Sa302 Example PDF Form

What is the SA302 example PDF?

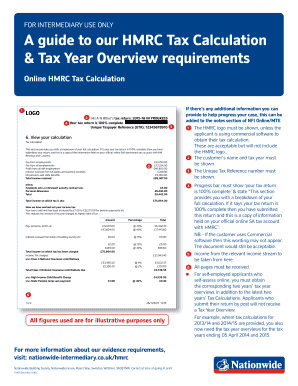

The SA302 example PDF is a document that provides a summary of an individual's income and tax calculations for a specific tax year. It is commonly used by self-employed individuals in the United States to report their earnings to HM Revenue and Customs (HMRC). The SA302 form includes essential details such as total income, tax owed, and any adjustments made to the tax calculation. It serves as an official record and can be requested by lenders or financial institutions to verify income when applying for loans or mortgages.

How to obtain the SA302 example PDF

To obtain the SA302 example PDF, individuals can request it directly from HMRC. This can be done through the online personal tax account or by contacting HMRC via phone or mail. The document can also be generated using tax software that complies with HMRC regulations. It is important to ensure that all income and deductions are accurately reported to receive a correct SA302 form.

Steps to complete the SA302 example PDF

Completing the SA302 example PDF involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and expense receipts. Next, calculate total income by summing all earnings for the tax year. After that, determine allowable expenses to arrive at the net profit. Finally, input these figures into the SA302 form, ensuring that all information is accurate before submission. Review the completed document for any errors before saving or printing the PDF.

Legal use of the SA302 example PDF

The SA302 example PDF is legally recognized as a valid document for tax purposes in the United States. It is essential for self-employed individuals to maintain accurate records and provide this form when required by financial institutions or during tax audits. The document must be filled out correctly and submitted by the tax deadline to avoid any penalties. Using a reliable electronic signature solution can enhance the legal validity of the SA302 form when submitted online.

Key elements of the SA302 example PDF

Key elements of the SA302 example PDF include the taxpayer's personal details, total income, tax calculation, and any adjustments made. The form typically contains sections for reporting various types of income, such as self-employment earnings, rental income, and dividends. Additionally, it includes fields for allowable expenses, tax reliefs, and the final tax liability. Understanding these elements is crucial for accurate completion and compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the SA302 example PDF, particularly for self-employed individuals. It is important to follow these guidelines to ensure that all income is reported accurately and that the correct tax is paid. The IRS emphasizes the importance of record-keeping and encourages taxpayers to maintain detailed documentation of income and expenses. Adhering to these guidelines can help prevent issues during audits and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the SA302 example PDF are crucial for self-employed individuals to meet. Typically, the deadline for submitting the form is January thirty-first of the following tax year. It is important to be aware of any extensions that may apply and to file the form on time to avoid penalties. Keeping track of important dates throughout the tax year can help ensure timely submission and compliance with IRS regulations.

Quick guide on how to complete sa302 example pdf

Effortlessly Prepare Sa302 Example Pdf on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Sa302 Example Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Sa302 Example Pdf with Ease

- Find Sa302 Example Pdf and click on Get Form to get started.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Sa302 Example Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa302 example pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SA302 example and why do I need it?

An SA302 example is a document that summarizes your income for a specific tax year. It is crucial for individuals applying for loans or mortgages, as lenders often require this information to assess financial stability.

-

How can airSlate SignNow help with SA302 examples?

With airSlate SignNow, you can easily upload, send, and eSign your SA302 example documents securely. This streamlines the process, ensuring your documents are handled efficiently and are legally binding.

-

Is there a cost associated with generating an SA302 example using airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. You can generate and manage your SA302 example documents at a competitive price, ensuring affordability without compromising on features.

-

What features are included for managing SA302 examples in airSlate SignNow?

airSlate SignNow provides various features for managing your SA302 examples, including customizable templates, secure cloud storage, and automated workflows. These tools help you streamline document management and enhance productivity.

-

Can I integrate airSlate SignNow with other applications when handling SA302 examples?

Yes, airSlate SignNow offers integrations with popular business applications such as Google Drive, Salesforce, and Dropbox. This enables you to manage your SA302 example documents seamlessly within your existing workflows.

-

What security measures are in place for my SA302 example documents in airSlate SignNow?

airSlate SignNow prioritizes security with features like encryption, two-factor authentication, and compliance with data protection regulations. This ensures that your SA302 example documents are safe and secure at all times.

-

How do I get started with airSlate SignNow for managing SA302 examples?

Getting started with airSlate SignNow is simple. Sign up for a free trial on our website, explore the features, and start uploading and eSigning your SA302 example documents right away.

Get more for Sa302 Example Pdf

Find out other Sa302 Example Pdf

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later