Vanguard Inherited Ira Application for Nonspouse Beneficiaries Form

What is the Vanguard Inherited IRA Application for Nonspouse Beneficiaries

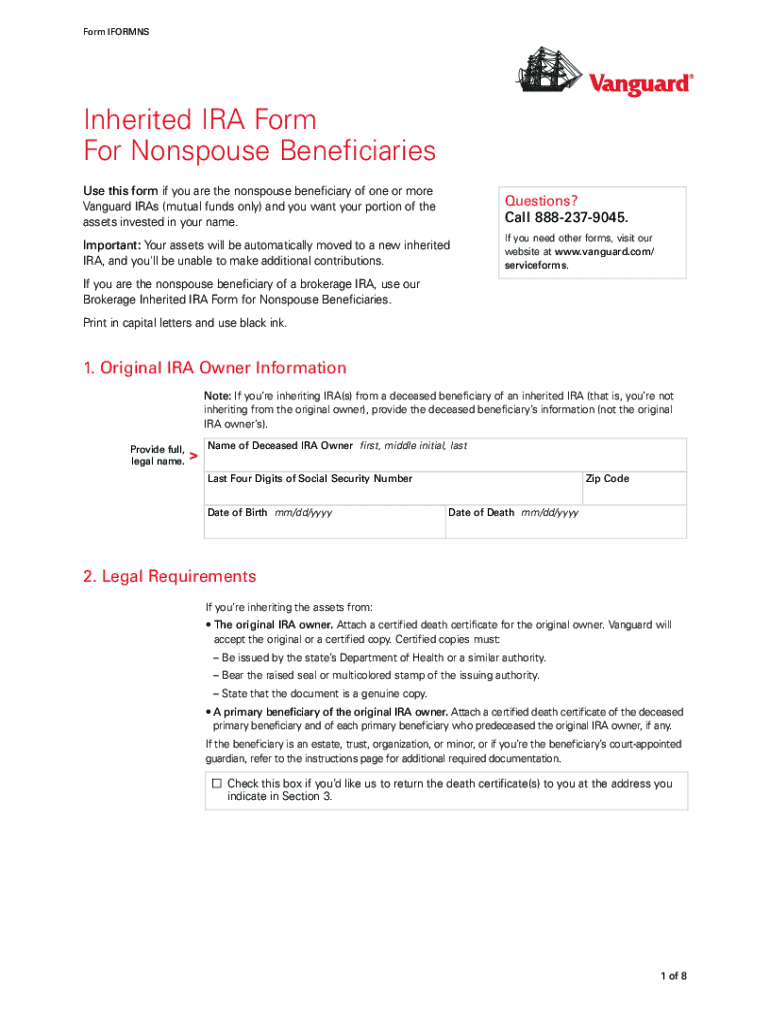

The Vanguard Inherited IRA application for nonspouse beneficiaries is a crucial document that allows individuals who inherit an IRA from someone other than their spouse to manage and transfer the inherited funds. This application is specifically designed to comply with IRS regulations, ensuring that the beneficiary can maintain tax-deferred growth on the inherited assets. Nonspouse beneficiaries must complete this application to establish their own inherited IRA account, which is distinct from the original account holder's IRA. This process is essential for proper tax treatment and to avoid penalties associated with early withdrawals.

Steps to Complete the Vanguard Inherited IRA Application for Nonspouse Beneficiaries

Completing the Vanguard Inherited IRA application involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary information about the deceased account holder, including their name, date of birth, and Social Security number.

- Collect your personal information, such as your name, address, and Social Security number.

- Determine the type of inherited IRA you wish to establish, whether it be a traditional or Roth inherited IRA.

- Fill out the Vanguard Inherited IRA application form with the required details, ensuring that all information is accurate and complete.

- Review the form for any errors and ensure that you have signed it where indicated.

- Submit the completed application to Vanguard through the designated submission method, which may include online submission or mailing the form.

Legal Use of the Vanguard Inherited IRA Application for Nonspouse Beneficiaries

The Vanguard Inherited IRA application for nonspouse beneficiaries is legally binding, provided it meets specific criteria set forth by the IRS and applicable state laws. To ensure its legal standing, the application must be completed accurately and submitted in a timely manner. Beneficiaries should be aware of the required distribution rules associated with inherited IRAs, as failure to comply can result in significant tax penalties. Utilizing a reliable platform, such as signNow, can enhance the security and legality of the document execution process.

Required Documents for the Vanguard Inherited IRA Application for Nonspouse Beneficiaries

When completing the Vanguard Inherited IRA application, several documents are typically required to verify the identity of the beneficiary and the status of the inherited account. These may include:

- A copy of the death certificate of the original account holder.

- Proof of identity for the beneficiary, such as a driver’s license or passport.

- Any legal documents that establish the beneficiary's right to inherit the IRA, such as a will or trust document.

Having these documents ready can streamline the application process and help avoid delays.

IRS Guidelines for Inherited IRAs

The IRS has established specific guidelines governing inherited IRAs, particularly for nonspouse beneficiaries. Key points include:

- Nonspouse beneficiaries must begin taking required minimum distributions (RMDs) based on their life expectancy or the ten-year rule, depending on when the account holder passed away.

- Inherited IRAs must be kept separate from the beneficiary's personal IRA accounts to maintain tax advantages.

- Failure to withdraw the required amounts can result in severe tax penalties, so understanding these guidelines is essential for compliance.

Eligibility Criteria for the Vanguard Inherited IRA Application for Nonspouse Beneficiaries

Eligibility to complete the Vanguard Inherited IRA application is primarily determined by the relationship to the deceased account holder. Nonspouse beneficiaries, such as children, siblings, or other relatives, are eligible to apply. Additionally, the beneficiary must be named in the decedent’s will or trust, or they must be designated as a beneficiary on the original IRA account. It is important for beneficiaries to confirm their eligibility before initiating the application process to ensure compliance with IRS regulations.

Quick guide on how to complete vanguard inherited ira application for nonspouse beneficiaries

Handle Vanguard Inherited Ira Application For Nonspouse Beneficiaries effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without any hold-ups. Manage Vanguard Inherited Ira Application For Nonspouse Beneficiaries on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Vanguard Inherited Ira Application For Nonspouse Beneficiaries with ease

- Locate Vanguard Inherited Ira Application For Nonspouse Beneficiaries and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Vanguard Inherited Ira Application For Nonspouse Beneficiaries and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vanguard inherited ira application for nonspouse beneficiaries

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Vanguard inherited IRA account?

A Vanguard inherited IRA account is a type of retirement account established for beneficiaries inheriting retirement funds from a deceased individual's IRA. This account allows for tax-deferred growth of the inherited assets and is crucial for managing the tax implications of an inheritance.

-

How do I open a Vanguard inherited IRA account?

To open a Vanguard inherited IRA account, you will need to provide necessary documentation, including the death certificate and the original account holder's information. Vanguard provides an easy online application process, guiding you through each step to ensure smooth setup of your inherited account.

-

What are the benefits of a Vanguard inherited IRA account?

One of the main benefits of a Vanguard inherited IRA account is the potential for continued tax-deferred growth of the assets. Additionally, it allows beneficiaries to stretch out distributions over their lifetimes, which can lead to increased overall returns on the inherited funds.

-

Are there any fees associated with a Vanguard inherited IRA account?

Vanguard typically offers low fees for its inherited IRA accounts, aligning with its commitment to cost-effective investment solutions. It’s important to review their fee schedule, as certain transactions may incur additional costs, but the overall management fees remain competitive.

-

Can I transfer other funds into my Vanguard inherited IRA account?

Generally, you cannot transfer other funds into your Vanguard inherited IRA account, as it is specifically designed for inherited assets. However, you can move the inherited funds from another brokerage to ensure they are managed within Vanguard's platform, optimizing your investment strategy.

-

What are the withdrawal rules for a Vanguard inherited IRA account?

Withdrawal rules for a Vanguard inherited IRA account depend on the beneficiary type, such as spouse or non-spouse. Typically, beneficiaries may be required to take distributions based on their life expectancy or, in some cases, withdraw the entire inherited amount within a set period, such as 10 years.

-

How does a Vanguard inherited IRA account differ from a traditional IRA?

A Vanguard inherited IRA account is specifically for beneficiaries of an inherited IRA, which comes with unique withdrawal regulations and tax implications. Conversely, a traditional IRA is owned by the individual and has different contribution and distribution rules, tailored to retirement funding.

Get more for Vanguard Inherited Ira Application For Nonspouse Beneficiaries

- Appendix a 1 model open end or finance vehicle lease disclosures federalreserve form

- Declaration of domicile for multi parish charter school application isl edu form

- How do i schedule an inspectiontown of herndon va form

- Peter harrison lawyer in signal mountain tn form

- Ive been paying taxes on upkept and justia ask a lawyer form

- Fillable online application to file commercial claims fax email form

- Application to file small claims for court use onl form

- Listing input security level application form

Find out other Vanguard Inherited Ira Application For Nonspouse Beneficiaries

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF