamlining the entire process. With its intuitive interface, users can quickly complete the form and ensure it is securely delivered and stored. This simplifies the often cumbersome tasks associated with handling paperwork.

-

Is there a cost associated with using airSlate SignNow for the m8453 form?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs for processing the m8453 form. Whether you’re a small business or a large enterprise, there are options available to suit your budget. Access to essential features such as templates and real-time tracking makes it a valuable investment.

-

What features does airSlate SignNow offer for managing the m8453 form?

airSlate SignNow comes with a variety of features specifically designed to enhance the management of the m8453 form. These include templates for easy customization, robust eSignature capabilities, and the ability to track document status in real-time. These features save time and reduce the risk of errors, making the process more efficient.

-

Can I integrate airSlate SignNow with other applications for the m8453 form?

Yes, airSlate SignNow offers seamless integrations with numerous applications that can help streamline your workflow with the m8453 form. You can connect it with CRMs, cloud storage services, and other essential tools to create a more connected and efficient system. This versatility enhances the utility of the m8453 form in your business processes.

-

What are the benefits of using airSlate SignNow for the m8453 form?

Using airSlate SignNow for the m8453 form offers numerous benefits including improved efficiency and reduced turnaround time. The platform simplifies the signing process, allowing for quicker approvals and easier tracking of documents. Businesses can also ensure compliance and security when handling sensitive information through airSlate SignNow.

-

Is it easy to learn how to use airSlate SignNow for the m8453 form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to navigate even for those unfamiliar with electronic documentation. Comprehensive resources and support are available to ensure users can quickly learn how to efficiently handle the m8453 form and other documents. This minimizes the learning curve and enables teams to get up to speed fast.

Get more for Ma Form M 8453

- Health care hiv test form cdph 8458 t pdf cdph ca

- Comtax nic upvatereturn form

- Leeway global logistics is excited to add your company to our list of approved contract form

- Javascript lsi keyword form

- Paradise planning and zoning department paradise caparadise planning and zoning department paradise caparadise planning and form

- Weekly planning workbook live your legend form

- Management policy contract template form

- Management raci chart contract template form

Find out other Ma Form M 8453

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast