Schedule Se Form 2012

What is the Schedule SE Form

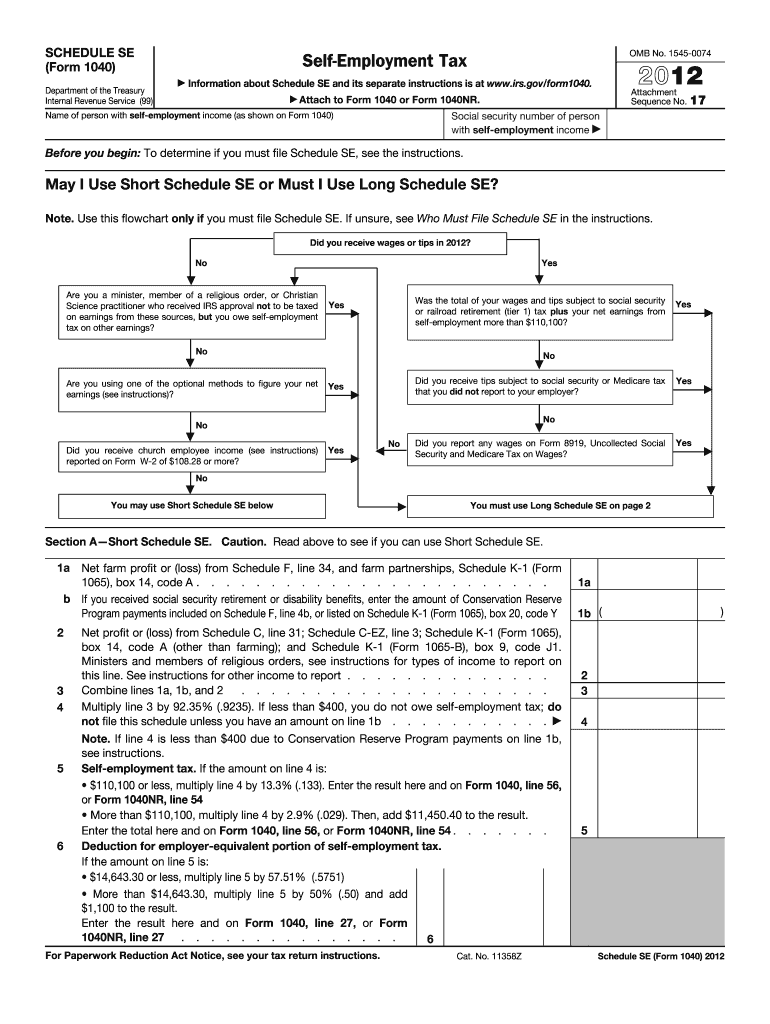

The Schedule SE Form is a tax document used by self-employed individuals to calculate their self-employment tax. This form is essential for reporting income from self-employment, which includes earnings from freelance work, business ownership, or any other form of self-generated income. The self-employment tax consists of Social Security and Medicare taxes, which are typically withheld from wages for employees. By using the Schedule SE Form, taxpayers can ensure they are meeting their obligations under U.S. tax law.

How to use the Schedule SE Form

To utilize the Schedule SE Form effectively, individuals must first gather their income information from self-employment activities. This includes all earnings reported on Schedule C or other income sources. The form requires taxpayers to calculate their net earnings from self-employment and apply the appropriate tax rates. It is important to follow the instructions carefully to ensure accurate reporting and compliance with IRS regulations.

Steps to complete the Schedule SE Form

Completing the Schedule SE Form involves several key steps:

- Gather all necessary income documentation, including any 1099 forms or records of earnings.

- Calculate your net earnings from self-employment by subtracting business expenses from gross income.

- Fill out the form by entering your net earnings and following the calculations provided in the instructions.

- Transfer the calculated self-employment tax to your main tax return form, such as Form 1040.

Legal use of the Schedule SE Form

The Schedule SE Form is legally required for individuals who earn income through self-employment. Proper completion of this form ensures compliance with federal tax laws and helps avoid potential penalties for underreporting income. It is crucial to maintain accurate records and file the form within the designated deadlines to uphold legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form align with the general tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file on time to avoid late fees or penalties.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule SE Form. These guidelines include detailed instructions on how to calculate self-employment tax, eligibility criteria, and reporting requirements. It is advisable to review these guidelines thoroughly to ensure compliance and accurate reporting of self-employment income.

Examples of using the Schedule SE Form

Common scenarios for using the Schedule SE Form include freelancers, independent contractors, and small business owners. For instance, a graphic designer working as a freelancer would report their earnings on Schedule C and then use the Schedule SE Form to calculate their self-employment tax. Similarly, a small business owner would report their business income and expenses and complete the Schedule SE Form to determine their tax liability.

Quick guide on how to complete 2012 schedule se form

Complete Schedule Se Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Schedule Se Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Schedule Se Form with minimal effort

- Locate Schedule Se Form and click on Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Choose your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign Schedule Se Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 schedule se form

Create this form in 5 minutes!

How to create an eSignature for the 2012 schedule se form

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the purpose of the Schedule Se Form in airSlate SignNow?

The Schedule Se Form in airSlate SignNow is designed to streamline document management by allowing users to create, send, and eSign essential documents efficiently. This feature empowers businesses to manage their workflows seamlessly and ensure timely submissions.

-

How does airSlate SignNow ensure the security of my Schedule Se Form?

Security is a top priority for airSlate SignNow. Your Schedule Se Form is protected with state-of-the-art encryption and complies with industry standards to keep your data safe. This ensures that all your sensitive information remains confidential and secure throughout the signing process.

-

Are there any costs associated with using the Schedule Se Form feature?

airSlate SignNow offers a flexible pricing structure that accommodates various business sizes and needs. While there are costs associated with premium features, the Schedule Se Form is part of our comprehensive service that helps you save time and money, maximizing your investment.

-

Can I customize my Schedule Se Form in airSlate SignNow?

Yes, customization is one of the key benefits of using the Schedule Se Form in airSlate SignNow. You can easily tailor the form to meet your specific requirements, including adding fields, branding elements, and specific instructions to enhance user experience.

-

What integrations are available for the Schedule Se Form in airSlate SignNow?

airSlate SignNow seamlessly integrates with a variety of applications, enhancing the functionality of the Schedule Se Form. You can connect it with platforms like Google Drive, Salesforce, and many others to create a more efficient workflow and improve your document management process.

-

How can using the Schedule Se Form benefit my business?

Utilizing the Schedule Se Form in airSlate SignNow empowers your business to reduce turnaround time on documents and increase productivity. By facilitating electronic signatures and document management, you can streamline your operations, improve customer satisfaction, and focus on your core objectives.

-

Is it easy to track the status of my Schedule Se Form?

Absolutely! airSlate SignNow provides real-time tracking for your Schedule Se Form, allowing you to monitor the status of each document throughout the signing process. You can easily see who has viewed, signed, or declined the document, giving you important insights into your workflow.

Get more for Schedule Se Form

Find out other Schedule Se Form

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy