Oh Cat Form Cs 2011

What is the Ohio Form CAT CS?

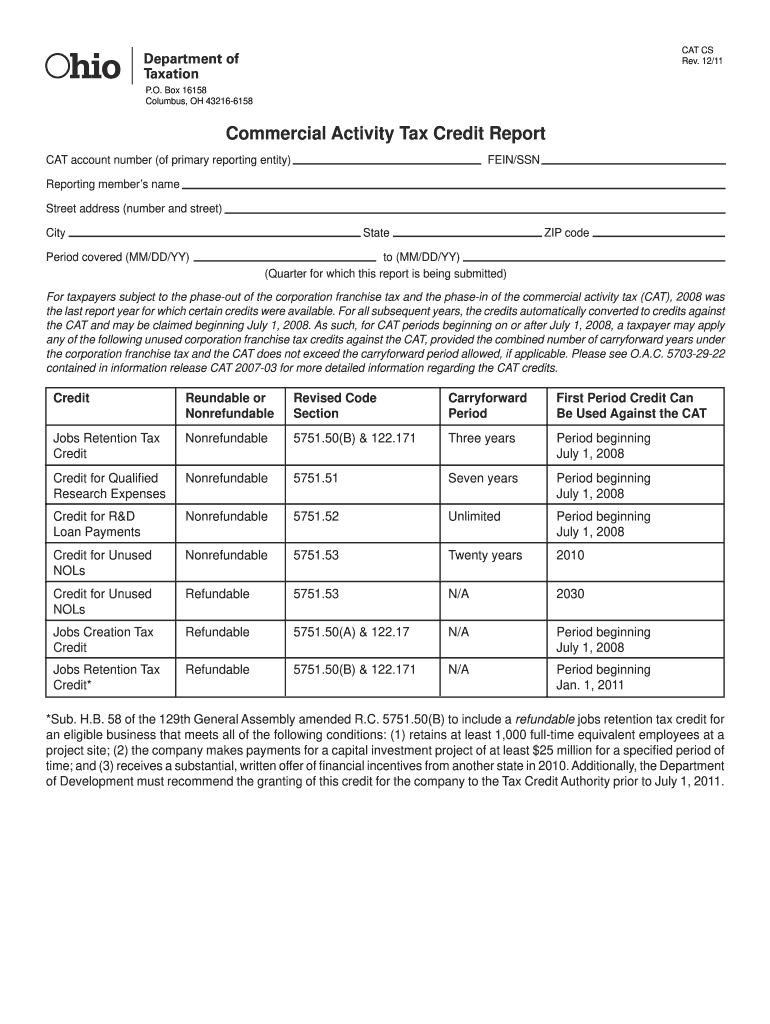

The Ohio Form CAT CS, also known as the Ohio Commercial Activity Tax Credit Schedule, is a document used by businesses to report their eligibility for certain tax credits under the state's commercial activity tax (CAT) system. This form is essential for businesses operating in Ohio, as it allows them to claim credits that can significantly reduce their tax liabilities. The CAT is a tax on gross receipts, and the CAT CS form specifically addresses various credits available to eligible taxpayers.

How to Use the Ohio Form CAT CS

To effectively use the Ohio Form CAT CS, businesses must first ensure they meet the eligibility criteria outlined by the Ohio Department of Taxation. Once eligibility is confirmed, the form needs to be filled out accurately, detailing the specific credits being claimed. Each section of the form requires precise information regarding gross receipts and the nature of the business activities. After completing the form, it should be submitted along with the business's CAT return to ensure that the credits are applied correctly.

Steps to Complete the Ohio Form CAT CS

Completing the Ohio Form CAT CS involves several key steps:

- Gather necessary financial documents, including gross receipts and prior tax returns.

- Review the eligibility criteria for the credits being claimed.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations to confirm the accuracy of claimed credits.

- Submit the completed form with your CAT return, either electronically or by mail.

Legal Use of the Ohio Form CAT CS

The legal use of the Ohio Form CAT CS is governed by the regulations set forth by the Ohio Department of Taxation. To be considered valid, the form must be completed in accordance with all applicable laws and guidelines. This includes providing truthful information and adhering to deadlines for submission. Failure to comply with these regulations can result in penalties or disqualification from receiving the claimed credits.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Form CAT CS coincide with the due dates for the commercial activity tax returns. Typically, businesses must file their CAT returns by the 15th day of the fourth month following the end of their fiscal year. It is crucial for businesses to be aware of these deadlines to avoid late fees and ensure they receive any eligible credits in a timely manner.

Required Documents

To complete the Ohio Form CAT CS, businesses must have several documents on hand, including:

- Financial statements showing gross receipts.

- Prior year tax returns for reference.

- Documentation supporting claims for specific credits.

- Any correspondence from the Ohio Department of Taxation regarding eligibility.

Eligibility Criteria

Eligibility for claiming credits on the Ohio Form CAT CS is determined by various factors, including the nature of the business activities and the amount of gross receipts. Businesses must meet specific thresholds and criteria set by the Ohio Department of Taxation. It is important for businesses to review these criteria carefully to ensure they qualify for the credits they intend to claim.

Quick guide on how to complete oh cat form cs

Easily Prepare Oh Cat Form Cs on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Oh Cat Form Cs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Edit and eSign Oh Cat Form Cs

- Locate Oh Cat Form Cs and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Oh Cat Form Cs and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oh cat form cs

Create this form in 5 minutes!

How to create an eSignature for the oh cat form cs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio form cat cs and how can airSlate SignNow help with it?

The ohio form cat cs is a crucial document for businesses operating in Ohio to report their Commercial Activity Tax. airSlate SignNow simplifies the process of filling out and signing this form electronically, ensuring you stay compliant and organized.

-

Are there any costs associated with using airSlate SignNow for ohio form cat cs?

Yes, there are various pricing plans available for airSlate SignNow, designed to accommodate different business needs. With a cost-effective solution, you'll find a plan that suits your budget while providing the tools necessary for managing ohio form cat cs efficiently.

-

What features does airSlate SignNow offer for managing ohio form cat cs?

airSlate SignNow offers features such as electronic signatures, customizable templates, and secure cloud storage that enhance the management of ohio form cat cs. These tools streamline the signing process, making it quicker and easier to handle such important documents.

-

Can I collaborate with my team while working on ohio form cat cs using airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration among team members when preparing the ohio form cat cs. You can invite colleagues to review or comment on the document, ensuring everyone stays on the same page.

-

Is airSlate SignNow compatible with other software when handling ohio form cat cs?

Yes, airSlate SignNow integrates seamlessly with popular software such as Google Drive, Salesforce, and Microsoft Office. This compatibility allows you to manage your ohio form cat cs without disrupting your existing workflows.

-

How does using airSlate SignNow for ohio form cat cs improve compliance?

Using airSlate SignNow for ohio form cat cs increases compliance by providing a tamper-proof eSignature solution and audit trails. This ensures that your documents are legally binding and properly documented, minimizing the risk of errors.

-

What are the benefits of eSigning the ohio form cat cs with airSlate SignNow?

eSigning the ohio form cat cs with airSlate SignNow saves you time and resources by eliminating paper-based processes. It enhances efficiency, allowing for quicker submissions and providing a secure, convenient method to handle important documents.

Get more for Oh Cat Form Cs

Find out other Oh Cat Form Cs

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe