FORM WDIIR W O Graph REVISED 10 10 13 DOC 2013-2026

Understanding the WDIIR Form

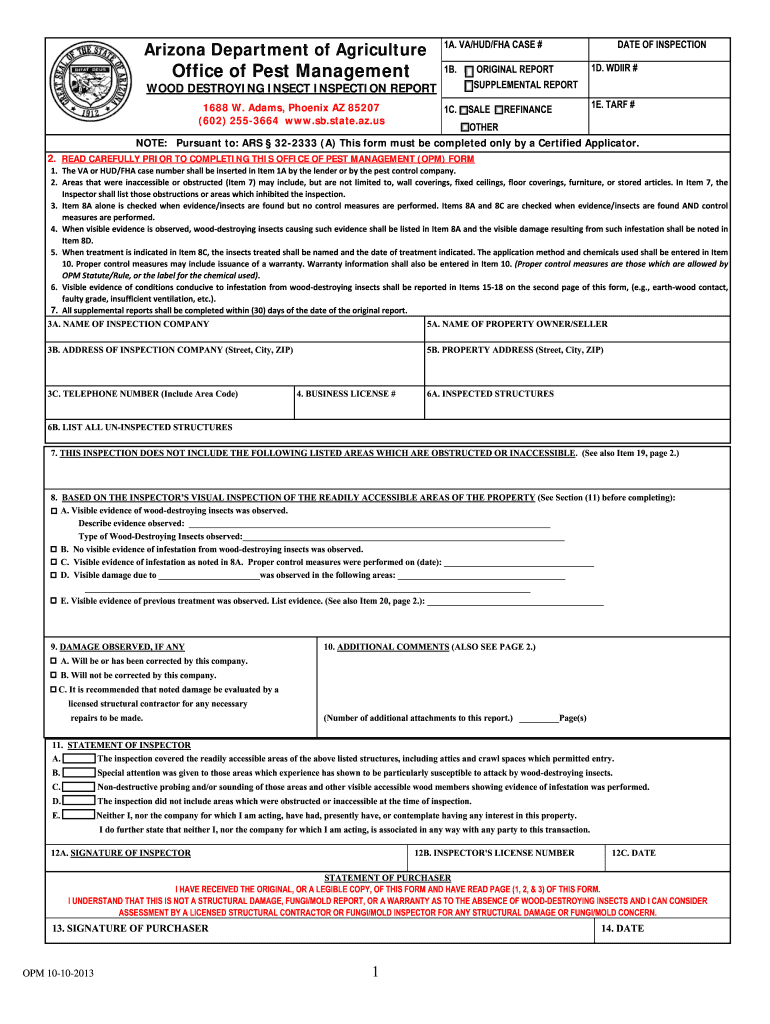

The WDIIR form, also known as the Wood Destroying Insect Inspection Report, is a crucial document used in Arizona for assessing properties for wood-destroying insects. This form is essential for real estate transactions and pest control inspections, ensuring that potential buyers are aware of any pest issues that could affect the integrity of the property. The form provides a detailed report on the presence of wood-destroying insects, such as termites, and outlines any necessary treatment recommendations.

Steps to Complete the WDIIR Form

Completing the WDIIR form involves several key steps to ensure accuracy and compliance. First, the inspector must conduct a thorough examination of the property, checking for signs of wood-destroying insects. After the inspection, the inspector fills out the form, detailing their findings, including the type of insects found, the extent of damage, and any recommended treatments. It is important to ensure that all sections of the form are completed accurately to avoid any legal issues or misunderstandings during property transactions.

Legal Use of the WDIIR Form

The WDIIR form is legally recognized in Arizona and is often required during real estate transactions. It serves as a formal declaration of the condition of the property concerning wood-destroying insects. Sellers are typically required to provide this report to potential buyers, ensuring transparency about any pest issues. Failure to disclose findings from the WDIIR form can lead to legal repercussions, making it essential for both buyers and sellers to understand its implications.

Key Elements of the WDIIR Form

Several key elements are included in the WDIIR form that are vital for a comprehensive inspection report. These elements typically consist of:

- Property Information: Address and details of the property being inspected.

- Inspector Details: Name and license number of the inspector performing the evaluation.

- Inspection Findings: Detailed notes on any signs of wood-destroying insects and the extent of damage.

- Recommendations: Suggested treatments or further actions needed to address any pest issues.

Obtaining the WDIIR Form

The WDIIR form can be obtained from various sources, including pest control companies, real estate agents, and online resources. It is advisable to use the most current version of the form to ensure compliance with state regulations. Many pest control companies provide this form as part of their inspection services, and it is essential to confirm that the inspector is licensed and qualified to conduct the inspection.

Examples of Using the WDIIR Form

The WDIIR form is commonly used in various scenarios, particularly in real estate transactions. For instance, a seller may need to provide a completed WDIIR form to a buyer to demonstrate that the property has been inspected for wood-destroying insects. Additionally, lenders may require this form as part of the mortgage approval process to ensure the property is free from pest-related issues that could affect its value. Understanding how to properly utilize the WDIIR form can facilitate smoother transactions and protect all parties involved.

Quick guide on how to complete form wdiir w o graph revised 10 10 13doc

Manage FORM WDIIR W O Graph REVISED 10 10 13 doc anywhere, anytime

Your routine business procedures may require extra attention when addressing state-specific forms. Reclaim your working hours and minimize the costs associated with document-oriented processes using airSlate SignNow. airSlate SignNow provides you with a wide array of pre-uploaded business forms, including FORM WDIIR W O Graph REVISED 10 10 13 doc, which you can utilize and share with your business associates. Manage your FORM WDIIR W O Graph REVISED 10 10 13 doc effortlessly with robust editing and eSignature features and send it directly to your recipients.

Steps to obtain FORM WDIIR W O Graph REVISED 10 10 13 doc in just a few clicks:

- Select a form pertinent to your state.

- Simply click Learn More to access the document and verify its accuracy.

- Click on Get Form to begin working with it.

- FORM WDIIR W O Graph REVISED 10 10 13 doc will automatically launch in the editor. No further steps are necessary.

- Utilize airSlate SignNow’s innovative editing tools to complete or modify the form.

- Locate the Sign tool to create your signature and eSign your document.

- Once ready, click Done, save changes, and access your document.

- Share the form via email or text, or use a link-to-fill option with partners or allow them to download the document.

airSlate SignNow greatly enhances your efficiency in managing FORM WDIIR W O Graph REVISED 10 10 13 doc and helps you find vital documents in one location. A comprehensive library of forms is organized and designed to encompass essential business operations required for your organization. The advanced editor minimizes the likelihood of errors, as you can swiftly correct mistakes and review your documents on any device before sending them out. Begin your free trial today to discover all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

Create this form in 5 minutes!

How to create an eSignature for the form wdiir w o graph revised 10 10 13doc

How to create an electronic signature for the Form Wdiir W O Graph Revised 10 10 13doc in the online mode

How to make an eSignature for your Form Wdiir W O Graph Revised 10 10 13doc in Chrome

How to make an eSignature for putting it on the Form Wdiir W O Graph Revised 10 10 13doc in Gmail

How to generate an electronic signature for the Form Wdiir W O Graph Revised 10 10 13doc right from your smart phone

How to generate an eSignature for the Form Wdiir W O Graph Revised 10 10 13doc on iOS devices

How to create an eSignature for the Form Wdiir W O Graph Revised 10 10 13doc on Android devices

People also ask

-

What is a WDIIR fillable PDF?

A WDIIR fillable PDF is a document format that allows users to input data directly into designated fields. With airSlate SignNow, you can easily create WDIIR fillable PDFs that streamline data collection for businesses, making it efficient to manage client information.

-

How can airSlate SignNow help with WDIIR fillable PDFs?

airSlate SignNow provides tools to create, edit, and manage WDIIR fillable PDFs effortlessly. You can customize your templates to fit your needs, enhancing user experience and ensuring that all necessary information is captured in a user-friendly format.

-

Is there a cost associated with using WDIIR fillable PDFs in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. The costs involve access to creating, sending, and eSigning WDIIR fillable PDFs, providing a cost-effective solution for businesses looking to streamline their document processes.

-

What features are available for WDIIR fillable PDFs within airSlate SignNow?

airSlate SignNow offers features such as customizable fields, automated workflows, and real-time tracking for WDIIR fillable PDFs. These features ensure that your documents are not only secure but also enhance collaboration and efficiency in your business operations.

-

Can I integrate WDIIR fillable PDFs with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports integration with popular applications like Google Drive, Salesforce, and more. This enables you to seamlessly manage your documents and WDIIR fillable PDFs alongside other tools you use, enhancing productivity.

-

What are the benefits of using WDIIR fillable PDFs for my business?

Utilizing WDIIR fillable PDFs can signNowly enhance your business operations by improving data accuracy and reducing manual entry errors. With airSlate SignNow, you can streamline your document processes, save time, and increase overall productivity.

-

How secure are WDIIR fillable PDFs created with airSlate SignNow?

Security is a priority at airSlate SignNow. All WDIIR fillable PDFs created are encrypted, ensuring that your sensitive information remains protected while complying with industry standards in data security for peace of mind.

Get more for FORM WDIIR W O Graph REVISED 10 10 13 doc

Find out other FORM WDIIR W O Graph REVISED 10 10 13 doc

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast