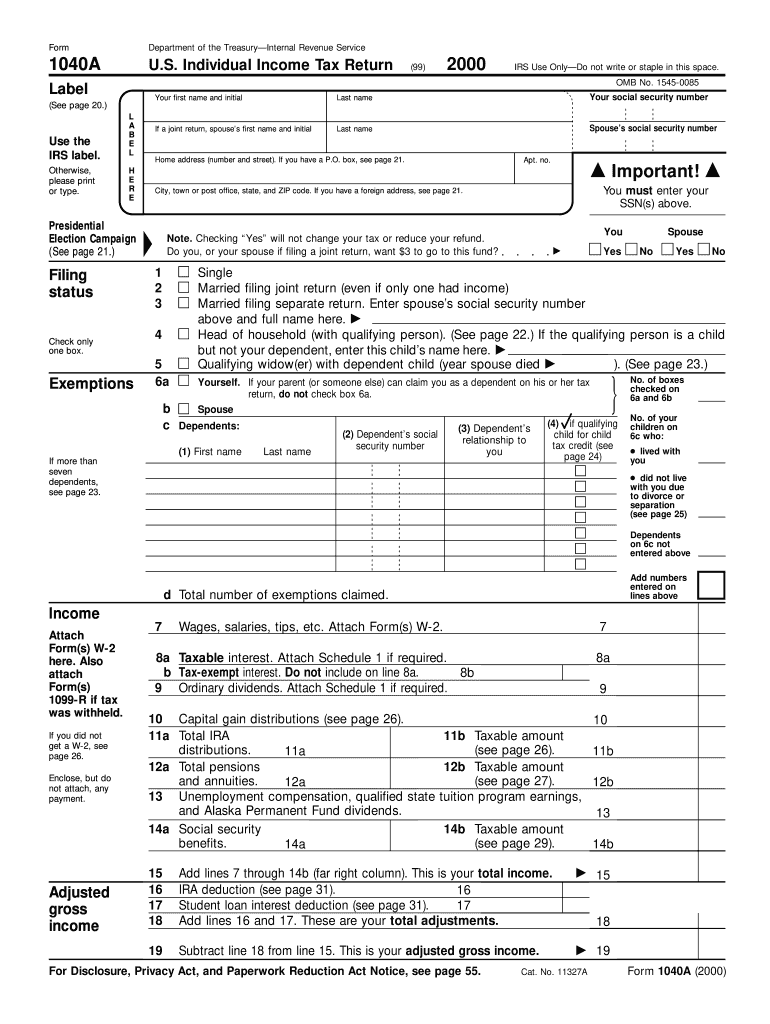

Irs Form 2000

What is the IRS Form?

The IRS Form refers to various forms issued by the Internal Revenue Service (IRS) that taxpayers use to report income, claim deductions, and fulfill their tax obligations. Each form serves a specific purpose, such as the W-2 for wage reporting or the 1040 for individual income tax returns. Understanding the specific IRS Form relevant to your situation is crucial for accurate tax filing and compliance with federal regulations.

How to Use the IRS Form

Using the IRS Form involves several steps to ensure accurate completion and submission. First, identify the correct form for your tax situation. Next, gather all necessary documentation, such as income statements and deduction records. Fill out the form carefully, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form either electronically or by mail, depending on your preference and the form's requirements.

Steps to Complete the IRS Form

Completing an IRS Form can be streamlined by following these steps:

- Identify the correct form for your tax situation.

- Gather required documents, including income statements and receipts for deductions.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check your entries for any mistakes or omissions.

- Submit the form electronically using IRS e-file or by mailing it to the appropriate address.

Legal Use of the IRS Form

The legal use of the IRS Form is essential for compliance with tax laws. Each form must be filled out truthfully and submitted by the specified deadlines. Failing to use the form correctly can lead to penalties, including fines or audits. It is important to understand the legal implications of the information provided on the form, as inaccuracies can result in legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for IRS Forms vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about specific deadlines for different forms to avoid late penalties.

Form Submission Methods

IRS Forms can be submitted through various methods, including:

- Online Submission: Use the IRS e-file system for quick and secure electronic filing.

- Mail: Send paper forms to the designated IRS address based on your location and the type of form.

- In-Person: Visit local IRS offices for assistance with form submission.

Penalties for Non-Compliance

Non-compliance with IRS Form requirements can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits. It is essential to understand the consequences of failing to submit the required forms accurately and on time to avoid financial repercussions.

Quick guide on how to complete 2000 irs form

Prepare Irs Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Handle Irs Form on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric procedure today.

How to edit and electronically sign Irs Form with ease

- Obtain Irs Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2000 irs form

Create this form in 5 minutes!

How to create an eSignature for the 2000 irs form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is an IRS Form and why is it important?

An IRS Form is a document used for tax-related purposes in the United States, necessary for reporting income, expenses, and other tax-related information to the Internal Revenue Service. Understanding how to correctly fill out and submit an IRS Form can help ensure compliance and avoid potential penalties. Using airSlate SignNow simplifies this process by allowing you to eSign and send IRS Forms efficiently.

-

How can airSlate SignNow assist with IRS Forms?

airSlate SignNow provides a user-friendly platform to electronically sign and send IRS Forms, streamlining your tax filing process. With features like save templates and automatic reminders, you can easily manage your IRS Forms and ensure timely submissions. This makes it an essential tool for both individuals and businesses dealing with IRS Forms.

-

Are there any pricing plans for using airSlate SignNow for IRS Forms?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, starting from a basic plan suitable for individuals to more advanced options for businesses. Each plan includes features that facilitate the electronic signing and submission of IRS Forms. Choosing the right plan can help ensure you have the necessary tools for effectively managing your IRS documentation.

-

What features does airSlate SignNow offer for IRS Forms?

airSlate SignNow includes features such as easy document creation, eSigning, and automated workflows, specifically tailored to help users manage their IRS Forms. With cloud storage, you can access your IRS Forms anytime, anywhere, making it convenient for busy professionals. Additionally, airSlate SignNow provides audit trails for accountability, ensuring the secure handling of your important tax documents.

-

Can I collaborate with others on IRS Forms using airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration on IRS Forms, enabling multiple users to view and edit documents simultaneously. This feature is beneficial for teams working together on tax submissions. By collaborating in one platform, you can streamline communication and improve efficiency when dealing with complex IRS Forms.

-

What integrations does airSlate SignNow have that can help with IRS Forms?

AirSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office, which can support your workflow related to IRS Forms. By connecting these tools, you can enhance your document management process and easily retrieve or store your IRS Forms. These integrations make it easier to keep all your tax-related documents in one accessible place.

-

Is airSlate SignNow secure for managing my IRS Forms?

Yes, airSlate SignNow takes security seriously and complies with industry standards to protect your information, including IRS Forms. The platform employs encryption and access controls to ensure that your sensitive data remains safe and secure. With strong security measures in place, users can confidently send and sign IRS Forms without worrying about data bsignNowes.

Get more for Irs Form

Find out other Irs Form

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online