Form 8880

What is the Form 8880

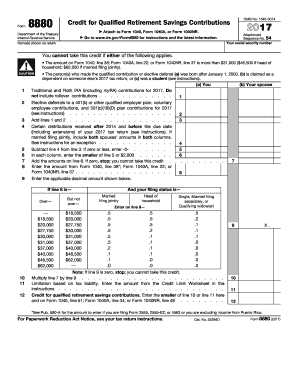

The 2017 Form 8880, also known as the IRS Form 8880 for 2017, is a tax form used by eligible taxpayers to claim a credit for qualified retirement savings contributions. This form is specifically designed for individuals who contribute to retirement accounts, such as IRAs or employer-sponsored plans, and who meet certain income criteria. The credit can help lower the overall tax burden, making it a valuable tool for those saving for retirement.

How to use the Form 8880

Using the 2017 Form 8880 involves several steps to ensure accurate completion and submission. Taxpayers need to gather all necessary documentation related to their retirement contributions, including statements from their financial institutions. Once the form is filled out, it should be submitted along with the federal income tax return. The credit calculated on the form will be applied to the taxpayer's overall tax liability, potentially resulting in a refund or reduced tax owed.

Steps to complete the Form 8880

To complete the Form 8880 for 2017, follow these steps:

- Gather all relevant documents, including contribution statements and income records.

- Fill out the personal information section accurately, including your filing status and adjusted gross income.

- Calculate your eligible contributions and determine the applicable credit percentage based on your income level.

- Complete the form by entering the calculated credit amount and any additional required details.

- Attach the completed Form 8880 to your federal income tax return before submitting it to the IRS.

Eligibility Criteria

To qualify for the credit claimed on the 2017 Form 8880, taxpayers must meet specific eligibility criteria. These include:

- Being at least eighteen years old by the end of the tax year.

- Not being a full-time student during the tax year.

- Not being claimed as a dependent on someone else's tax return.

- Meeting the income limits set for the tax year, which vary based on filing status.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 8880 for 2017. Taxpayers should refer to the official IRS instructions for detailed information on eligibility, filing procedures, and how to calculate the credit. It is crucial to follow these guidelines to ensure compliance and avoid potential issues with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 2017 Form 8880 can be submitted through various methods, depending on how you file your taxes. Taxpayers can choose to file electronically using tax preparation software, which often includes the form as part of the filing process. Alternatively, the form can be printed and submitted by mail along with the federal tax return. In-person submission is generally not an option for this form, as it must accompany the overall tax return.

Quick guide on how to complete form 8880

Complete Form 8880 effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without holdups. Handle Form 8880 on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 8880 with ease

- Locate Form 8880 and click Get Form to commence.

- Use the tools we provide to finalize your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you want to send your form, by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or mislaid documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Form 8880 and ensure excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8880

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2017 Form 8880 and why is it important?

The 2017 Form 8880 is used to claim the Retirement Savings Contributions Credit, which benefits individuals who contribute to retirement accounts. This form is important as it allows you to reduce your tax liability, making it easier to save for retirement. Understanding how to fill out the 2017 Form 8880 can signNowly impact your finances.

-

How can airSlate SignNow assist with the submission of the 2017 Form 8880?

AirSlate SignNow allows users to create, sign, and send documents electronically, including the 2017 Form 8880. With its user-friendly interface, you can easily fill out and eSign this important tax form, ensuring timely and accurate submission to the IRS. Our platform enhances your document workflow for tax-related filings.

-

What features does airSlate SignNow offer for managing the 2017 Form 8880?

AirSlate SignNow provides a range of features including document templates, user-friendly editing tools, and secure eSigning capabilities that are ideal for the 2017 Form 8880. You can also automate reminder notifications for submissions, ensuring you never miss a deadline. Our platform streamlines the whole process, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 2017 Form 8880?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including options for individuals and businesses. Using our software to manage the 2017 Form 8880 will provide you value through its time-saving features and ease of use. Check our pricing page for details on subscription options.

-

Can airSlate SignNow integrate with other tax preparation software for the 2017 Form 8880?

Absolutely! AirSlate SignNow integrates seamlessly with various tax preparation software solutions, enhancing your ability to manage the 2017 Form 8880. This integration allows for a smoother workflow where you can import information directly from your tax software into your documents.

-

What benefits does airSlate SignNow offer for filing the 2017 Form 8880 digitally?

Filing the 2017 Form 8880 digitally through airSlate SignNow offers numerous benefits including reduced paperwork, faster processing times, and increased accuracy. The electronic submission helps in minimizing errors commonly associated with handwritten forms. Plus, you get the added benefit of tracking submission status anytime.

-

How secure is airSlate SignNow for handling sensitive forms like the 2017 Form 8880?

AirSlate SignNow takes security very seriously, implementing bank-level encryption to protect sensitive documents such as the 2017 Form 8880. We also allow for secure authentication methods, ensuring that only authorized users can access your documents. Your privacy and data security are our top priorities.

Get more for Form 8880

Find out other Form 8880

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure