Form 8805 2015

What is the Form 8805

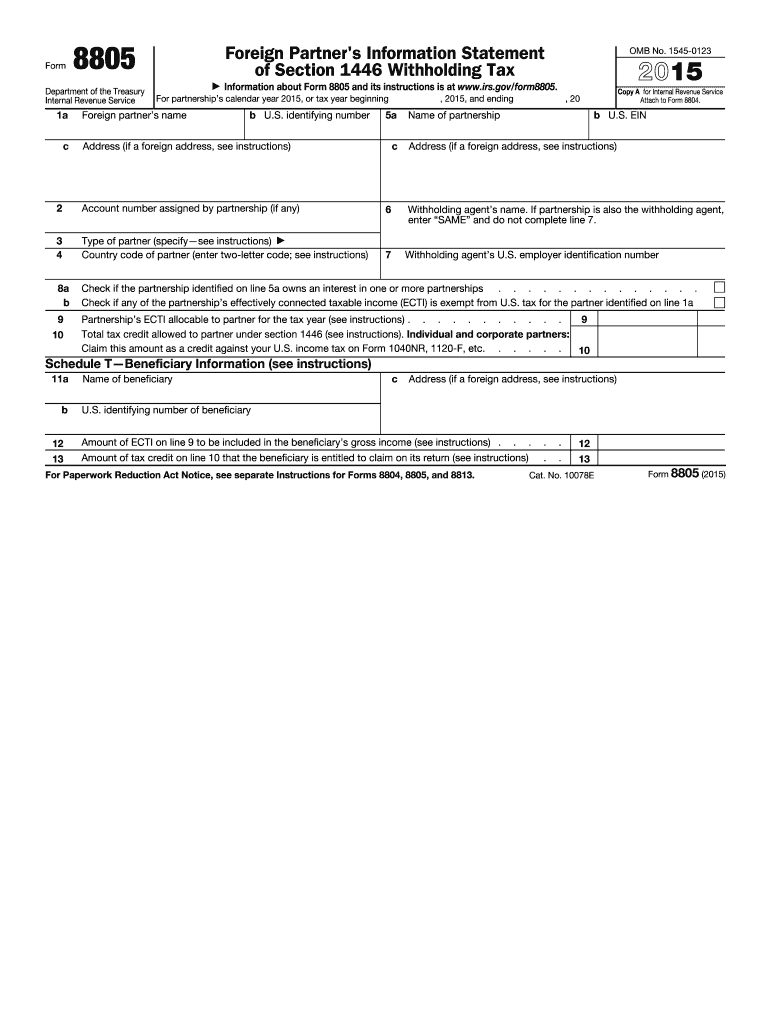

The Form 8805 is a tax document used by partnerships to report the income, deductions, and credits allocated to foreign partners. This form is essential for ensuring that foreign partners receive the correct information regarding their share of income from the partnership, which is necessary for their U.S. tax obligations. It serves as a means for the IRS to track income that may be subject to withholding tax and ensures compliance with U.S. tax laws.

How to use the Form 8805

Using Form 8805 involves several steps. Partnerships must complete the form to report each foreign partner's share of income, deductions, and credits. The form requires detailed information about the partnership, including its name, address, and Employer Identification Number (EIN). Additionally, it must include the foreign partner's details, such as their name, address, and taxpayer identification number. After completing the form, partnerships must file it with the IRS and provide a copy to each foreign partner to ensure they can accurately report their income.

Steps to complete the Form 8805

Completing Form 8805 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the partnership and foreign partners.

- Fill out the partnership's identifying information, including name, address, and EIN.

- Provide details for each foreign partner, including their name, address, and taxpayer identification number.

- Report the income, deductions, and credits allocated to each foreign partner accurately.

- Review the completed form for accuracy and completeness.

- File the form with the IRS by the designated deadline and distribute copies to the foreign partners.

Legal use of the Form 8805

The legal use of Form 8805 is governed by IRS regulations. It is crucial for partnerships to ensure that the information reported on the form is accurate and complete. Misreporting can lead to penalties for both the partnership and the foreign partners. Compliance with tax laws is essential, as it protects the interests of all parties involved and ensures that foreign partners can meet their tax obligations in the United States.

Filing Deadlines / Important Dates

Filing deadlines for Form 8805 are critical for compliance. Generally, partnerships must file this form by the 15th day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is essential to be aware of these dates to avoid late filing penalties and ensure that foreign partners receive their copies in a timely manner.

Penalties for Non-Compliance

Failing to file Form 8805 or submitting inaccurate information can result in significant penalties. The IRS may impose fines for late filing, which can accumulate daily until the form is submitted. Additionally, if a partnership fails to provide the necessary information to foreign partners, it could lead to complications in their tax filings and potential penalties for them as well. It is crucial for partnerships to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 2015 form 8805

Complete Form 8805 effortlessly on any device

Web-based document administration has risen in popularity among businesses and individuals. It offers an ideal environmentally-friendly option to traditional printed and signed documents, allowing you to find the appropriate template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8805 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form 8805 without hassle

- Obtain Form 8805 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or black out sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8805 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8805

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8805

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is Form 8805 and why is it important?

Form 8805 is used to report the income and withholding tax on a partner's share of effectively connected income from a partnership. It is crucial for tax compliance, ensuring that partnerships correctly distribute income and their associated tax responsibilities to partners.

-

How can airSlate SignNow help with signing Form 8805?

With airSlate SignNow, you can easily upload and send Form 8805 for electronic signatures. Our platform ensures that the signing process is secure, quick, and legally binding, making it ideal for partnerships needing to file this important tax document.

-

What are the main features of airSlate SignNow for handling Form 8805?

airSlate SignNow offers features like document templates, bulk sending, and real-time tracking specifically designed for forms like 8805. These functionalities enable businesses to streamline their tax document processes and maintain compliance efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8805?

Yes, airSlate SignNow is a cost-effective solution for managing documents, including Form 8805. Our pricing tiers are designed to fit various business needs, ensuring affordable access to essential eSignature functionalities without sacrificing quality.

-

Can I integrate airSlate SignNow with other software for Form 8805 management?

Absolutely! airSlate SignNow easily integrates with various accounting and productivity software. This enables seamless handling of Form 8805 alongside your existing tools, promoting a smoother and more efficient workflow.

-

What benefits does using airSlate SignNow provide for Form 8805?

Using airSlate SignNow for Form 8805 offers numerous benefits, including enhanced speed of the signing process and improved accuracy in document handling. This solidifies your business's compliance with tax regulations while saving time and reducing paperwork.

-

How does airSlate SignNow ensure the security of Form 8805 documents?

airSlate SignNow prioritizes security with robust encryption and authentication measures for your Form 8805 and other sensitive documents. You can trust our platform to protect your tax information while ensuring compliance with industry standards.

Get more for Form 8805

- Same name affidavit form

- Eyelash extension agreement form

- Unum form cl 1008

- Kern family health plan form

- Medicare insurance verification form impact physical therapy impactpt

- Request for surgery or special procedure and patients pposbc form

- Life insurance needs worksheet form

- Patient bhealth questionnaireb placer private physicians form

Find out other Form 8805

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online