Schedule C Ez Form

What is the Schedule C EZ

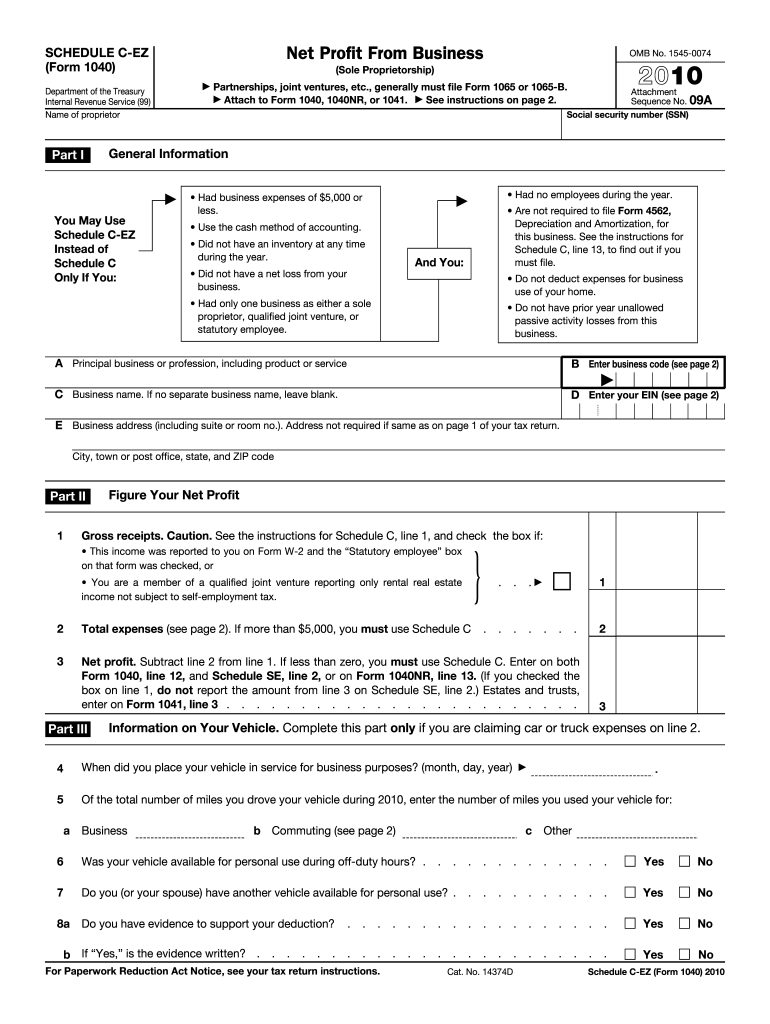

The Schedule C EZ is a simplified version of the Schedule C form used by sole proprietors to report income and expenses from their business. This form is designed for individuals with straightforward business operations, allowing them to file their taxes more easily. It is ideal for self-employed individuals who do not have inventory, do not claim depreciation, and have business expenses that do not exceed five thousand dollars. By using the Schedule C EZ, taxpayers can streamline their filing process while still meeting IRS requirements.

How to use the Schedule C EZ

Using the Schedule C EZ involves a few straightforward steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, ensuring that all income is reported and expenses are categorized correctly. The Schedule C EZ requires basic information such as your business name, type of business, and total income. After completing the form, review it for accuracy before submitting it with your tax return. This ensures that you comply with IRS regulations and avoid potential issues.

Steps to complete the Schedule C EZ

Completing the Schedule C EZ can be done in a few simple steps:

- Start by entering your name and Social Security number at the top of the form.

- Provide the name of your business and its address.

- Report your gross receipts or sales in the appropriate section.

- List your business expenses, ensuring that they do not exceed five thousand dollars.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Sign and date the form before submitting it with your tax return.

Legal use of the Schedule C EZ

The Schedule C EZ is legally valid when completed accurately and submitted in compliance with IRS guidelines. To ensure its legal standing, taxpayers must provide truthful information regarding their business income and expenses. Additionally, using a reliable eSignature solution can enhance the legitimacy of the document, as it provides a digital certificate that verifies the signer's identity. This is particularly important when filing electronically, as it helps to meet legal standards for electronic signatures.

Eligibility Criteria

To use the Schedule C EZ, certain eligibility criteria must be met. Taxpayers must be sole proprietors with no employees and must not have inventory. The total business expenses reported on the form should not exceed five thousand dollars, and the taxpayer should not claim any depreciation or business use of a vehicle. Furthermore, the taxpayer must be reporting income from a business that is not considered a hobby, ensuring that the income is generated with the intent of making a profit.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Schedule C EZ. It is essential to follow these instructions carefully to avoid errors that could lead to penalties or audits. The guidelines outline what qualifies as income and deductible expenses, as well as the necessary documentation to support claims. Taxpayers should also be aware of the deadlines for filing the Schedule C EZ, which align with the overall tax return deadlines to ensure timely submission.

Quick guide on how to complete schedule c ez

Prepare Schedule C Ez effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Schedule C Ez on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and eSign Schedule C Ez with ease

- Find Schedule C Ez and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule C Ez and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule C EZ and how can airSlate SignNow help with it?

Schedule C EZ is a simplified form used by sole proprietors to report income and expenses. airSlate SignNow streamlines the process by allowing you to easily send and eSign important documents related to your Schedule C EZ filing, ensuring that everything is signed, sealed, and sent quickly.

-

What features does airSlate SignNow offer for managing Schedule C EZ documents?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking, making it easier to manage your Schedule C EZ submissions. These tools simplify the workflow, allowing users to focus on completing their taxes instead of getting bogged down in paperwork.

-

Is airSlate SignNow affordable for freelancers and small business owners working with Schedule C EZ?

Yes, airSlate SignNow is a cost-effective solution designed with freelancers and small business owners in mind. With flexible pricing plans, you can choose an option that fits your budget while still gaining access to features that streamline the Schedule C EZ filing process.

-

Can I integrate airSlate SignNow with other platforms when preparing my Schedule C EZ?

Absolutely! airSlate SignNow offers integrations with a variety of third-party applications, including accounting and financial software. This means you can easily sync data related to your Schedule C EZ, making the overall process more efficient and coherent.

-

How secure is airSlate SignNow for handling sensitive Schedule C EZ information?

Security is a priority at airSlate SignNow. The platform utilizes industry-standard encryption and robust compliance protocols to ensure that all data, including sensitive information related to your Schedule C EZ, is protected and safe from unauthorized access.

-

Can I use airSlate SignNow on mobile devices when submitting my Schedule C EZ?

Yes, airSlate SignNow is fully accessible on mobile devices. Whether you're at home or on the go, you can eSign documents and manage your Schedule C EZ paperwork directly from your smartphone or tablet, making it convenient for busy entrepreneurs.

-

What are the benefits of using airSlate SignNow for Schedule C EZ?

By using airSlate SignNow for your Schedule C EZ, you can save time with automated workflows, ensure document accuracy with easy-to-use templates, and reduce stress with reliable eSigning. This efficiency allows you to focus on managing your business rather than dealing with cumbersome paperwork.

Get more for Schedule C Ez

- 2019 form or 20 oregon corporation excise tax return 150 102 020

- 2019 form 990 return of organization exempt from income tax

- Private foundation internal revenue service form

- 2019 form or tm tri county metropolitan transportation district trimet self employment tax 150 555 001

- Whitley county application for occupational license tax po box form

- 2019 form 763 virginia nonresident income tax return 2019 virginia nonresident income tax return

- Income tax credit forms current year taxnygov new york

- Httpinsurance illinois gov httpinsurance illinois govproducer form

Find out other Schedule C Ez

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure