Changes to the Ohio Commercial Activity Tax CAT 2019

Understanding the Ohio Commercial Activity Tax (CAT)

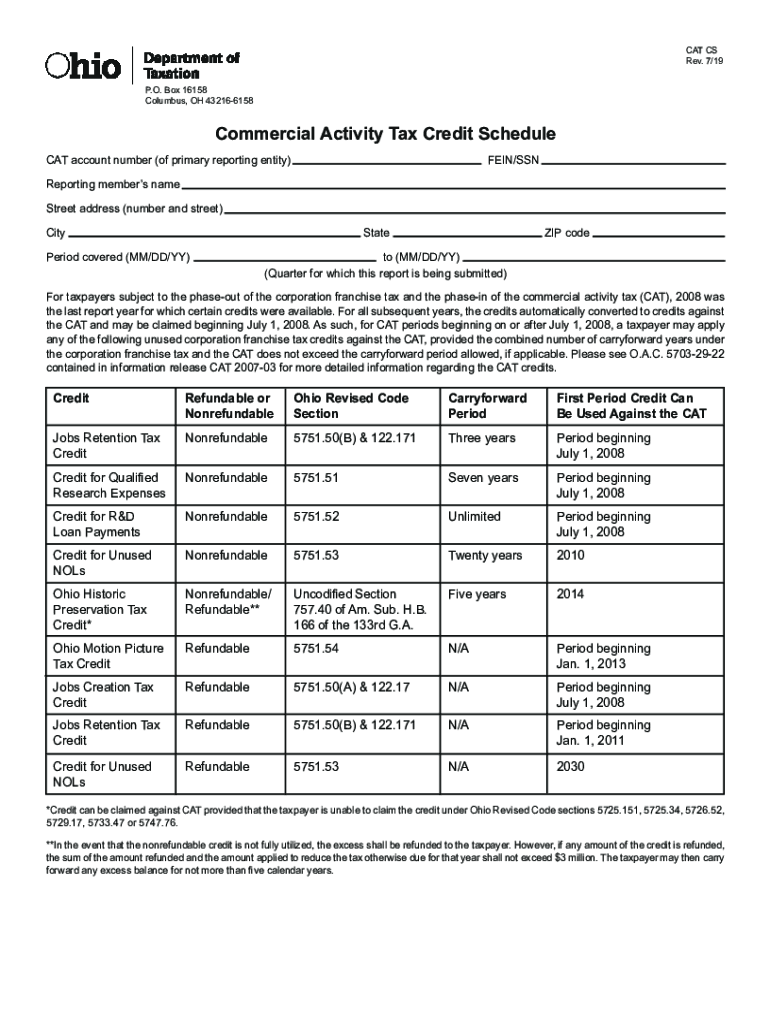

The Ohio Commercial Activity Tax (CAT) is a tax imposed on businesses for the privilege of doing business in Ohio. It is based on gross receipts, which means it applies to the total revenue generated by a business, regardless of its expenses. The CAT is designed to be a simple and fair tax structure that supports the state's economy. Businesses with gross receipts exceeding $150,000 are required to register and pay the tax. This tax is distinct from income tax and is applicable to all types of business entities, including corporations, partnerships, and sole proprietors.

Eligibility Criteria for the Commercial Activity Tax Credit

To qualify for the commercial activity tax credit, businesses must meet specific eligibility requirements set by the state of Ohio. Generally, businesses must be registered in Ohio and have gross receipts that fall within the defined thresholds. The credit is typically available to those who have incurred expenses related to their business operations and can demonstrate a significant economic presence in the state. It is essential for businesses to review the specific criteria and ensure compliance to maximize their benefits under this tax credit.

Steps to Complete the Ohio Commercial Activity Tax Credit Form

Completing the Ohio commercial activity tax credit form involves several key steps. First, businesses should gather necessary financial documents, including gross receipts records and any relevant tax filings. Next, they must accurately fill out the Ohio CAT CS form, ensuring all sections are completed. This form includes information about the business, the amount of credit being claimed, and any supporting documentation required. Once the form is filled out, businesses should review it for accuracy before submission to avoid potential delays or penalties.

Filing Deadlines and Important Dates

Businesses must be aware of the filing deadlines associated with the Ohio commercial activity tax. Generally, the tax year aligns with the calendar year, and the filing deadline for the CAT is typically due on the fifteenth day of the fourth month following the end of the tax year. For example, if a business's tax year ends on December 31, the CAT return would be due by April 15 of the following year. It is crucial for businesses to stay informed about these dates to ensure timely compliance and avoid late fees.

Required Documents for Submission

When submitting the Ohio commercial activity tax credit form, businesses must include specific documents to support their claims. Required documents typically include financial statements, proof of gross receipts, and any other relevant tax forms. It is advisable for businesses to maintain organized records throughout the year to facilitate the preparation of these documents. Proper documentation not only supports the validity of the credit claim but also ensures compliance with state regulations.

Form Submission Methods

Businesses can submit the Ohio commercial activity tax credit form through various methods. The primary options include online submission via the Ohio Department of Taxation's website, mailing a paper form, or delivering it in person to a designated tax office. Each method has its own processing times, with online submissions generally being the fastest. Businesses should choose the method that best suits their needs while ensuring that submissions are completed by the required deadlines.

Quick guide on how to complete changes to the ohio commercial activity tax cat

Complete Changes To The Ohio Commercial Activity Tax CAT effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to conveniently access the needed form and securely save it online. airSlate SignNow equips you with all the resources required to create, revise, and eSign your documents quickly without delays. Manage Changes To The Ohio Commercial Activity Tax CAT on any device with airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

How to modify and eSign Changes To The Ohio Commercial Activity Tax CAT with ease

- Locate Changes To The Ohio Commercial Activity Tax CAT and then click Get Form to get started.

- Use the tools we offer to complete your document.

- Select pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Changes To The Ohio Commercial Activity Tax CAT and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct changes to the ohio commercial activity tax cat

Create this form in 5 minutes!

How to create an eSignature for the changes to the ohio commercial activity tax cat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the commercial activity tax credit?

The commercial activity tax credit is a tax incentive designed to encourage businesses to engage in activities that stimulate economic growth. By utilizing this credit, businesses can reduce their overall tax liability, making it a valuable financial tool. Understanding how this credit works can help you maximize your savings.

-

How can airSlate SignNow help me apply for the commercial activity tax credit?

airSlate SignNow streamlines the process of applying for the commercial activity tax credit by providing an easy-to-use platform for document management. You can quickly prepare, send, and eSign necessary documents, ensuring that your application is submitted accurately and on time. This efficiency can signNowly enhance your chances of receiving the credit.

-

What features does airSlate SignNow offer for managing tax credit applications?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools simplify the management of your commercial activity tax credit applications, allowing you to focus on your business operations. With our platform, you can ensure that all necessary documentation is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for tax credit applications?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution ensures that you can manage your commercial activity tax credit applications without breaking the bank. By investing in our platform, you can save time and resources, ultimately enhancing your bottom line.

-

What are the benefits of using airSlate SignNow for the commercial activity tax credit?

Using airSlate SignNow for the commercial activity tax credit provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage all your documentation in one place, making it easier to track your applications. Additionally, the eSigning feature ensures that your documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for tax credit management?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the commercial activity tax credit process. Whether you use accounting software or CRM systems, our platform can connect with them to streamline your workflow. This integration capability ensures that all your data is synchronized and easily accessible.

-

How does airSlate SignNow ensure the security of my tax credit documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your commercial activity tax credit documents. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure throughout the application process.

Get more for Changes To The Ohio Commercial Activity Tax CAT

Find out other Changes To The Ohio Commercial Activity Tax CAT

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement