Ny Form it 216

What is the NY Form IT-216

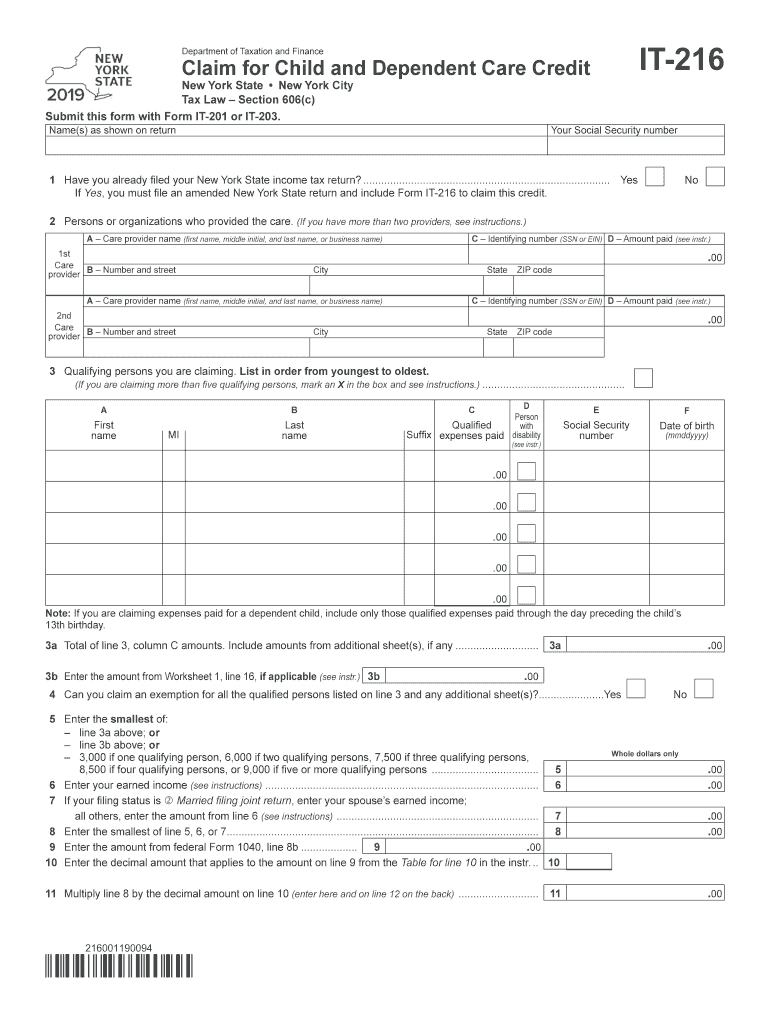

The NY Form IT-216, also known as the New York State Claim for Child and Dependent Care Credit, is a tax form used by residents of New York to claim a credit for expenses incurred for the care of qualifying children or dependents. This form allows taxpayers to reduce their state income tax liability based on the costs associated with child care while they work or look for work. The IT-216 is specifically designed for those who meet certain eligibility criteria, including income limits and qualifying expenses.

How to Use the NY Form IT-216

To effectively use the NY Form IT-216, you must first determine your eligibility based on the criteria set by the New York State Department of Taxation and Finance. Gather all necessary documentation, including proof of child care expenses and information about your dependents. Complete the form by entering your personal information, the details of your dependents, and the amount of child care expenses incurred. After filling out the form, it should be submitted along with your New York State income tax return.

Steps to Complete the NY Form IT-216

Completing the NY Form IT-216 involves several key steps:

- Gather necessary documents, such as receipts for child care expenses and Social Security numbers for your dependents.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about your qualifying dependents, including their names and ages.

- Calculate the total amount of child care expenses and enter this figure on the form.

- Review the completed form for accuracy before submitting it with your tax return.

Legal Use of the NY Form IT-216

The NY Form IT-216 is legally recognized as a valid method for claiming the child and dependent care credit in New York State. To ensure its legal use, taxpayers must comply with all relevant tax laws and regulations. This includes maintaining accurate records of expenses and ensuring that all information provided on the form is truthful and complete. Failure to comply with these requirements may result in penalties or denial of the credit.

Eligibility Criteria for the NY Form IT-216

To qualify for the NY Form IT-216, taxpayers must meet specific eligibility criteria. These include:

- Having a qualifying child or dependent under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- Incurring child care expenses that allow the taxpayer to work or look for work.

- Meeting income limits set by the New York State Department of Taxation and Finance.

Form Submission Methods

The NY Form IT-216 can be submitted through various methods. Taxpayers may choose to file the form electronically as part of their online tax return, or they can print and mail the completed form to the appropriate tax office. In-person submission is also an option at designated tax assistance centers. It is important to follow the specific submission guidelines provided by the New York State Department of Taxation and Finance to ensure timely processing.

Quick guide on how to complete income tax credit forms current year taxnygov new york

Complete Ny Form It 216 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily locate the correct document and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Ny Form It 216 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Ny Form It 216 with ease

- Locate Ny Form It 216 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ny Form It 216 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax credit forms current year taxnygov new york

How to make an eSignature for the Income Tax Credit Forms Current Year Taxnygov New York online

How to create an electronic signature for the Income Tax Credit Forms Current Year Taxnygov New York in Chrome

How to create an eSignature for putting it on the Income Tax Credit Forms Current Year Taxnygov New York in Gmail

How to make an electronic signature for the Income Tax Credit Forms Current Year Taxnygov New York straight from your mobile device

How to generate an electronic signature for the Income Tax Credit Forms Current Year Taxnygov New York on iOS

How to make an eSignature for the Income Tax Credit Forms Current Year Taxnygov New York on Android devices

People also ask

-

What is nyit216 in relation to airSlate SignNow?

Nyit216 refers to a specific feature or promotion within the airSlate SignNow ecosystem that enhances document management. This unique identifier helps users better understand how the platform can streamline eSigning and document workflows.

-

How does airSlate SignNow pricing work for users interested in nyit216?

The pricing for airSlate SignNow, including options available under nyit216, is designed to be competitive and affordable. Various plans cater to businesses of different sizes, ensuring that everyone can benefit from the platform's powerful eSigning capabilities.

-

What features does nyit216 offer within airSlate SignNow?

Nyit216 encompasses several valuable features, such as secure electronic signatures, customizable templates, and automated workflows. These tools empower users to enhance their document management processes efficiently.

-

What benefits does airSlate SignNow provide for those utilizing nyit216?

Using nyit216 with airSlate SignNow allows businesses to improve their turnaround time for document approvals. This leads to increased productivity, reduced paperwork, and a seamless experience for all parties involved in the eSigning process.

-

Can nyit216 integrate with other software solutions?

Absolutely, nyit216 is designed to integrate smoothly with popular software applications, enhancing overall productivity. This allows users to leverage airSlate SignNow’s eSigning capabilities within their existing workflows, making the transition seamless.

-

Is there a free trial available for exploring nyit216 on airSlate SignNow?

Yes, airSlate SignNow offers a free trial for users interested in exploring the features associated with nyit216. This is an excellent opportunity to experience the platform's capabilities before committing to a paid plan.

-

What types of documents can be signed with nyit216 on airSlate SignNow?

Nyit216 enables users to eSign a variety of document types, including contracts, agreements, and consent forms. The versatility of airSlate SignNow makes it suitable for industries like real estate, healthcare, and finance.

Get more for Ny Form It 216

Find out other Ny Form It 216

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation