1040a Form 2011

What is the 1040A Form

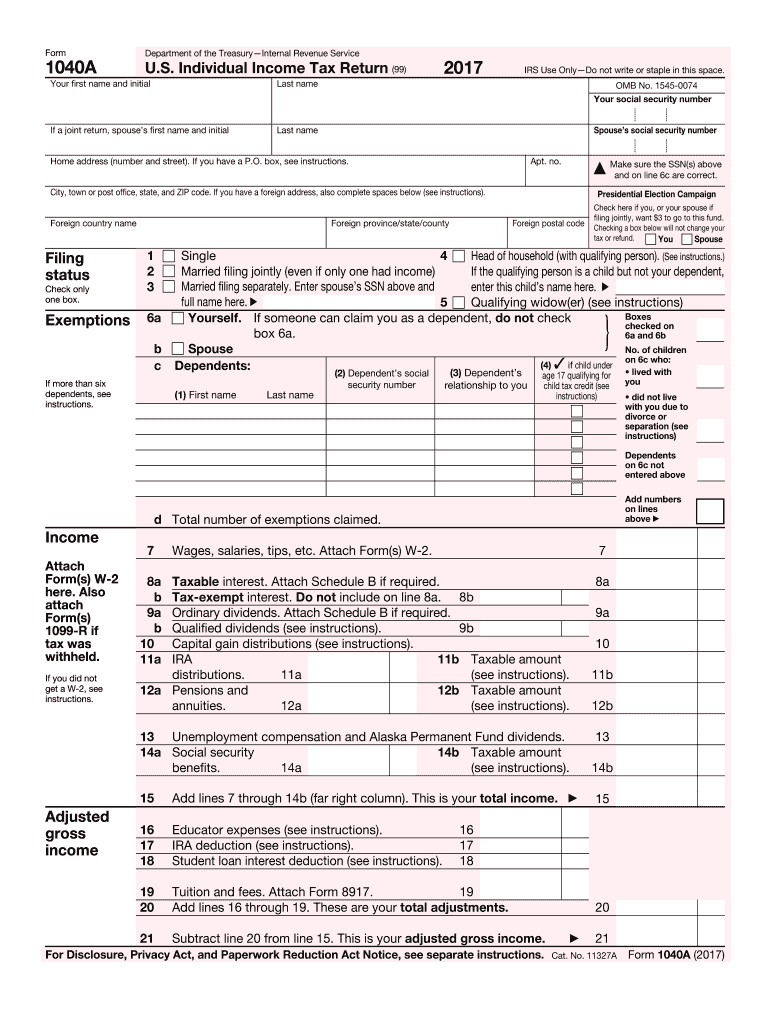

The 1040A Form is a simplified version of the U.S. Individual Income Tax Return, designed for taxpayers with straightforward tax situations. It allows individuals to report their income, claim certain tax credits, and calculate their tax liability. This form is suitable for those who do not itemize deductions and have income sources such as wages, salaries, and interest. The 1040A Form streamlines the filing process, making it easier for eligible taxpayers to fulfill their tax obligations.

How to use the 1040A Form

Using the 1040A Form involves several steps to ensure accurate completion. First, gather all necessary documents, including W-2s and 1099s, which report your income. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Report your income on the designated lines, and claim any applicable credits or adjustments. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to complete the 1040A Form

Completing the 1040A Form requires attention to detail. Follow these steps for a successful filing:

- Gather necessary documents, including income statements and any relevant tax forms.

- Fill in your personal information at the top of the form.

- Report your total income, including wages, interest, and dividends.

- Claim adjustments to income, if applicable, such as educator expenses or student loan interest.

- Calculate your adjusted gross income (AGI) and taxable income.

- Claim any tax credits you qualify for, such as the Earned Income Tax Credit or Child Tax Credit.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040A Form

The 1040A Form is legally recognized by the IRS as a valid method for reporting income and calculating taxes owed. To ensure compliance, it is essential to provide accurate information and adhere to IRS guidelines. Filing the form electronically or by mail is acceptable, and both methods are considered legally binding when completed correctly. Maintaining records of submitted forms and supporting documents is advisable for future reference or in case of an audit.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040A Form. Generally, the deadline for submitting your federal tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers can request an extension, allowing for additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the 1040A Form, certain documents are necessary. These include:

- W-2 forms from employers, which report wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductible expenses or credits, such as tuition payments or childcare expenses.

- Social Security numbers for yourself and any dependents.

Quick guide on how to complete 2011 1040a form

Complete 1040a Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle 1040a Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign 1040a Form effortlessly

- Locate 1040a Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Modify and eSign 1040a Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 1040a form

Create this form in 5 minutes!

How to create an eSignature for the 2011 1040a form

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the 1040a Form and who needs it?

The 1040a Form is a simplified version of the U.S. IRS tax return that allows eligible taxpayers to file their federal income taxes easily. Typically, it is suited for individuals with straightforward tax situations, including those without itemized deductions. If your income is below a certain threshold, you may find the 1040a Form to be a quick and efficient way to fulfill your tax obligations.

-

How can airSlate SignNow help me with my 1040a Form?

airSlate SignNow offers an intuitive platform for electronically signing and sending your 1040a Form securely. With our customizable templates and user-friendly interface, you can streamline the process of completing and submitting your tax documents. This eliminates the hassle of printing and mailing, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for my 1040a Form?

While airSlate SignNow provides various pricing plans, the service remains cost-effective, especially if you need to manage multiple documents, including the 1040a Form. Our subscription plans are designed to meet different business needs, offering an excellent value for the convenience and security your tax documents require. You can choose a plan that fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with other software for my 1040a Form?

Absolutely! airSlate SignNow can seamlessly integrate with various software applications, enhancing your workflow while handling your 1040a Form. Our platform supports popular CRMs, document management systems, and storage solutions, allowing you to manage and eSign documents efficiently without switching between different tools.

-

What features does airSlate SignNow offer for managing 1040a Forms?

airSlate SignNow provides numerous features tailored for document management, including templates for the 1040a Form, advanced eSignature capabilities, and tracking options. You can automate workflows, set reminders for deadlines, and ensure compliance, all while maintaining data security. Our platform makes it easy to manage your tax forms with confidence.

-

How secure is the information I send with my 1040a Form using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption protocols to safeguard your personal information when sending your 1040a Form. Additionally, our platform complies with relevant regulations to ensure that your data remains confidential and secure throughout the signing process.

-

Can I use airSlate SignNow on mobile devices for my 1040a Form?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to manage your 1040a Form on the go. Whether you're using a smartphone or tablet, our mobile-friendly platform provides full functionality to eSign and send documents from anywhere. This flexibility enables you to handle your tax prep efficiently, even during busy times.

Get more for 1040a Form

Find out other 1040a Form

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template