Form 14 313

What is the Form 14 313

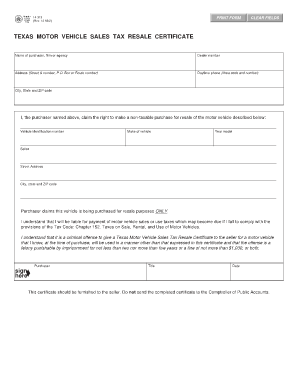

The Form 14 313, commonly known as the Texas resale certificate, is a legal document used in the state of Texas. It allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This form is crucial for retailers and wholesalers who need to maintain compliance with Texas tax regulations while managing their inventory effectively.

How to use the Form 14 313

Utilizing the Form 14 313 involves a straightforward process. First, the buyer must complete the form by providing their business information, including the name, address, and sales tax permit number. Next, the buyer should specify the type of goods being purchased for resale. Once filled out, the form is presented to the seller at the time of purchase. The seller keeps this document on file to validate the tax-exempt status of the transaction.

Steps to complete the Form 14 313

Completing the Form 14 313 requires attention to detail. Follow these steps for accurate completion:

- Provide your business name and address in the designated fields.

- Enter your Texas sales tax permit number, ensuring it is current and valid.

- Describe the items being purchased for resale, including any relevant details that clarify the nature of the goods.

- Sign and date the form to certify its accuracy and authenticity.

Legal use of the Form 14 313

The legal use of the Form 14 313 is governed by Texas state tax laws. This form must be used correctly to avoid penalties. It is essential that the buyer genuinely intends to resell the items purchased under this certificate. Misuse of the form, such as using it for personal purchases or non-resale items, can lead to legal repercussions, including fines or audits by the Texas Comptroller's office.

Key elements of the Form 14 313

Several key elements must be included in the Form 14 313 to ensure its validity:

- Business Information: Name and address of the purchaser.

- Sales Tax Permit Number: A valid Texas sales tax permit number is mandatory.

- Description of Goods: A clear description of the items intended for resale.

- Signature: The form must be signed by an authorized representative of the business.

Examples of using the Form 14 313

Examples of using the Form 14 313 include scenarios where a retailer purchases inventory from a wholesaler. For instance, a clothing store buying new apparel to sell in their shop would present the resale certificate to their supplier. This allows the retailer to avoid paying sales tax on the purchase, which they will later collect from customers when the items are sold. Another example is a restaurant purchasing kitchen supplies intended for food preparation, which will ultimately be sold to customers.

Quick guide on how to complete form 14 313

Accomplish Form 14 313 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Manage Form 14 313 on any device using airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and eSign Form 14 313 effortlessly

- Locate Form 14 313 and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 14 313 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14 313

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 14 313 and why is it important?

The form 14 313 is a standardized document used in various industries for specific administrative purposes. It's important because it ensures compliance with regulatory requirements and facilitates efficient data collection. Using airSlate SignNow, you can easily create, send, and eSign the form 14 313, streamlining your workflows.

-

How can airSlate SignNow help with the completion of form 14 313?

airSlate SignNow provides a user-friendly platform for completing the form 14 313 by allowing users to fill out the document electronically. With our eSigning capabilities, you can securely sign and send the form 14 313 in just a few clicks, improving efficiency and reducing paper waste.

-

What features does airSlate SignNow offer for managing form 14 313?

airSlate SignNow offers a variety of features for managing form 14 313, including customizable templates, automated workflows, and real-time tracking of submitted documents. These features enhance the overall user experience and ensure that you can handle the form 14 313 efficiently and accurately.

-

Is airSlate SignNow cost-effective for using form 14 313?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage documents like form 14 313. Our pricing plans are flexible, allowing you to choose a plan that fits your budget while providing all the necessary features for efficient document management.

-

Can I integrate airSlate SignNow with other tools for form 14 313?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and more. These integrations enhance your ability to manage form 14 313 with existing tools, streamlining processes across different platforms.

-

What are the benefits of using airSlate SignNow for form 14 313?

Using airSlate SignNow for form 14 313 offers several benefits, including increased efficiency, reduced turnaround time, and enhanced document security. The platform's ease of use enables even those unfamiliar with digital forms to navigate the process smoothly.

-

How secure is airSlate SignNow when handling the form 14 313?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your data when handling the form 14 313. With compliance to various industry standards, you can trust that your documents and eSignatures are safe and secure.

Get more for Form 14 313

Find out other Form 14 313

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later