Ct 706 Form

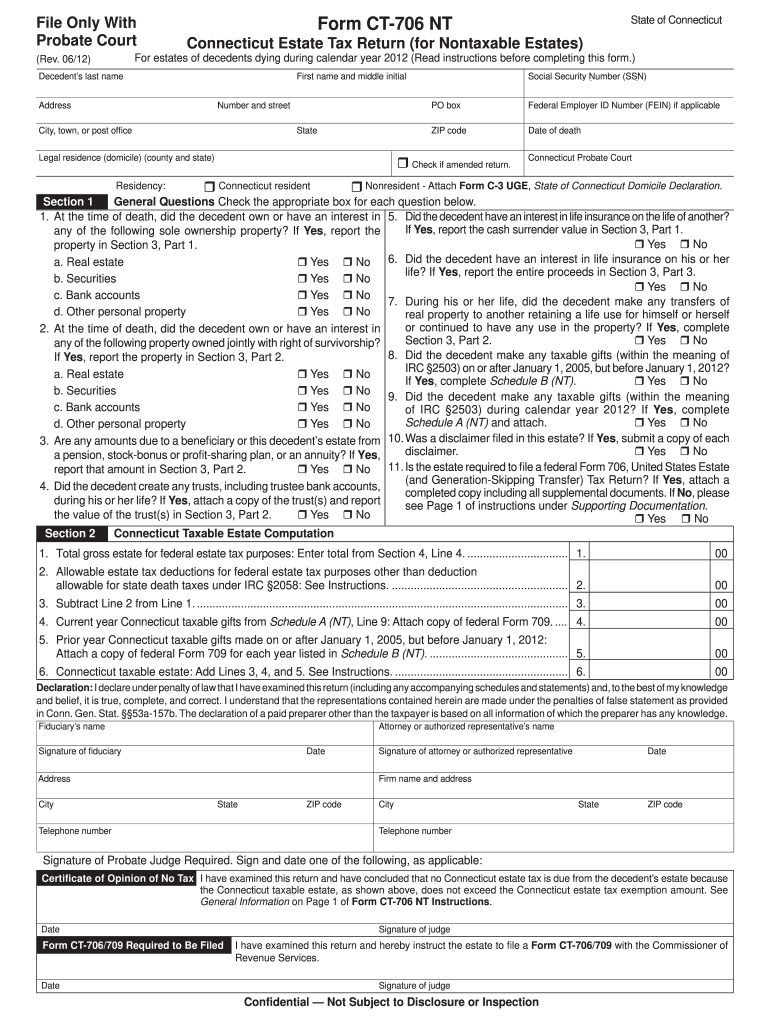

What is the Ct 706?

The Ct 706 is a continuation sheet used primarily in the context of estate tax returns in the United States. It is specifically designed to provide additional information that may not fit within the confines of the primary estate tax return form. This form is essential for ensuring that all necessary details about the estate are disclosed to the Internal Revenue Service (IRS). By completing the Ct 706, executors can clarify the valuation of assets, liabilities, and any deductions that may apply to the estate, allowing for accurate tax assessments.

Steps to complete the Ct 706

Completing the Ct 706 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant financial documents related to the estate, including property valuations, debts, and any previous tax returns. Next, fill out the form by providing detailed information about the estate's assets and liabilities. It's crucial to ensure that all values are supported by appropriate documentation. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the Ct 706 along with the primary estate tax return to the IRS by the designated filing deadline.

Legal use of the Ct 706

The Ct 706 holds legal significance as it serves as an official document submitted to the IRS. To be considered valid, it must be completed accurately and in accordance with IRS guidelines. The information provided on the Ct 706 can impact the estate's tax liability, making it essential for executors to ensure that all details are correct. Additionally, the form must be signed by the executor or authorized representative, affirming that the information is true and complete to the best of their knowledge. Failure to comply with these legal requirements can result in penalties or delays in the processing of the estate tax return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Ct 706 is crucial for compliance. Generally, the estate tax return, including the Ct 706, must be filed within nine months of the date of death of the decedent. However, an extension may be requested, allowing for an additional six months to file. It is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Executors should keep track of these dates to ensure timely submission and compliance with IRS regulations.

Required Documents

To complete the Ct 706 accurately, several documents are required. These include the decedent's will, prior tax returns, property appraisals, and documentation of debts and liabilities. Additionally, any relevant financial statements that detail the estate's assets should be gathered. Executors should ensure that they have all necessary paperwork organized and accessible to facilitate the completion of the Ct 706 and the primary estate tax return.

Examples of using the Ct 706

There are various scenarios where the Ct 706 may be utilized. For instance, if an estate includes multiple properties, the executor may need to provide detailed valuations for each property on the Ct 706. Another example is when an estate has significant debts; the executor would use the form to clarify these liabilities and their impact on the overall tax calculation. By providing thorough and accurate information on the Ct 706, executors can help ensure that the estate's tax obligations are met appropriately.

Quick guide on how to complete ct 706

Complete Ct 706 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Manage Ct 706 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Ct 706 with ease

- Obtain Ct 706 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ct 706 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 706

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 706 nt 2023, and how does it relate to airSlate SignNow?

The ct 706 nt 2023 is a crucial document for Connecticut taxpayers regarding their nonresident income tax returns. AirSlate SignNow simplifies the process of preparing and signing this document by providing an efficient electronic signature solution, making compliance easier for businesses.

-

How can airSlate SignNow help me manage the ct 706 nt 2023 document?

AirSlate SignNow offers features specifically designed for document management, including templates and automated workflows that streamline the completion of the ct 706 nt 2023. Users can easily fill out, sign, and send this important tax document directly within the platform.

-

Is airSlate SignNow cost-effective for handling the ct 706 nt 2023?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage the ct 706 nt 2023. With various pricing plans available, users can choose what fits their budget while benefiting from essential features that help in managing documents efficiently.

-

What features of airSlate SignNow are beneficial for completing the ct 706 nt 2023?

AirSlate SignNow offers several features beneficial for the ct 706 nt 2023, including template creation, easy electronic signatures, and document tracking. These features enhance the overall efficiency and convenience for users preparing their tax documents.

-

Can I integrate airSlate SignNow with other software for my ct 706 nt 2023 submissions?

Absolutely! AirSlate SignNow supports integration with several popular software tools, allowing you to streamline your workflow for submitting the ct 706 nt 2023. This connectivity ensures seamless operations between your document management system and tax software.

-

What are the benefits of using airSlate SignNow for the ct 706 nt 2023?

Using airSlate SignNow for the ct 706 nt 2023 offers numerous benefits, including enhanced security for your sensitive tax documents, reduced processing times, and improved collaboration among team members. This ensures that your tax submissions are handled promptly and securely.

-

How does airSlate SignNow ensure the security of my ct 706 nt 2023 data?

AirSlate SignNow prioritizes security with advanced encryption and access controls, ensuring that your ct 706 nt 2023 data is well-protected. Users can trust that any information shared or stored is kept confidential and secure throughout the signing process.

Get more for Ct 706

- Court visitor name form

- Final judgment of dissolution of marriage with property but no dependent or minor children uncontested this cause came before form

- Answering a complaint in probate ampamp family court masslegalhelp form

- Tenancy summons and return of service r 62 1 nj judiciary form

- Foreclosure by sale committee deed connecticut judicial branch jud ct form

- Fl 276 response to notice of motion to set aside judgment of paternity family law governmental judicial council forms courts ca

- Form mt 51519mortgage recording tax returnmt15

- Form it 205 t2019allocation of estimated tax payments to

Find out other Ct 706

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe